CBDCs on Chainstack: Leveraging enterprise-grade infrastructure in development

Central Bank Digital Currencies (CBDCs) are revolutionizing the financial landscape, offering increased efficiency, security, and accessibility in monetary systems. As central banks and financial institutions around the world explore the potential of CBDCs, reliable and secure infrastructure solutions become crucial for the effective development and implementation of these digital currencies.

In this article, we delve into the diverse use cases of CBDCs and how Chainstack’s cutting-edge infrastructure empowers organizations to launch, manage, and scale their CBDC projects with ease. From modular and auto-scalable infrastructure to seamless mobile wallet integration, Chainstack provides the tools and support needed for successful CBDC adoption.

What are CBDCs?

Central Bank Digital Currency (CBDC) is a digital form of a country’s fiat currency, issued and controlled by its central bank. Unlike cryptocurrencies such as Bitcoin, which operate in a decentralized manner, CBDCs are centralized and regulated, maintaining the stability and trust associated with traditional currencies. CBDCs are designed to offer the benefits of digital currencies, such as faster transactions, lower costs, and increased financial inclusion, while mitigating the risks and volatility often associated with cryptocurrencies.

As governments and central banks explore the adoption of CBDCs, the need for robust and secure infrastructure becomes paramount. Chainstack’s CBDC infrastructure solutions address this need, offering a suite of tools and services that help central banks, financial institutions, and enterprises to launch, manage, and scale their CBDC networks effectively. By leveraging Chainstack’s cutting-edge infrastructure, organizations can ensure a smooth transition to CBDC and harness the full potential of digital currencies in improving the efficiency, security, and accessibility of their monetary systems.

Why CBDCs?

CBDCs are gaining traction worldwide as governments and central banks recognize the potential benefits of leveraging digital currencies in their monetary systems. Here are some key reasons why CBDCs are becoming an essential consideration for modern financial ecosystems:

- Faster transactions: CBDCs enable quicker, more efficient transactions compared to traditional payment methods. By eliminating the need for intermediaries, CBDCs can significantly reduce transaction times and costs, facilitating smoother domestic and cross-border payments.

- Increased financial inclusion: CBDCs can help bridge the gap between the banked and unbanked populations. By providing a digital alternative to cash, CBDCs can offer access to financial services for individuals who are currently underserved by traditional banking systems.

- Enhanced security: CBDCs leverage the security features of blockchain technology, making them more resilient to cyber-attacks and fraud. This heightened security can help protect both consumers and financial institutions from potential risks and losses.

- Greater transparency: The use of CBDCs can increase transparency in the financial sector by providing real-time data on transactions and monetary flows. This improved visibility can assist in detecting illegal activities and enabling more effective regulatory oversight.

- Reduced reliance on physical cash: The adoption of CBDCs can help reduce the dependence on physical cash, which can be expensive to produce, store, and transport. By offering a digital alternative, CBDCs can potentially lower the costs associated with cash management and circulation.

- Monetary policy implementation: CBDCs can provide central banks with new tools for implementing monetary policy, including the ability to apply negative interest rates or conduct more targeted interventions in the financial system.

- Interoperability: CBDCs can be designed to interoperate with existing financial ecosystems, making it easier for individuals and businesses to transition between digital and traditional currencies seamlessly.

As the interest in CBDCs continues to grow, Chainstack’s CBDC infrastructure solutions offer a robust and secure platform for central banks, financial institutions, and enterprises to develop and deploy their CBDC networks. By capitalizing on Chainstack’s expertise and cutting-edge technology, organizations can successfully navigate the challenges of CBDC implementation and harness the full potential of digital currencies in the modern financial landscape.

What types of CBDCs are there?

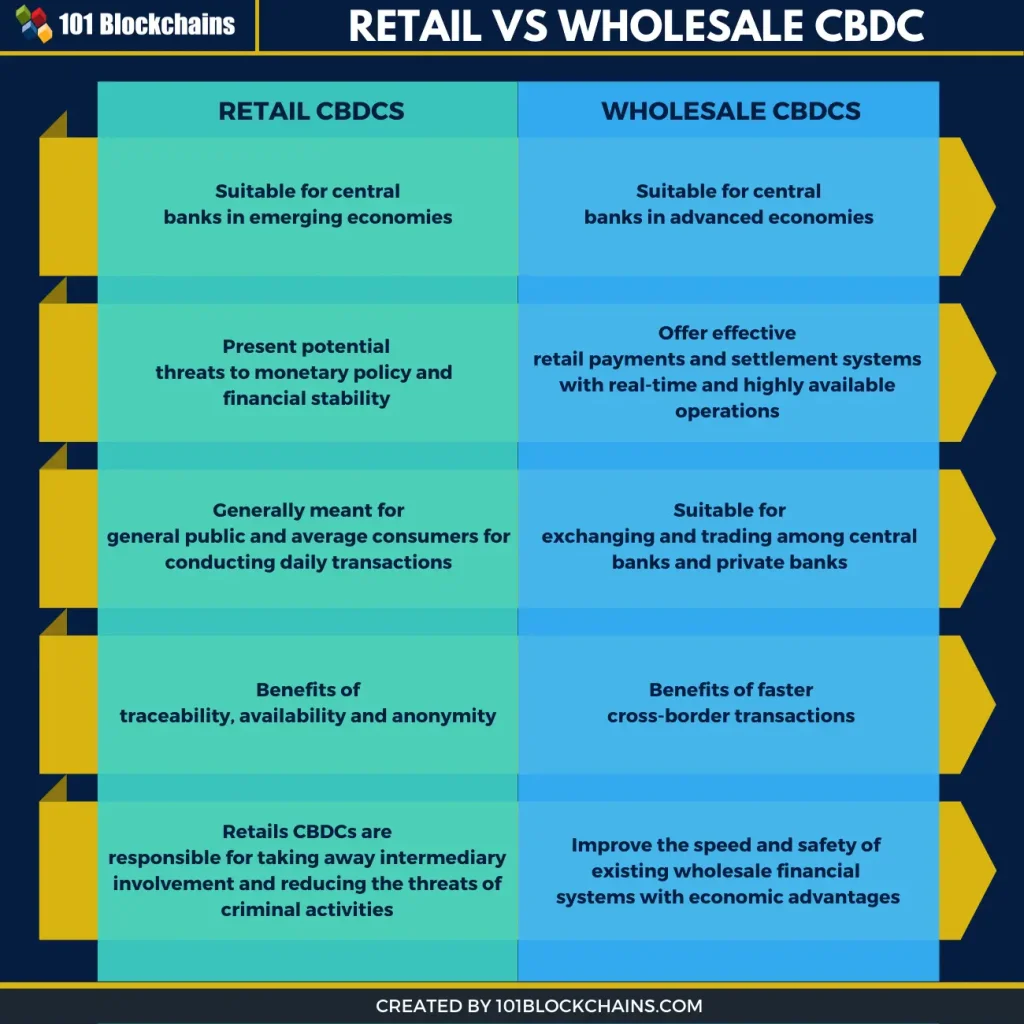

CBDCs can be classified into two main types: retail CBDCs and wholesale CBDCs. Retail CBDCs are designed for use by the general public, providing a digital alternative to cash for everyday transactions, while wholesale CBDCs are intended for use by financial institutions for interbank settlements and large-value transactions. When it comes to their design, they can be account-based and digital tokens:

Account-based CBDCs

Account-based CBDCs, also known as central bank electronic money, function similarly to general deposit accounts. Users set up an account that allows them to conduct transactions, send, and receive digital currency. These CBDCs require user identity verification for transactions, ensuring compliance with Know Your Customer (KYC) procedures.

Digital tokens

Digital token-based systems involve the transfer of objects of value between wallets. Unlike account-based CBDCs, digital tokens do not rely on user identity verification for sending and receiving payments. Transactions with digital tokens are authenticated using public-private key pairs and digital signatures between the sender and receiver. However, digital tokens face challenges, such as the lack of identity requirements and the potential loss of assets when tokens are misplaced.

Retail CBDCs

Retail CBDCs are used for payments between businesses and individuals or between individuals. They function as digital versions of conventional currency notes and are generally associated with low-value transactions. Retail CBDCs can be account-based or digital tokens.

The demand for retail CBDCs is driven by inefficiencies and complexities in existing electronic retail payment systems. Retail CBDCs can simplify transaction processes, improve transparency, and reduce transaction costs, particularly in cross-border payments.

Wholesale CBDCs

Wholesale CBDCs facilitate payments and settlement of transactions among financial institutions. While banks can already directly access electronic central bank money, wholesale CBDCs can improve efficiency and risk management in the settlement process. Wholesale CBDCs enable more financial market participants, including those who cannot currently hold central bank accounts, to access CBDCs.

Additionally, wholesale CBDCs can be used for asset transfers involving securities. For instance, two parties trading a security for cash could use a wholesale CBDC for instant payment and delivery of the asset.

What are some example use cases for CBDCs?

Central bank digital currencies (CBDCs) are being explored and tested by various countries for different use cases in the financial services sector. Some of the most promising CBDC applications include cashless retail payments, cross-border payments, programmable money, and virtual asset transactions.

Cashless retail payments

One of the primary use cases for CBDCs is facilitating cashless retail payments. For instance, the National Bank of Ukraine conducted a survey exploring the potential introduction of a CBDC-based system called e-hryvnia, which aims to support cashless retail payments. CBDCs in this context provide a reliable alternative to cash, not a replacement, and offer faster and more secure electronic transactions.

Cross-border payments

CBDC use cases also extend to cross-border payments, where they can significantly reduce transaction costs and increase the speed of international transactions. By leveraging the interoperability of CBDCs with foreign CBDCs or multi-CBDC platforms, cross-border payments could become more efficient, further promoting global economic integration.

Programmable money

Programmable money is another compelling use case for CBDCs. With the integration of smart contract technology, CBDCs can enable programmable payments, which can automatically execute transactions based on predefined conditions. This functionality can streamline various financial processes, such as the automatic payment of taxes, dividends, or other obligations, and lead to the development of more complex financial products.

Virtual asset transactions

Finally, CBDCs can be employed in virtual asset transactions, providing a secure and efficient means of transferring digital assets. This application can support the growth of emerging industries, such as cryptocurrencies and digital securities, by providing a stable and widely accepted digital currency for transactions.

In conclusion, CBDCs offer various use cases that can revolutionize the financial sector by providing a reliable alternative to cash, supporting digitization, and enabling advanced functionalities such as programmable payments and seamless cross-border transactions. As more countries explore the potential of CBDCs, it is likely that additional use cases will emerge, further shaping the future of digital currencies and the global financial landscape.

Launch your CBDC infrastructure with Chainstack

Embracing the future of national money is now more accessible than ever, thanks to Chainstack’s CBDC infrastructure solutions. Our platform is designed to support central banks, financial institutions, and enterprises in launching, managing, and scaling their CBDC networks with ease. Here’s how Chainstack can facilitate the effective development of your CBDC project:

- Robust security: Our CBDC infrastructure nodes are built using the latest security protocols and best practices, ensuring that your CBDC network is safeguarded against cyber threats and attacks.

- High performance: Chainstack’s infrastructure is optimized for speed and scalability, enabling you to handle high transaction volumes and support the growing user demand for digital currencies.

- Flexibility and customization: Our platform can be tailored to meet your specific needs and requirements, whether you’re launching a new CBDC network or upgrading an existing one.

- 24/7 support: Our team of experts is available around the clock to provide technical support, troubleshooting, and advice, ensuring that your CBDC project runs smoothly and efficiently.

- Easy integration: Chainstack’s nodes can be seamlessly integrated with other systems and platforms, including existing blockchain networks, databases, and APIs, facilitating a smoother transition to a CBDC ecosystem.

- Rapid deployment: With Chainstack, you can launch your CBDC infrastructure in just a few clicks. Our platform automates the deployment process, allowing you to focus on building innovative CBDC applications while reducing time to market.

- Cloud provider integration: Our platform’s integration with leading cloud providers enables you to launch your blockchain nodes on your preferred cloud provider in just a few minutes, ensuring a scalable and reliable infrastructure for your CBDC network.

By leveraging Chainstack’s CBDC infrastructure solutions, you can be confident in the success of your CBDC project. Our platform offers a range of benefits that will help you save time, reduce costs, and achieve your goals. Contact us today to learn more about our CBDC infrastructure services and discover how we can help you take your CBDC project to new heights.

Deploy blockchain networks in minutes with flexible and robust infrastructure

Embrace the future of CBDCs with Chainstack’s cutting-edge platform, which supports a wide range of blockchain networks, including Ethereum, Polygon, BNB Smart Chain, Avalanche, Arbitrum, and 20 others. Our platform offers flexibility, speed, and reliability for launching your CBDC infrastructure in just a few clicks.

Additionally, our platform also supports app chains such as Avalanche Subnets, Polygon Supernets, BNB Application Sidechains, and StarkEx Apps, offering flexibility, speed, and reliability for launching your CBDC infrastructure in just a few clicks.

To accommodate various use cases and requirements, Chainstack offers a diverse range of hosting options:

- Chainstack-managed: Gain instant access to a fully-managed blockchain as a service, with an intuitive user interface, powerful orchestration capabilities, and white-label branding available on the Enterprise tier. No need to host or manage any software components yourself.

- Chainstack Cloud: Maximize node performance with robust cloud infrastructure designed for handling resource-heavy operations. Ideal for DeFi, GameFi, and NFT applications, Chainstack Cloud offers lightning-fast network interactions and minimal latency.

- Hybrid: Choose which components of the Chainstack infrastructure you’d like to manage and operate yourself while letting Chainstack take care of the rest. This option is perfect for customers concerned about self-sovereignty but don’t want to build their own tools for orchestration.

- Self-hosted: License a self-hosted Chainstack solution to have full control over operating every component yourself. Great for clients interested in fully hosted solutions who have the capabilities to manage everything in-house.

In addition to supporting a wide range of blockchain networks, Chainstack seamlessly integrates with leading cloud providers, enabling you to launch your blockchain nodes on your preferred cloud provider in just a few minutes. This ensures your CBDC infrastructure is scalable, reliable, and ready to handle growing user demand.

Experience the power and flexibility of Chainstack’s platform as you develop and deploy your CBDC infrastructure with ease. Accelerate your CBDC project today with Chainstack’s versatile, user-friendly, and performance-driven solutions.

Power-boost your project on Chainstack

- Discover how you can save thousands in infra costs every month with our unbeatable pricing on the most complete Web3 development platform.

- Input your workload and see how affordable Chainstack is compared to other RPC providers.

- Connect to Ethereum, Solana, BNB Smart Chain, Polygon, Arbitrum, Base, Optimism, Avalanche, TON, Ronin, zkSync Era, Starknet, Scroll, Aptos, Fantom, Cronos, Gnosis Chain, Klaytn, Moonbeam, Celo, Aurora, Oasis Sapphire, Polygon zkEVM, Bitcoin and Harmony mainnet or testnets through an interface designed to help you get the job done.

- To learn more about Chainstack, visit our Developer Portal or join our Discord server and Telegram group.

- Are you in need of testnet tokens? Request some from our faucets. Multi-chain faucet, Sepolia faucet, Holesky faucet, BNB faucet, zkSync faucet, Scroll faucet.

Have you already explored what you can achieve with Chainstack? Get started for free today.

Ethereum

Ethereum Solana

Solana TON

TON Base

Base BNB Smart Chain

BNB Smart Chain Sui

Sui Unichain

Unichain Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Gnosis Chain

Gnosis Chain Scroll

Scroll Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains