What is Hyperliquid? RPC, API, and trading infrastructure

Hyperliquid was built for speed and trading first, everything else second. An on-chain order book, a validator set tuned for latency, and an EVM layer for contracts. The rest of this guide shows how to plug in: RPC endpoints, APIs, and reliable node access.

Most chains start from smart contracts and tack trading on later. Hyperliquid flips that order. It’s built first for speed, with a validator set tuned for low-latency confirms and an on-chain order book that runs perpetuals like a native feature, not a dApp. Blocks close in under a second, and every match is final.

At the same time, Hyperliquid ships an EVM environment that runs standard Solidity contracts against the same ledger. That mix — trading engine + general compute — shapes how developers connect through RPC and API. Before getting into endpoints and tooling, let’s break down the chain itself.

What is Hyperliquid?

Hyperliquid runs its own Layer-1 protocol designed for trading. It uses Proof-of-Stake with a custom algorithm called HyperBFT, adapted from Meta’s LibraBFT. The consensus layer is optimized for low-latency transactions: blocks finalize in about 0.2 seconds on median, and even at the 99th percentile, confirmations land under a second.

The speed comes from a Tendermint-based Byzantine Fault Tolerant engine and a deliberately small validator set. Only a few dozen validators take part today, which keeps latency low but trades off the scale of larger networks.

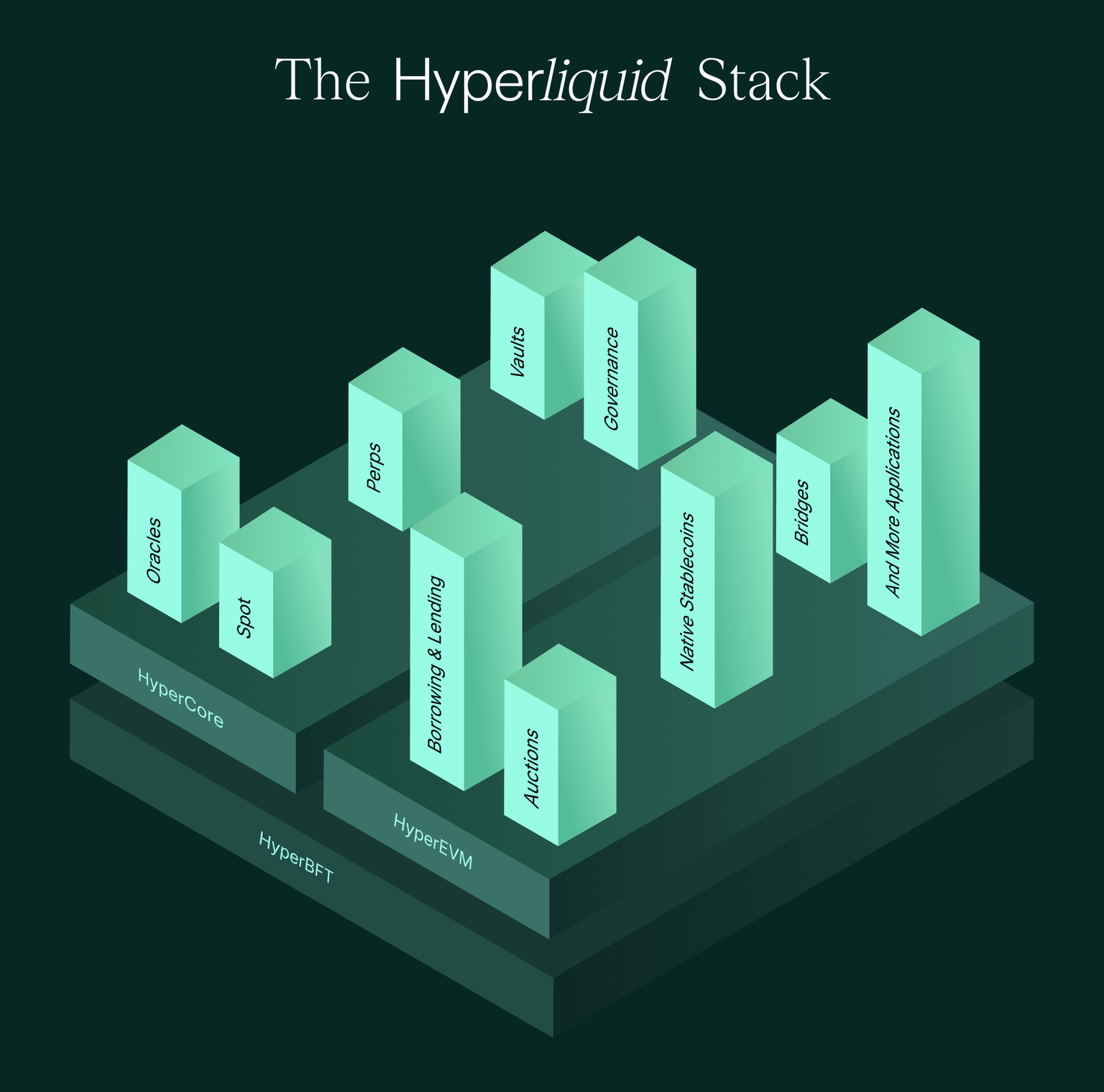

On top of this, Hyperliquid runs a dual execution environment under one state and consensus:

- HyperCore – the trading engine. It manages the perpetual futures and spot order book directly on-chain. Orders, cancels, and liquidations all finalize in a single block. The state machine is purpose-built for exchange operations.

- HyperEVM – an Ethereum-compatible environment secured by HyperBFT and the same validator set. It lets developers deploy Solidity smart contracts that can interact with the trading state.

For a deeper look at how HyperCore and HyperEVM operate under one consensus layer, see our guide on Hyperliquid infrastructure and RPC architecture.

The chain is built for high throughput. It handles more than 200,000 transactions per second compared to Ethereum’s ~15. Gas fees are negligible — usually less than a tenth of a cent per trade. All market activity, including advanced order types like limit or conditional, is written to the chain order book, and nothing is hidden off chain. The result is decentralized trading with the speed and user experience of a centralized exchange.

What Hyperliquid is built for

Hyperliquid’s first focus is derivatives. The chain runs a perpetual futures exchange with up to 50× leverage on major assets. All trades are matched on-chain and settle straight to wallets.

The bigger play is infra for low-latency DeFi. Because HyperEVM sits next to the book, contracts can hook into live trading data. A lending app can liquidate against the chain’s own price feed. Stablecoins and AMMs can use the same liquidity instead of splitting it across pools.

So Hyperliquid isn’t just a DEX. It’s both a trading platform and a base layer for financial apps that need real-time settlement and high throughput.

Building on Hyperliquid: SDKs, APIs, and testnet

With Hyperliquid, you get a growing stack of trading tools to work with, including:

SDKs and libraries

Official client SDKs are available in Python and Rust. They expose trading functions, market data, and account management programmatically, so you don’t have to work with raw API calls. The SDKs simplify building bots or integrating Hyperliquid markets into apps — fetching order book depth, placing orders, or managing positions can all be done in a few lines.

APIs (JSON-RPC and REST)

Hyperliquid exposes two main API surfaces: JSON-RPC and REST.

- JSON-RPC runs on HyperEVM. It covers block, transaction, and contract queries, which means existing Ethereum tooling — Web3 libraries, ethers.js, MetaMask — can connect to a Hyperliquid node like it would to any other EVM chain.

- REST API is aimed at trading. Endpoints handle order submission, cancels, fills, and streaming market data. For real-time performance, you can subscribe to WebSocket feeds that push updates on order book changes and executions.

This way, you get both sides of the chain: compatibility with EVM smart contracts and direct hooks into HyperCore’s trading engine.

Explorers and dashboards

You can use explorers to monitor activity + debug contracts. The main options available are:

- HypurrScan — shows blocks, transactions, and chain order book stats in real time. It also tracks auction prices, TWAPs (time-weighted average prices), transaction history, and token data on Hyperliquid’s L1.

- HyperEVMScan — focused on the smart contract side. Works like Etherscan, letting you search contract transactions and wallet addresses. Useful for debugging and tracking usage on HyperEVM.

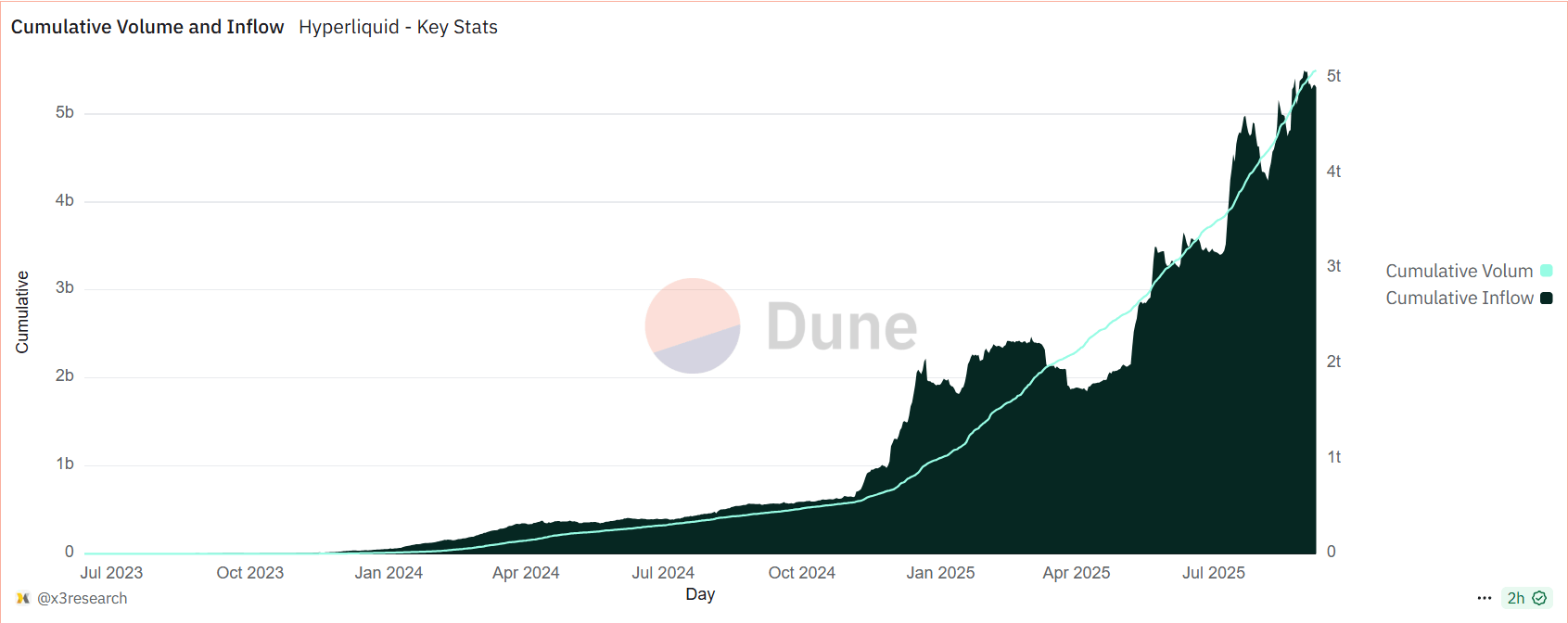

- Third-party dashboards — platforms like Dune, or custom builds, can ingest Hyperliquid data to visualize trading volume, open interest, latency, and other metrics over time.

Docs, testnet, and HYPE faucet

Hyperliquid keeps docs in the GitBook and API references. They cover both sides of the chain — HyperCore and HyperEVM — and there’s a public testnet where you can deploy contracts or try trading setups without risk. It’s the usual entry point if you just want to get a feel for the chain before going live.

Public faucets are often slow, rate-limited, or require verifications. That’s why on Chainstack, we run our own Hyperliquid testnet faucet so you can grab HYPE tokens instantly and focus on building.

With a funded wallet, you can deploy Solidity contracts on HyperEVM or test perpetual futures bots straight away.

How to run a Hyperliquid node

To build on Hyperliquid, you need to connect through RPC. Running your own node is possible, but heavy. The HyperEVM client has to be compiled, and the chain’s order book synced from genesis — requiring serious compute and storage.

Most teams decide to skip that overhead and use a managed RPC. A good endpoint gives you full access to HyperEVM and HyperCore without worrying about uptime or latency. For trading, missing a price feed or a cancel is costly, so stability matters more here than on most chains.

If you want to skip the overhead of running your own node, on Chainstack, you can get ready-to-use HTTPS and WebSocket endpoints. The nodes are fully synced, patched, and served from our global network with 99.9%+ uptime SLA. That means your trading bot or dApp connects to a stable, low-latency endpoint instead of a public node that might stall under load.

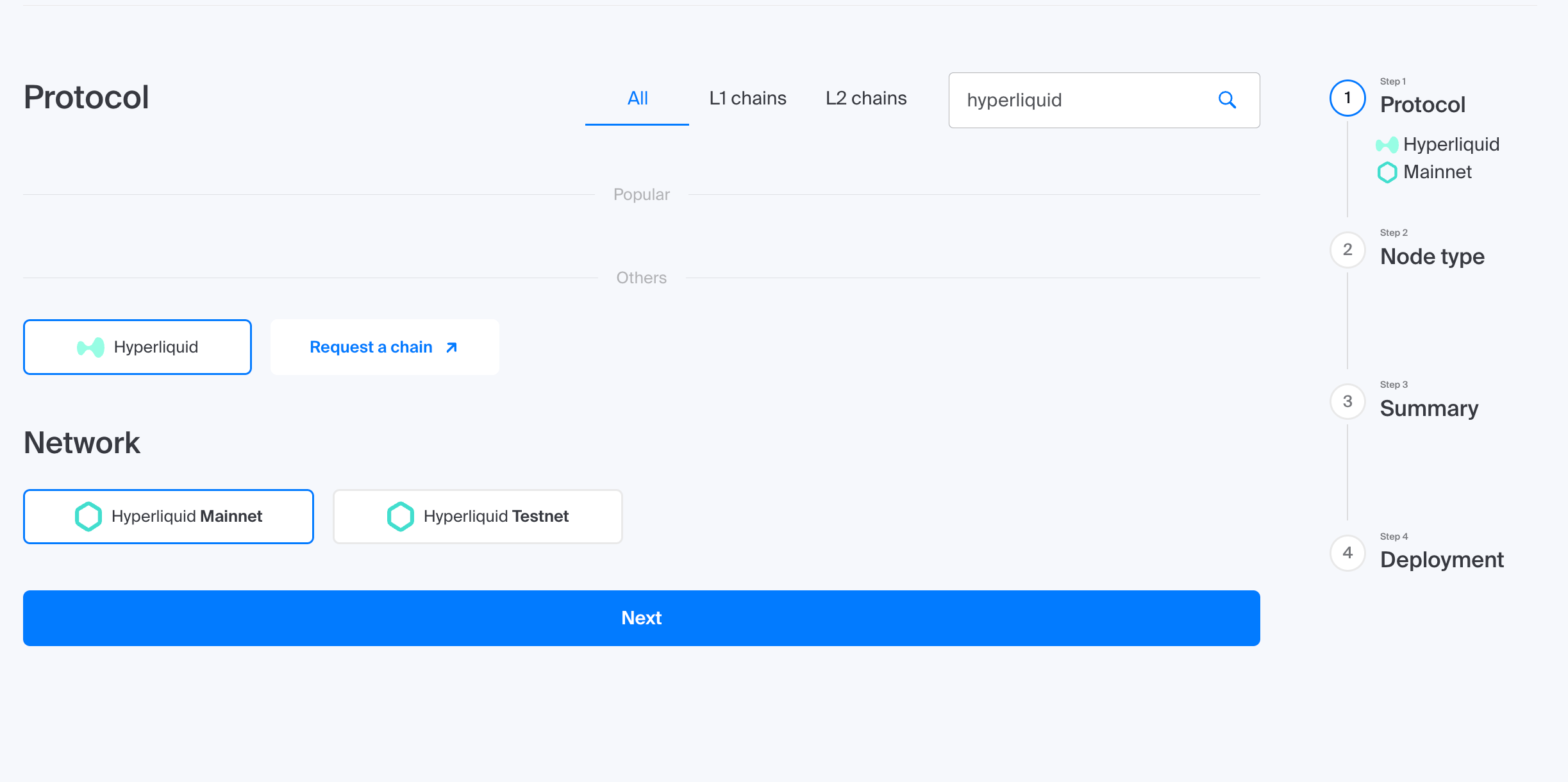

Set up a Hyperliquid RPC node on Chainstack:

- Log in to your Chainstack account (or create one if you don’t have it yet).

- Create a new project or select an existing one.

- Pick Hyperliquid as the network and choose mainnet or testnet.

- Deploy a node configured for RPC access.

- Once deployed, your private RPC URLs — including /evm and /info endpoints — are available in the node dashboard.

With both JSON-RPC and trading-specific endpoints exposed, you can run smart contracts and real-time trading logic from the same connection.

Wrapping up

If you’re building on Hyperliquid, Chainstack is the easiest way in. We run the full stack end-to-end so you don’t have to piece things together.

Everything you need to go from first deploy to production is in one place:

- Spin up your own Hyperliquid node on Chainstack and connect through private RPC.

- Use the Chainstack faucet to grab HYPE test tokens and fund your dev wallet.

- Check the HyperEVM method availability table for a live view of 100+ RPC methods and their support status.

- Run archive nodes and WebSockets on Hyperliquid HyperEVM mainnet for both historical lookups and realtime streams.

- Browse the Hyperliquid API reference for details on endpoints and payloads.

- And if you’re testing bots, there’s a ready-to-clone trading bot repo on GitHub.

Power-boost your project on Chainstack

- Discover how you can save thousands in infra costs every month with our unbeatable pricing on the most complete Web3 development platform.

- Input your workload and see how affordable Chainstack is compared to other RPC providers.

- Connect to Ethereum, Solana, BNB Smart Chain, Polygon, Arbitrum, Base, Optimism, Avalanche, TON, Ronin, Plasma, Hyperliquid, Scroll, Aptos, Fantom, Cronos, Gnosis Chain, Klaytn, Moonbeam, Celo, Aurora, Oasis Sapphire, Polygon zkEVM, and Bitcoin mainnet or testnets through an interface designed to help you get the job done.

- Fast access to blockchain archive data and gRPC streaming on Solana.

- To learn more about Chainstack, visit our Developer Portal or join our Telegram group.

- Are you in need of testnet tokens? Request some from our faucets. Sepolia faucet, Hoodi faucet, BNB faucet, zkSync faucet, Scroll faucet, Hyperliquid faucet.

Have you already explored what you can achieve with Chainstack? Get started for free today.

FAQ

Hyperliquid is a Layer-1 blockchain built for high performance trading. It runs a native order book at the protocol level with sub-second finality, and also includes HyperEVM for Ethereum-compatible smart contracts.

You can create a node in the Chainstack console, choose mainnet or testnet, and deploy it. Once live, your HTTPS and WebSocket RPC URLs — including /evm and /info — are available in the node dashboard.

Yes. HyperEVM is an Ethereum-compatible environment where developers can deploy Solidity smart contracts. These contracts can interact directly with the on-chain order book and trading data.

Deploy a Hyperliquid node on Chainstack and copy the private RPC URLs. Add them to your bot configuration so it can read order book data and submit transactions through a stable endpoint.

Hyperliquid exposes both JSON-RPC and REST APIs. JSON-RPC supports standard EVM queries such as blocks, transactions, and contract state. The REST API covers trading actions like submitting or canceling orders and streaming market data.

Chainstack provides a Hyperliquid faucet where you can instantly claim free HYPE tokens for testnet. With these tokens, you can deploy contracts on HyperEVM or simulate trading strategies without using real assets.

Yes. Archive nodes and WebSockets are available on Hyperliquid HyperEVM mainnet. Archive nodes let you query full historical state, while WebSockets provide real-time trading and contract data streams.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains