Stablecoins in cross-border settlements

Stablecoins are becoming the rails for cross-border money movement. Here’s a look at the networks carrying the flow and the reliable infrastructure to keep it running.

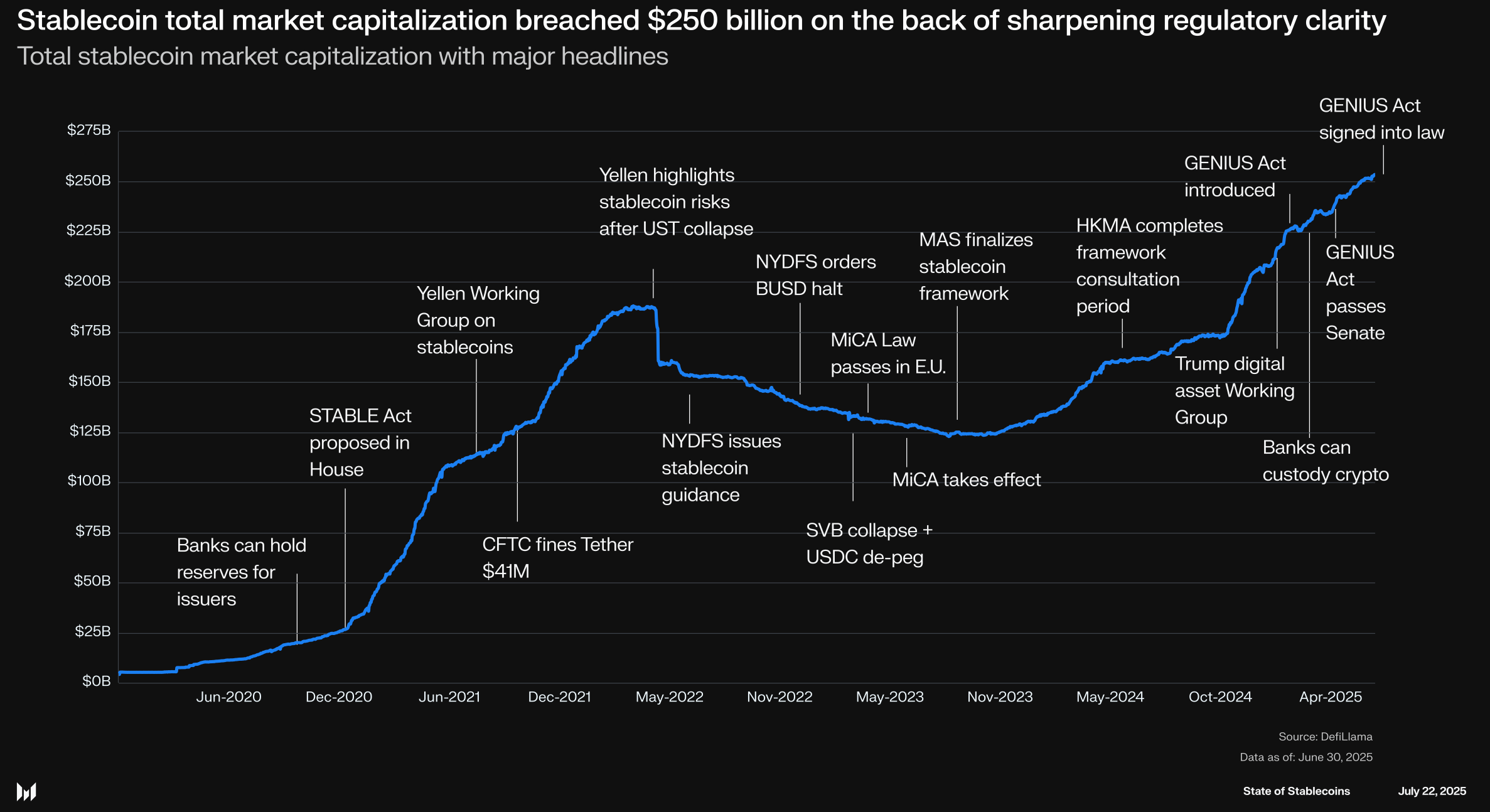

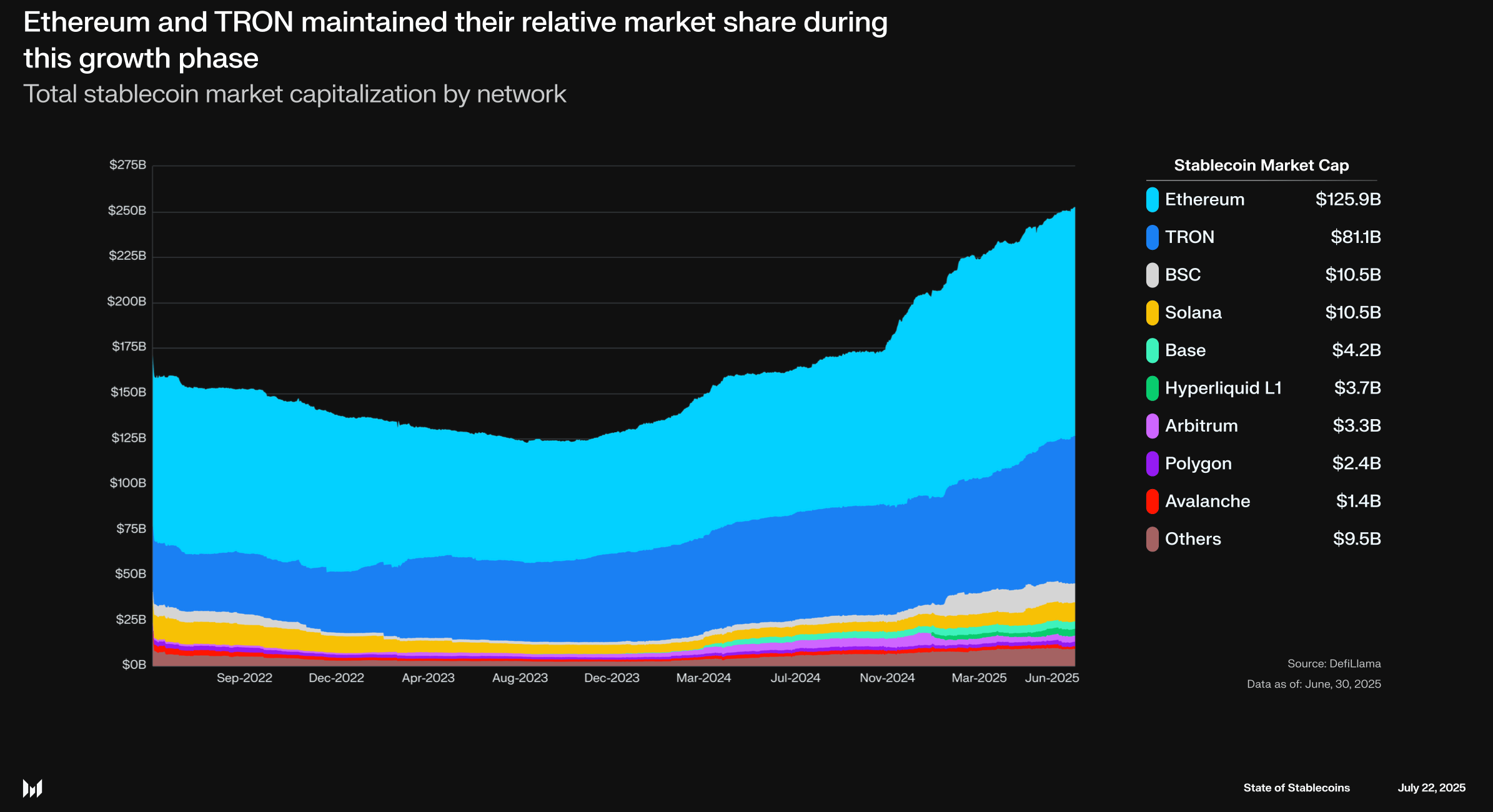

Stablecoins have moved into mainstream finance, linking bank systems with digital asset networks. Dollar-pegged tokens already move volumes on the scale of major payment networks, with transactions rivaling ACH, Visa, and PayPal. In mid-2025, the supply of stablecoins crossed $250B, reflecting demand for quicker, always-on payments.

This growth has driven demand for purpose-built blockchain infrastructure. Networks like Tempo are optimized specifically for stablecoin workloads, offering the low latency and predictable execution that payment applications require.

This rise comes from the need for faster, always-on payment rails. Regulators and institutions are paying closer attention, while banks and fintech firms roll out stablecoin strategies to modernize their transfers. Once a trading side-product, stablecoins are now part of mainstream payment infrastructure.

How Stablecoins improve cross-border settlements

In cross-border transfers, stablecoins cut time and cost. The main advantages are:

- Faster settlement for cross-border transactions: Transfers land in minutes instead of one to two days. There are no wire cutoffs or banking hours to wait for, so money can move between regions anytime. For businesses, that kind of speed improves cash flow and reduces settlement risk.

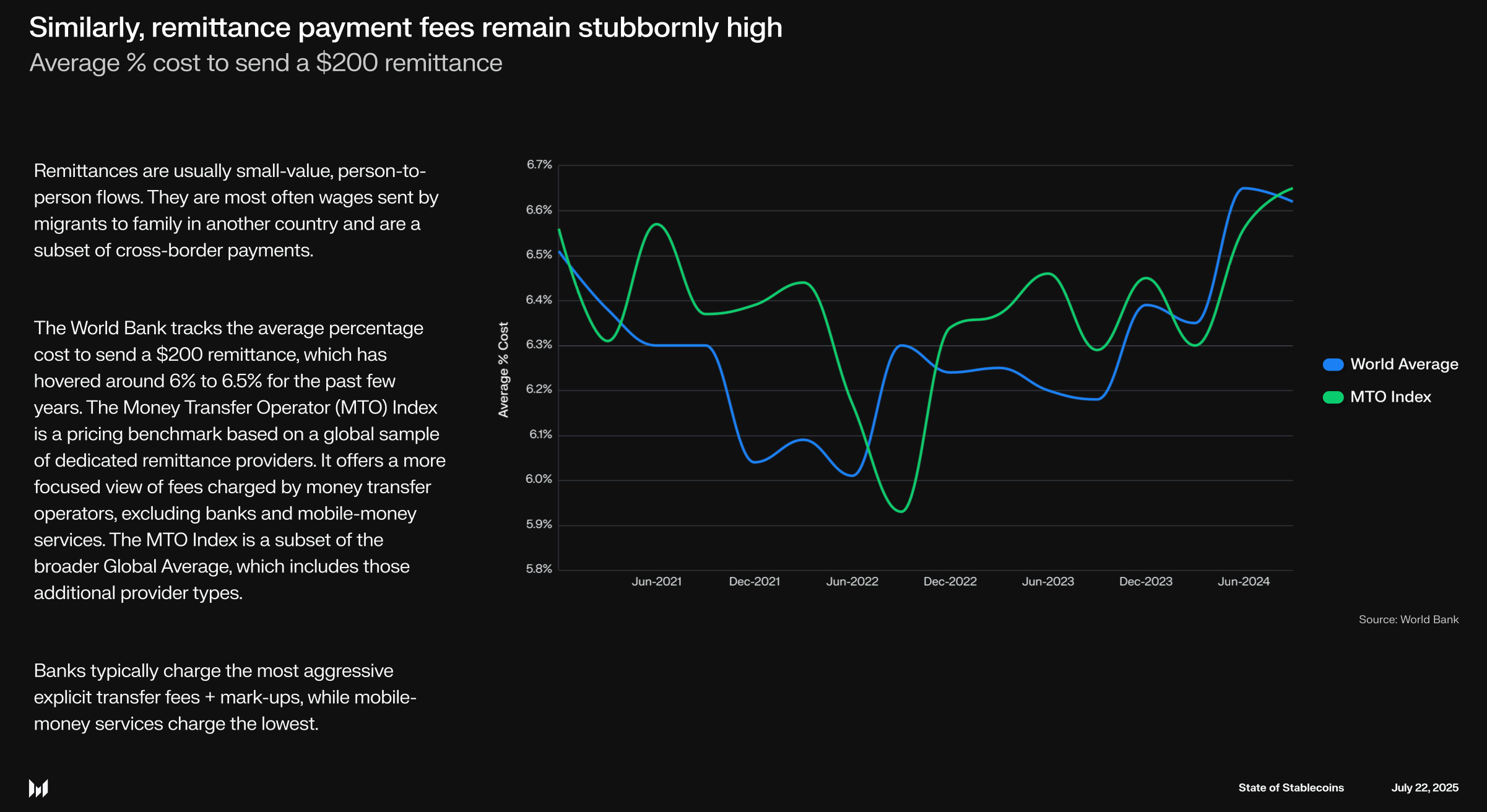

- Lower costs: By bypassing correspondent banks and reducing currency conversion steps, stablecoins cut fees. Users enjoy lower FX and transaction costs, which is especially impactful for emerging markets and high-volume remittances. Even small businesses can avoid hefty wire fees and unfavorable exchange rates by using stablecoins for international payments.

- Financial access: In countries with volatile currencies or limited banking, a phone wallet holding USDT or USDC works like a dollar account. Anyone with internet access can hold and send value in dollars, which opens up global commerce to people locked out of the traditional system.

Companies now use stablecoins for things like moving capital between subsidiaries, and payment networks have run pilots for payouts. Real-time settlement and reduced FX friction are the main draws, with speed, cost, and accessibility improving over traditional systems.

Stablecoin adoption and network data in 2025

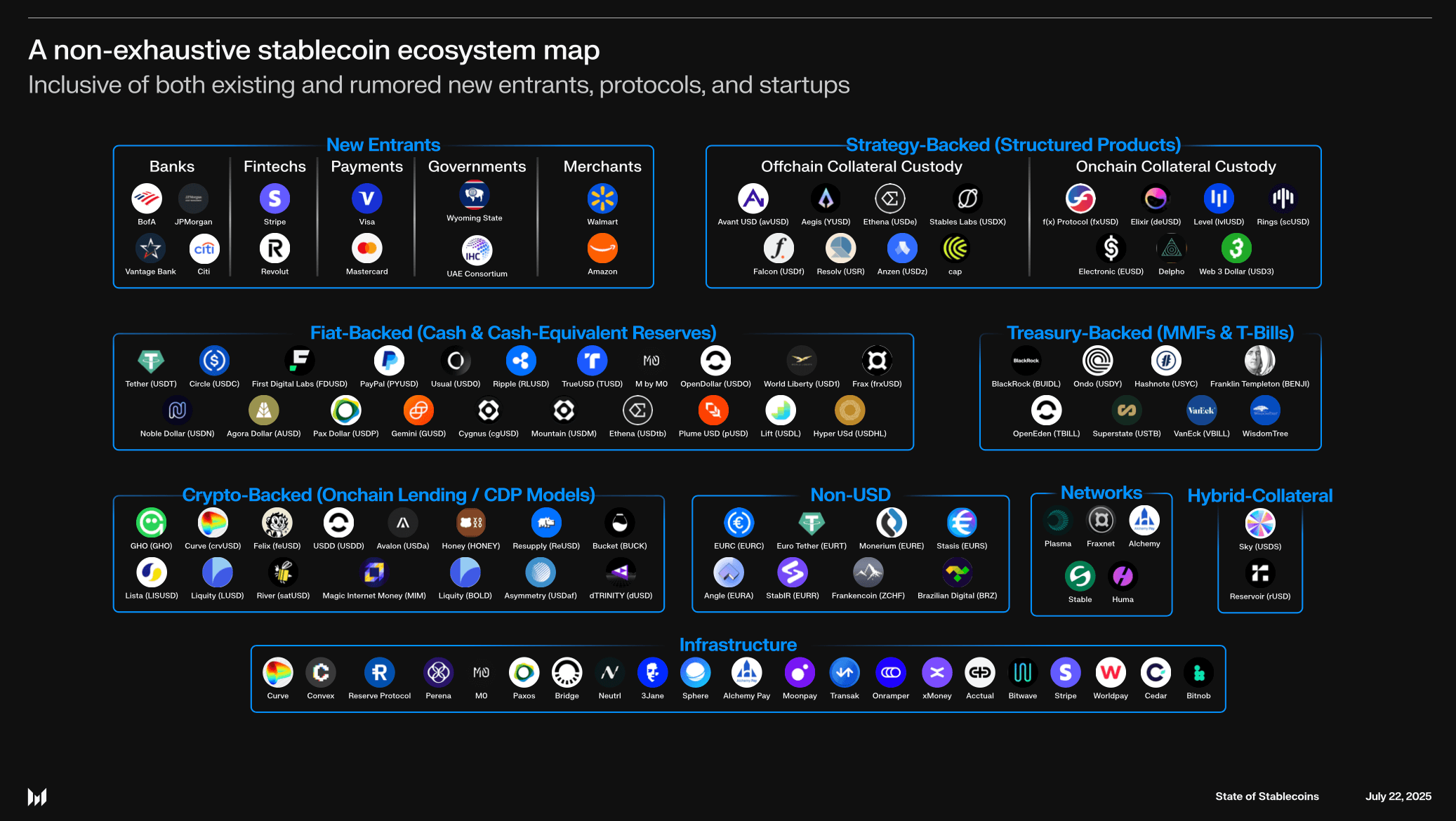

Messari’s State of Stablecoins 2025 gives a clear picture of adoption, market size, and on-chain activity:

- Market size: Global stablecoin capitalization passed $250B in 2025 as regulatory clarity improved. The demand for digital dollars now extends well beyond crypto trading.

- USDT dominance: Tether’s USDT leads the market with about 63% share and over $155B in circulation. More than half of that supply runs on Tron, which has become a major hub for stablecoin activity. By size alone, USDT now rivals the market cap of large banks.

- Tron network usage: Tron has grown into one of the main settlement layers for stablecoins, especially in emerging markets. The network handles the majority of USDT supply and supports billions in daily transfers. More than half of USDT lives on Tron, which processes around $21.5 billion in USDT transfers daily. Tron’s low fees and fast transactions have attracted a huge user base – the network now accounts for roughly 26% of global active stablecoin addresses. (Ethereum remains the largest by value, but Tron and BNB Chain lead in active usage.)

- Transaction volumes vs. payment networks: Stablecoin usage is reaching parity with traditional payment systems. By mid-2025, monthly stablecoin transfers had overtaken PayPal and Visa and were closing in on ACH volumes. The amounts moving each month now match the scale of the largest payment processors.

Stablecoins have grown fast: hundreds of millions of users transact with them, and chains like Ethereum, Tron, BNB Chain, and Solana process much of the flow. The result is a system already handling value at the level of global settlement infrastructure.

USDT vs. USDC: use cases in global transactions (emerging markets focus)

Tether (USDT) and Circle’s USD Coin (USDC) are the two dominant stablecoins, but they have somewhat different use case profiles – especially in emerging markets. USDT is by far the most widely used stablecoin in day-to-day trading and informal economies, while USDC plays a bigger role in regulated and institutional contexts.

USDT picked up early as the base currency on exchanges, and today it counts over 400 million users around the world. Traders rely on it because of its liquidity and because almost every crypto pair is quoted in USDT. Beyond trading, it has become the go-to option for savings and everyday payments in many emerging markets. In places dealing with currency depreciation or capital controls, people often use USDT as a practical substitute for dollars.

Across most of Africa and Asia, on-chain USDT accounts vastly outnumber USDC accounts. (In contrast, usage in Europe and North America is more balanced between the two stablecoins.) The Messari report finds that on average there are 5.4 times more USDT users than USDC users worldwide, with the gap being highest in regions like West Africa and the Caribbean. This reflects how deeply ingrained USDT has become in emerging market transactions.

Peer-to-peer fiat markets on exchanges show the gap clearly. In most emerging economies, USDT trades at higher volume — and often at a higher price — than USDC.

In places like Nigeria or Russia, it even runs at a premium to the official bank rate, since people are willing to pay extra for stable USD value. For many, these P2P desks work like informal remittance or FX channels, a way to swap local currency into USDT to hedge inflation or send money abroad.

Liquidity and recognition make USDT the easier choice; holders know they can convert it back into goods or cash almost anywhere. USDC sees less use in these settings, since its base of users in developing markets is still catching up.

That said, USDC has been picking up ground in more formal transactions. It’s the second-largest stablecoin and is often chosen by fintechs, banks, and corporate treasuries because of its regulatory clarity and U.S.-based reserves.

Circle has pushed USDC toward enterprise use. It built a payments network for institutions and expanded liquidity across chains. The effect shows in the numbers: by early 2024, monthly transfers cleared $1 trillion, much of it in B2B flows, e-commerce, and ramps.

In developed markets, and especially where banks integrate directly, USDC is a common tool for settling trades or powering financial products. But at the retail level in emerging economies, USDT still holds the lead. Liquidity follows habit. People have used USDT for years, and that history keeps it ahead of USDC.

Scaling stablecoin infrastructure with Chainstack

Stablecoins are moving billions across networks every day. Running them at scale requires reliable nodes, cross-chain connectivity, and 24/7 monitoring. That’s the piece Chainstack solves. With 70+ supported networks, including Ethereum, Solana, Tempo, and BNB Chain, Chainstack lets teams deploy nodes in minutes and keep them synced without the overhead of maintenance. Issuers and platforms get secure, low-latency access for minting, burning, and transferring stablecoins at scale — all backed by global infrastructure and expert management.

For stablecoin-specific workloads, Chainstack also supports Tempo—a blockchain optimized for payment infrastructure with predictable gas costs and sub-second finality.

Wrapping up

Stablecoins are no longer just a trading tool, they’ve become one of the main rails for cross-border money movement. USDT dominates peer-to-peer flows in emerging markets, while USDC is finding its place in regulated and institutional payments. Both rely on dependable infrastructure to keep growing.

As adoption climbs past $250B in circulation, the technical backbone matters as much as the tokens themselves. The networks carrying the flows and the infrastructure that keeps them reliable will decide how far stablecoins go in global finance.

Power-boost your project on Chainstack

- Discover how you can save thousands in infra costs every month with our unbeatable pricing on the most complete Web3 development platform.

- Input your workload and see how affordable Chainstack is compared to other RPC providers.

- Connect to Ethereum, Solana, BNB Smart Chain, Polygon, Arbitrum, Base, Optimism, Avalanche, TON, Ronin, Plasma, Hyperliquid, Scroll, Aptos, Fantom, Cronos, Gnosis Chain, Klaytn, Moonbeam, Celo, Aurora, Oasis Sapphire, Polygon zkEVM, and Bitcoin mainnet or testnets through an interface designed to help you get the job done.

- Fast access to blockchain archive data and gRPC streaming on Solana.

- To learn more about Chainstack, visit our Developer Portal or join our Telegram group.

- Are you in need of testnet tokens? Request some from our faucets. Sepolia faucet, Hoodi faucet, BNB faucet, zkSync faucet, Scroll faucet, Hyperliquid faucet.

Have you already explored what you can achieve with Chainstack? Get started for free today.

FAQ

A stablecoin is a crypto asset pegged to a fiat currency, most often the US dollar. In cross-border payments it works like a digital dollar, moving value quickly and at lower cost than traditional correspondent banks.

Because they settle in minutes and run 24/7 on public chains. That avoids the delays and high fees of bank wires, making them efficient for sending money across borders.

USDT dominates in peer-to-peer markets across Africa, Asia, and Latin America because of its liquidity and recognition. USDC is more common in regulated or institutional contexts.

Ethereum handles the largest share of value, while Tron and BNB Chain lead in active user counts and daily transfer volumes. Solana also supports significant flows.

Regulation varies by country. The U.S., EU, and several Asian markets are rolling out frameworks that require reserve transparency and licensing for issuers.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains