What is a Stablecoin: types, trade-offs, and how they run in 2026

Stablecoins peg to fiat, most often the US dollar. They move trillions a month now and sit underneath payments, trading, and cross-border payouts. If you build on-chain, you need to know how they’re designed and where the trade-offs are.

Stablecoins are crypto’s closest thing to digital cash. They’re tokens pegged to currencies like the U.S. dollar, designed to cut out price swings. In 2026, there’s more than $250B in circulation and over $2T moved each month. That’s a bigger flow than PayPal and close to legacy rails like ACH.

What started as “stable dollars for trading” has become core internet money. Visa, Stripe, PayPal, and JPMorgan now plug stablecoins into payments and settlement. On-chain, they backstop lending markets, power payrolls, and handle cross-border payouts at scale. If you’re building crypto infrastructure, you’ll end up touching them — whether that means minting, redeeming, or just moving tokens across networks.

Stablecoin-based applications are highly sensitive to latency, reliability, and predictable execution.

For these workloads, purpose-built blockchains such as Tempo are often a better fit than general-purpose networks.

What is Stablecoin?

A stablecoin is a type of cryptocurrency that aims to hold a steady price. Most are pegged to the U.S. dollar. Instead of moving like Bitcoin or Ether, they track one unit of a reference asset such as dollars, euros, or commodities, which makes them usable as digital money.

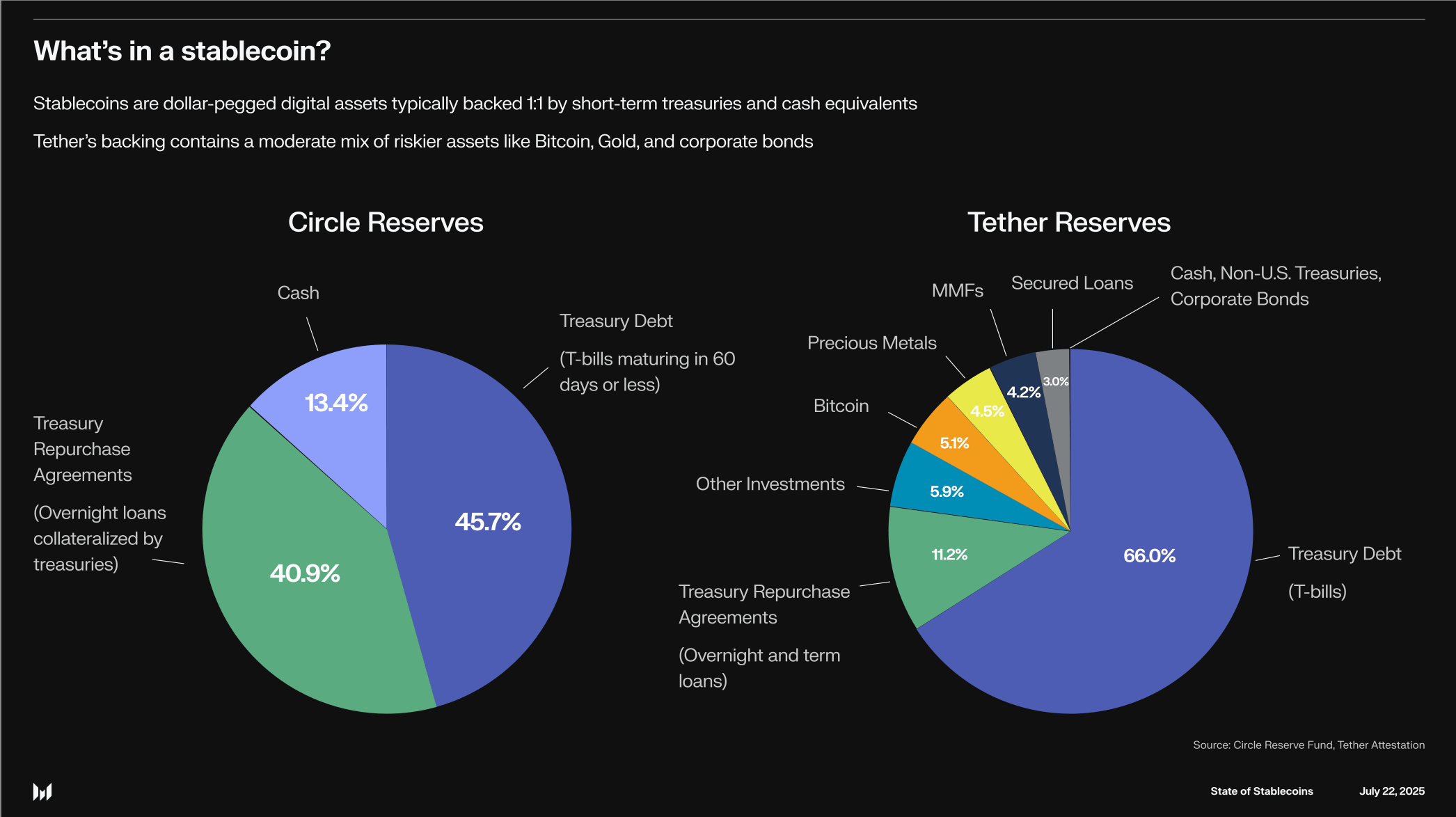

Most stablecoins are backed by reserves such as cash, short-term U.S. treasuries, or on-chain collateral. Others use algorithmic or hybrid designs to manage supply. Whatever the design, the purpose is to stay stable enough to move money on-chain, making it the base unit for exchanges, lending markets, and settlement flows.

Difference between Stablecoins and cryptocurrency

Most cryptocurrencies swing in price. Stablecoins are built to hold steady by tracking fiat currencies like the U.S. dollar. That design changes how they’re used, how they’re redeemed, and who integrates them.

| Stablecoins | Other Cryptocurrencies |

| Pegged to fiat (usually USD) to reduce price fluctuations | Float freely, often highly volatile |

| Backed by reserves or collateral; redemption rights through an issuer | No reserves, no redemption; price set only by supply and demand |

| Treated as digital money for payments, cross-border transfers, and settlement | Treated as speculative assets for upside or store of value |

| Integrated by financial institutions and payment firms; tied into AML and regulatory frameworks | Listed on crypto exchanges with fewer compliance layers |

| Some contracts allow freeze/blacklist controls and multi-chain mint/redeem | No issuer controls; immutable once minted |

Many people still ask is Bitcoin a Stablecoin? It isn’t. Bitcoin moves with market demand and has no peg or reserves. A stablecoin is different: it’s issued to track the dollar or another currency, backed by cash or collateral, and meant to hold steady so it can be used like digital cash on-chain.

How does a Stablecoin work to maintain value?

Stablecoins hold their peg with different mechanisms:

- Fiat-backed coins use bank reserves in cash and short-term treasuries. Users can mint by depositing dollars and redeem near 1:1, which keeps the token trading close to its peg.

- Crypto-collateralized designs lock excess crypto into smart contracts. If collateral value drops, liquidations restore balance.

- Algorithmic models adjust token supply using oracles and circuit breakers, though many add collateral after past depegs.

The common thread is redemption and arbitrage. If a stablecoin trades off-peg, traders can mint or redeem to close the gap. Reserves, oracles, and clear redemption rules make the difference between a stable peg and sudden price fluctuations.

Why Stablecoins matter: benefits, risks, and trade-offs

Stablecoins are the closest thing to digital money that crypto has. They move across blockchains without banking hours, give traders a steady unit of account, and cut friction in cross border payments. That’s why they now handle trillions each month. But every design comes with trade-offs, from depeg risk to the policies that issuers and regulators enforce.

| Benefits | Risks/Cons |

| Fast settlement across time zones and chains | Regulatory framework still shifting; rules differ by region |

| Lower costs for cross border payments compared to wires or cards | On/off-ramp access tied to your bank account and jurisdiction |

| Pegged value avoids the swings of other types of cryptocurrency | Price fluctuations can still happen if reserves or oracles fail |

| Works with wallets, crypto exchanges, and enterprise payouts | Smart-contract or governance bugs can break mint/burn logic |

| Integrated by financial institutions as settlement rails | Some stablecoin issuers disclose more than others; trust varies |

| 24/7 transfer rails and composable DeFi flows | Freeze/blacklist features and anti-money laundering controls can halt funds |

How Stablecoins work under the hood

Stablecoins hold their peg through a loop of mint, reserve, and redemption. New tokens are minted when dollars or collateral flow in, and burned when users redeem back out. Fiat-backed stablecoins like USDC and USDT keep cash and short-term treasuries with custodians; issuers publish attestations to show backing.

DAI is the template for crypto-collateralized stablecoins. You lock in more ETH than you borrow. If the price of ETH dives, the system sells it off to keep the peg. Oracles call the shots on pricing, and some protocols wire in circuit breakers or freezes for stress events.

Three things keep stablecoins near $1:

- Redemption rights — issuers mint and burn to match inflows and outflows.

- Collateral — cash, treasuries, or crypto locked against supply.

- Market arbitrage — traders close small gaps on crypto exchanges.

Algorithmic models have tried to manage supply without reserves, but most failed to hold parity.

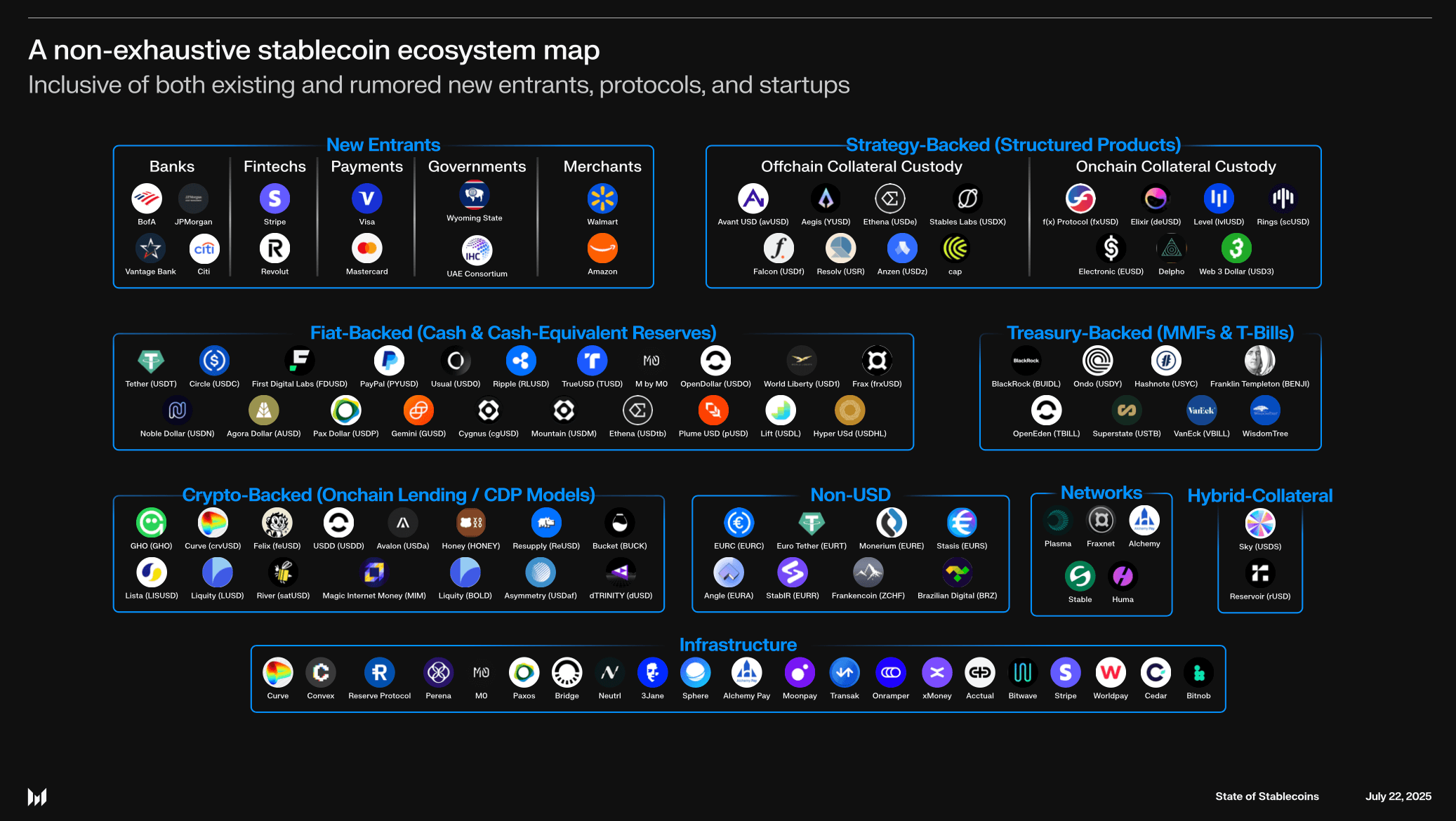

Types of Stablecoins

There are a few types of stablecoins. Each holds a peg in a different way, which changes risk, disclosure, and how you build on it.

- Fiat-backed stablecoins: Backed by cash and short-term U.S. treasuries held with custodians. You can redeem near $1 through an issuer. Low drift and fast settlement. (Examples: USDC, USDT on Plasma chain, PYUSD.)

- Crypto-collateralized: Backed by on-chain collateral with overcollateralization and liquidations. Transparent and programmable. (Example: DAI.)

- Algorithmic stablecoins: Aim to hold parity with supply rules or swap mechanics. Capital-light on paper.

- Hybrids / PSM models: Mix fiat and crypto backing or use a price stability module to keep swaps around $1. Flexible design.

Stablecoin list 2026: top tokens and supported networks

Most stablecoin supply concentrates on a few networks. That’s where the liquidity and transfers concentrate.

| Stablecoin | Peg | Main Network |

| USDT (Tether) | USD | Tron, Ethereum, BNB Chain, Solana, EVM L2s |

| USDC (Circle) | USD | Ethereum, Solana, Base, Arbitrum, Avalanche, Polygon |

| DAI (MakerDAO) | USD | Ethereum (bridged to L2s) |

| PYUSD (PayPal) | USD | Ethereum, Solana |

| EURC (Circle) | EUR | Ethereum, Solana |

| FDUSD (First Digital) | USD | BNB Chain, Ethereum |

USDT dominates on Tron and Ethereum. USDC spans EVM chains and Solana with CCTP for native moves. DAI stays on Ethereum, backed by on-chain collateral. Newer entrants like PYUSD and EURC are tied to payments and euro rails.

Stablecoin use cases

For builders, the main use cases break down into four areas:

- Payments and remittance — Fast, cheap cross border payments without bank hours or FX drag.

- Trading and settlement — the unit of account on exchanges and DeFi pools.

- On-chain treasury and payouts — payrolls, reserves, and contractor pay now run in tokens.

- AI and agents — Early pilots use stablecoins as programmable money for bots and automated services.

Stablecoin infrastructure with Chainstack

For stablecoins, you need infrastructure that holds steady under load. With Chainstack, you get 99.99% uptime to reach 70+ blockchain protocols through Global Nodes and Dedicated Nodes, including purpose-built chains like Tempo optimized for stablecoin workloads, keeping flows for USDT, USDC, DAI, PYUSD, EURC, and FDUSD consistent across networks.

On top of that, you get the controls and speed required to run in production. Access rules let you gate keys, methods, and IPs. While Trader Nodes provide low-latency execution over HTTP and WebSocket, and on Solana, the Geyser plugin streams transfers in real time.

As for data, with Chainstack, you also get Subgraphs to index balances, holders, supply snapshots, and redemption events into a single source for dashboards, audits, and monitoring.

With this stack, you can launch, scale, and operate stablecoin apps without worrying about downtime or missing anything.

Wrapping up

You’ve now seen how stablecoins actually work: mint and burn, reserves, redemptions, oracles, and the trade-offs between models. They’ve grown into the default money layer on-chain, which means every builder ends up touching them: for payouts, treasuries, or settlement.

If you’re ready to take that into production, run it on Chainstack. You’ll get reliable nodes, archive history, live streams, and controls across 70+ networks. And if you’re still comparing RPC vendors, here’s a guide to six free tools that benchmark top node providers.

Power-boost your project on Chainstack

- Discover how you can save thousands in infra costs every month with our unbeatable pricing on the most complete Web3 development platform.

- Input your workload and see how affordable Chainstack is compared to other RPC providers.

- Connect to Ethereum, Solana, BNB Smart Chain, Polygon, Arbitrum, Base, Optimism, Avalanche, TON, Ronin, Plasma, Hyperliquid, Scroll, Aptos, Fantom, Cronos, Gnosis Chain, Klaytn, Moonbeam, Celo, Aurora, Oasis Sapphire, Polygon zkEVM, and Bitcoin mainnet or testnets through an interface designed to help you get the job done.

- Fast access to blockchain archive data and gRPC streaming on Solana.

- To learn more about Chainstack, visit our Developer Portal or join our Telegram group.

- Are you in need of testnet tokens? Request some from our faucets. Sepolia faucet, Hoodi faucet, BNB faucet, zkSync faucet, Scroll faucet, Hyperliquid faucet.

Have you already explored what you can achieve with Chainstack? Get started for free today.

FAQ

A stablecoin is a crypto token designed to hold a steady price, usually pegged 1:1 to the U.S. dollar. Reserves, collateral, or supply controls keep it near the peg so it can be used as digital money instead of a speculative asset.

Stablecoins work through minting, burning, and redemption. Fiat-backed models hold cash and treasuries with custodians, while crypto-backed models lock excess collateral in smart contracts and liquidate when coverage slips.

The two main types are fiat-backed stablecoins (like USDC, USDT, PYUSD) and crypto-collateralized stablecoins (like DAI). Algorithmic or hybrid models exist but have struggled to hold their peg.

Bitcoin is not a stablecoin. It has no peg, no reserves, and its price moves with market demand. Stablecoins track fiat currencies like the U.S. dollar and are used for payments, trading, and settlement.

To create a stablecoin on Ethereum, you design a contract (often ERC-20), define mint and burn functions, and connect reserves to back the supply. With Chainstack you can run Ethereum nodes, apply Access rules for admin calls, and scale the same setup across 70+ networks.

They are used for cross border payments, trading collateral, on-chain treasuries, and embedded finance. Most crypto exchanges settle trades in stablecoins, and institutions use them for fast international payouts.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains