Tempo blockchain: Low-latency infrastructure for stablecoins

TL;DR

Stablecoins now function as real-world money, not just crypto-native instruments. Payments, remittances, treasury settlement, and onchain FX place strict requirements on latency, finality, reliability, and fee predictability—constraints that most general-purpose blockchains struggle to meet at scale. Tempo blockchain is built specifically for stablecoin-dominant transaction flows, prioritizing:

- Low and predictable latency for real-time payments

- Fast finality to reduce settlement risk

- High reliability under sustained load

- Fee stability for high-frequency, low-margin transfers

This article explains why stablecoin infrastructure demands these properties, where traditional blockchains fall short, and how the Tempo blockchain aligns with the economic realities of stablecoin-driven systems.

Why stablecoin infrastructure need low-latency

When users send stablecoins, they expect behavior closer to card payments, UPI, bank transfers or FX settlement rails. Stablecoins have quietly become the most widely used blockchain application category by volume. Unlike volatile assets, stablecoins are:

- Storage of value

- Unit of account

- Medium of exchange

For our everyday lives, we need a stable currency to fulfil these three functions of money which has low volatility. Not the probabilistic, congestion-sensitive experience historically associated with blockchains.

However, achieving this stability isn’t just about pegging a token to a dollar. A critical, often overlooked requirement is latency. It is often treated as a “nice to have” metric in blockchains. For stablecoin infrastructure use cases, it is a hard constraint.

Low latency directly affects:

- User experience: Payments that take seconds (or minutes) feel broken in real-world commerce.

- Settlement risk: Delayed finality increases exposure between counterparties.

- Capital efficiency: Longer settlement times require higher buffers and collateral.

- Market efficiency: FX, arbitrage, and treasury operations degrade with delayed execution.

Stablecoin infrastructure that operates at scale, whether remittances, merchant payments, or liquidity routing, must process large volumes of low-value transactions quickly and consistently.

This creates a non-negotiable requirement: predictable, low end-to-end latency.

What is Tempo blockchain

Tempo is a payments-first blockchain designed for real-world stablecoin infrastructure, built around the core principles of decentralization, neutrality, reliability, and execution predictability. Tempo is developed from Stripe’s experience operating global payment systems and Paradigm’s expertise in crypto protocol design, and is led by Matt Huang, co-founder and managing partner of Paradigm, who also serves on Stripe’s board and acts as Tempo’s CEO.

Tempo’s development is shaped directly by design partners operating large-scale, real-world payment, banking, and platform infrastructure, including Anthropic, Deutsche Bank, DoorDash, Lead Bank, Nubank, OpenAI, Revolut, Shopify, Standard Chartered, and Visa with infra partners such as BitGo, Blockdaemon, Chainstack and many more.

At the protocol level, Tempo introduces a payments-first execution model:

Predictable Low Fees: Tempo is engineered to maintain stable, low transaction fees even under sustained high load, ensuring cost predictability for payments, payroll, and remittance flows.

Stablecoin-Native Gas: Payments and gas fees can be paid in any stablecoin through an enshrined AMM. This removes the need for a separate gas token and avoids application-level abstractions that introduce friction into stablecoin payment flows.

Opt-In Privacy: Tempo supports selective disclosure, allowing participants to preserve privacy while still meeting compliance and operational requirements.

Payments-First UX: The protocol includes native features such as a dedicated payments lane, transaction memos, and access lists, enabling clean, expressive, and auditable payment execution.

Deterministic Execution Under Load: Tempo guarantees predictable transaction behavior during peak usage, eliminating the fee spikes and execution uncertainty common on generalized blockchains.

High Scalability: The network is designed to support 100,000+ transactions per second with sub-second finality, meeting the demands of global payment systems.

Infrastructure-Grade Reliability: Tempo prioritizes uptime, fault tolerance, and consistency to meet the standards required by banks, fintech platforms, and global payment processors.

EVM Compatibility: Tempo is fully EVM-compatible and built on Reth, preserving compatibility with existing Ethereum tooling while tuning execution for payment-centric workloads rather than generalized smart-contract computation.

Tempo enables a broad range of real-world, stablecoin-driven use cases, including:

- Global Payouts

- Remittance

- Embedded Finance

- Tokenized deposits with 24/7 continuous settlement

- Microtransactions

- Agentic payments

Scroll down to the ‘Use Cases’ section to learn more

Tempo delivers a blockchain architecture capable of supporting global financial flows with the performance, predictability, and reliability required for real-world adoption.

Tempo blockchain payments-first architecture

Tempo is a blockchain designed specifically for stablecoin payments, built with the Reth SDK. Its architecture focuses on high throughput, predictable low cost, deterministic finality, and operational reliability, properties required by financial institutions, payment service providers, and fintech platforms.

Tempo is fully EVM-compatible, preserving Ethereum tooling while extending the protocol with payments-first primitives.

Tempo blockchain transactions

Tempo extends the transaction layer to natively support modern payment workflows.

Tempo introduces a payments-first typed transaction based on EIP-2718, purpose-built for real-world payment workflows and available exclusively on Tempo. By enshrining features commonly grouped under account abstraction natively into the protocol, Tempo eliminates the need for custom smart contracts or third-party middleware, reducing integration risk and operational overhead for payment applications.

Tempo Transactions natively supports:

- Batch execution: Thousands of payments can be executed atomically in a single transaction, ensuring that large payout runs either fully succeed or fully revert, which is critical for payroll, merchant settlements, and refunds.

- Fee sponsorship: Transactions can be signed by a user while fees are paid by a sponsor, with gas denominated in USD stablecoins infrastructure, removing the need for users to hold volatile gas assets.

- Scheduled execution: Transactions can specify a valid execution window, enabling recurring payments and subscriptions without off-chain automation.

- Modern authentication: Native WebAuthn / P256 passkey support allows biometric authentication backed by secure enclaves, eliminating seed phrase management while preserving cryptographic security.

By embedding these features into the transaction format, Tempo simplifies wallet design and improves UX for both consumer and enterprise payment flows.

Native stablecoins infrastructure

Tempo is designed around the economic constraints of stablecoin payments.

- Stablecoin-Native Gas: Transaction fees are paid directly in USD-backed stablecoins. Users are not required to hold volatile assets (e.g., ETH) to move stablecoins, eliminating a major operational friction present on most blockchains.

- Predictable, Low Fee Structure: Tempo targets a consistently low fee level, approximately $0.001 (0.1 cents) per transaction, that remains stable regardless of transaction volume.

- TIP-20 Token Standard: Tempo defines an enshrined stablecoin token standard optimized for payments, reconciliation, and accounting workflows.

{

"name": "MyToken",

"symbol": "MTK",

"decimals": 18,

"chainId": 42429,

"address": "0x...",

"logoURI": "<https://esm.sh/gh/tempoxyz/tempo-apps/apps/tokenlist/data/42429/icons/><address>.svg",

"extensions": {

"chain": "tempo"

}

}

- Built-In Stable Asset DEX: A protocol-level decentralized exchange optimized for stablecoins and tokenized deposits enables:

- Paying fees in any supported USD stablecoin infrastructure

- Validators receiving fees in their preferred USD stablecoin

- Automatic conversion between stable assets using onchain liquidity

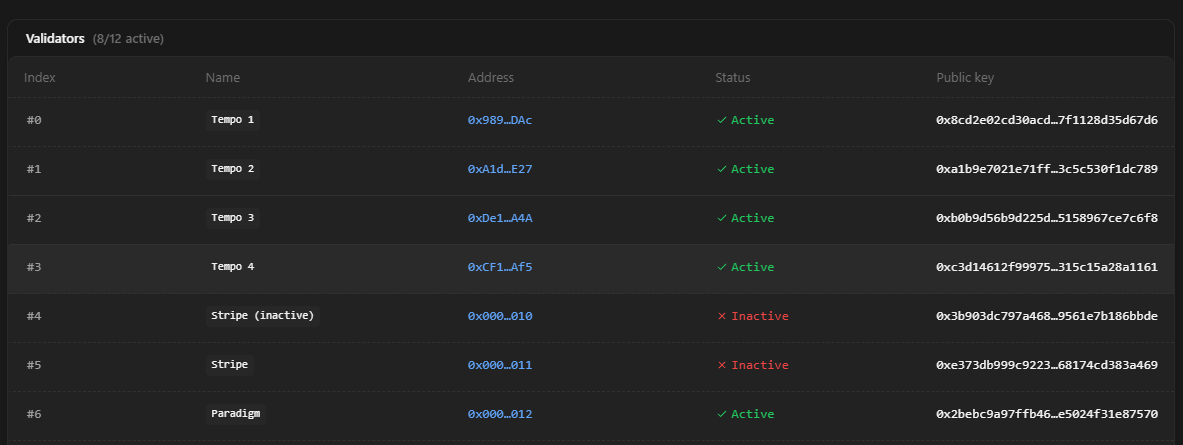

All validators are listed on Tempo Explorer:

Fee volatility that may be tolerable for speculative trading is unacceptable for payments infrastructure. From the user perspective, this results in “dollars in” being equivalent to “digital dollars out,” without managing separate token inventories for fees simplifying cross-stablecoin payments and routing.

Fast Finality

Tempo is built on the Commonware Library, a modular blockchain infrastructure stack. Tempo is a core contributor to Commonware and is leading a $25M strategic investment to advance high-performance, reliable infrastructure for payment systems.

- Modular primitives: Commonware provides P2P, Networking, Consensus, Execution, Storage, Runtime, and Mempool primitives that can be modified or upgraded while live, enabling continuous improvement without disrupting payment flows on Tempo.

- Simplex Consensus: Tempo uses Simplex, a Byzantine fault-tolerant protocol producing blocks every ~600ms, with a distributed validator set to prevent single points of censorship. Minimmit targets block times of roughly 300ms while strengthening guarantees around block finality, aiming to optimize both speed and safety rather than trading one off for the other.

- Dedicated payment lanes: Tempo routes payment transactions through a dedicated payments lane at the protocol level, ensuring they do not compete with unrelated activity such as NFT mints, liquidations, or high-frequency DeFi calls. This guarantees that payment transactions always have available blockspace, even during periods of high network congestion, with no action required from the user.

- Separate gas limits enforced by validators: Reliable payment execution is enforced through distinct gas constraints during block construction. Validators apply a global

gas_limit, representing the total gas available per block, alongside ageneral_gas_limit, which caps the maximum gas that non-payment transactions can consume. Non-payment transactions in the proposer’s lane are limited togeneral_gas_limit, while payment transactions can consume the remaining capacity up to the totalgas_limit. This design eliminates congestion-driven downtime and supports predictable, high-volume payment flows for payment processors.

By building on Commonware, Tempo can focus on payment-specific execution, blockspace guarantees, and stablecoin-native economics while pursuing sub-250ms finality on a globally distributed, permissionless validator network.

EVM compatibility

Tempo is built on a high-performance, modular EVM execution layer powered by the Reth SDK.

- Built with the Reth SDK: Tempo leverages Reth’s modular architecture to tune execution for payment-heavy workloads rather than generalized smart-contract computation.

- Full EVM Compatibility: Existing Ethereum tooling, contracts, and developer workflows remain usable, reducing integration friction for payment applications.

Tempo blockchain privacy

Tempo is developing opt-in privacy features that preserve the compliance and auditability required by regulated stablecoin issuers. Rather than making privacy an all-or-nothing property, the design enables confidentiality for balances and transfers while allowing authorized parties to retain the visibility needed for reporting, monitoring, and policy enforcement.

This is achieved through a native private token standard designed specifically for stablecoins. Unlike traditional blockchains where all transaction data is publicly exposed, Tempo’s approach supports private balances and confidential transfers while enabling selective disclosure. Issuers and regulators can access required information without forcing sensitive financial data to be broadcast on a public ledger.

- Private balances: Account balances are hidden from public view while remaining auditable by authorized parties

- Confidential transfers: Transaction amounts and participants can be shielded from the public ledger

- Selective disclosure: Issuers and regulators retain visibility for compliance without exposing sensitive data publicly

Tempo blockchain use cases

Tempo is built for stablecoin-driven financial workflows where reliability, latency, and fee predictability matter more than generalized smart-contract flexibility. Stablecoins are already being used in production by global platforms, fintech, and institutions.

Global Payouts

Managing payroll and payouts across borders is notoriously complex. Traditional transfers are slow, expensive, and prone to errors due to intermediary banks, currency conversion, and local banking rules. Tempo simplifies this by enabling direct stablecoin payments that settle in seconds, with predictable, low fees and minimal operational overhead.

By moving value onchain, companies can bypass slow correspondent networks. For example, a $1,000 cross-border payout that might cost $10–$40 in wire fees and take several days now completes almost instantly with just 0.1–0.4% in fees, giving recipients full dollar value without exposure to FX volatility. Funds can be distributed globally from a central wallet or via subsidiaries in seconds, removing the need for pre-funded local accounts.

- DoorDash: Seamless contractor and driver payouts worldwide

- Shopify: Fast, predictable merchant settlements across multiple countries

- Klarna: Immediate merchant settlements using KlarnaUSD to optimize cash flow

- Mastercard: Testing stablecoin settlement rails alongside traditional card infrastructure

- Global employers: Efficient payroll and contractor payments across regions without banking friction

Remittance

Tempo enables near-instant stablecoin payments at minimal cost, while reducing operational complexity for providers. Funds settle onchain in seconds, with predictable fees and full transparency, eliminating FX exposure and reliance on pre-funded liquidity. Stablecoins enable practical remittance flows:

- Direct Transfers: Sender onramps to stablecoins and sends funds directly to the recipient’s wallet. Recipients can hold, spend, or off-ramp to local currency.

- Orchestrated Payments: Transfers pass through a stablecoin orchestration layer, automatically converting funds into the recipient’s local currency while maintaining speed and low cost.

- Backend Settlement: Providers move liquidity between their own entities across borders, removing the need for correspondent banks or pre-funded accounts.

Embedded Finance

Tempo enables platforms and marketplaces to integrate stablecoin wallets directly into their products, delivering instant partner payouts, low-cost consumer payments, and programmable financial experiences. Funds settle onchain in seconds, removing delays, regional banking limitations, and high card interchange fees. Stablecoins unlock key embedded finance flows:

- Partner & Creator Payouts: Platforms pay collaborators instantly, globally, and with minimal fees.

- Consumer Payment Acceptance: Marketplaces can collect stablecoin payments with low cost and immediate settlement.

- Loyalty & Rewards Programs: Funds can be distributed or spent directly within embedded wallets for flexible, on-demand rewards.

- Mercury: Embedded stablecoin balances for startups, enabling fast transfers and programmable payouts

- Lead Bank: Infrastructure for platforms and SaaS companies to manage internal stablecoin flows

- Kalshi: Real-time settlement for platform transactions and high-frequency operations

Tokenized Deposits for 24/7 Settlement

Tokenized deposits and stablecoins let companies manage global funds on a single onchain infrastructure while retaining regulatory compliance.

- Instant intercompany transfers: Move funds between parent and subsidiary accounts without relying on slow regional banking rails.

- Real-time cash visibility: Onchain balances give treasuries an up-to-the-minute view of global liquidity.

- Programmable workflows: Approvals, sweeps, and compliance processes can be automated via smart contracts.

Tokenized deposits complement stablecoins rather than replace them. Deposits are bank-issued and regulated, while stablecoins are reserve-backed and optimized for frictionless, cross-chain payments. Together, they provide treasuries with speed, visibility, and efficiency that traditional banking cannot match.

- Deutsche Bank & Standard Chartered: Using tokenized deposits for corporate liquidity and cross-border settlement.

- UBS: Real-time intercompany transfers and treasury operations.

Microtransactions

Digital services are increasingly moving toward usage-based models, where users pay only for what they consume. High-frequency, low-value payments require extremely low fees and predictable execution to be viable. Tempo’s payments-first design makes microtransactions practical at internet scale.

- Kalshi: Real-time settlement for millions of small, rapid-fire financial transactions

- Digital platforms: Usage-based billing for APIs and online services

- Consumer apps: High-volume, low-value transfers without congestion risk

Agentic Payments

As software and AI systems increasingly act autonomously, payment infrastructure must support programmatic and non-interactive execution. Agents can hold and spend stablecoins globally in real time, with programmable wallets enabling automatic top-ups, spending limits, and policy enforcement. Onchain settlement removes intermediaries, simplifies liquidity management, and ensures agents always have the funds they need.

- OpenAI: Autonomous agents initiating, scheduling, and managing payments programmatically

- AI platforms: Machine-driven treasury operations and recurring payment execution

- Automated services: Machine-to-machine payments for software-native workflows

Conclusion

Stablecoins are no longer an experimental crypto use case. They are quickly becoming a core financial primitive for payments, settlement, payroll, remittances, and treasury operations. As stablecoin infrastructure matures and stablecoin payments transition to real economic activity, the requirements placed on blockchain architecture change fundamentally.

On a payments-first chain like Tempo, low latency is non-negotiable:

- Latency is user experience

- Finality is operational certainty

- An unavailable RPC endpoint is a system failure.

To operate at scale, Tempo-based applications require RPC infrastructure that delivers predictable latency, consistent reads, and high availability under sustained load. Chainstack provides production-grade Tempo RPC connectivity, enabling developers to submit transactions reliably, read state consistently, and scale payment systems without unexpected failures or rate limits.

Getting started with Tempo on Chainstack takes minutes. Follow the step-by-step guide on how to get a Tempo RPC endpoint, deploy a reliable Tempo node through the Chainstack Console, and connect your application to low-latency infrastructure designed for real-world stablecoin payments.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains