The agentic payments landscape

The moment payments met agents

Payment infrastructure was built for humans clicking checkout buttons. That model breaks when AI agents start transacting autonomously. Traditional processors require authorization patterns that assume manual confirmation. Credit card networks expect predictable fraud profiles. Settlement systems tolerate multi-day clearing because humans accept the delay. None of this works when software makes purchasing decisions at machine speed.

Three protocols emerged in 2025 with different approaches to solving this problem. Beyond authorization, the critical question is settlement infrastructure. Which blockchain networks will actually process these transactions determines whether agent commerce consolidates around shared standards or fragments across competing platforms.

TL;DR

- Three protocols have emerged with different approaches: ACP (OpenAI/Stripe) works within existing payment rails and shipped with ChatGPT, AP2 (Google) is a platform-agnostic trust layer with 60+ partners but no live product, and x402 (Coinbase) is the only protocol with meaningful volume at 500K weekly transactions.

- Two ecosystems are forming. OpenAI/Stripe pair ACP with Tempo for vertical integration. Google/Coinbase built a broader coalition around AP2/x402 with multi-chain support across Base, BNB Chain, and Solana.

- Settlement infrastructure is contested between purpose-built chains (Tempo, GCUL) still in private testnet and established networks (Base, Ethereum, Solana) offering working solutions today.

- The market remains fragmented without interoperability standards. Whether infrastructure consolidates or splits into specialized implementations will be determined by transaction volume in 2026, not partnership announcements.

The protocol layer

Agentic Commerce Protocol (ACP)

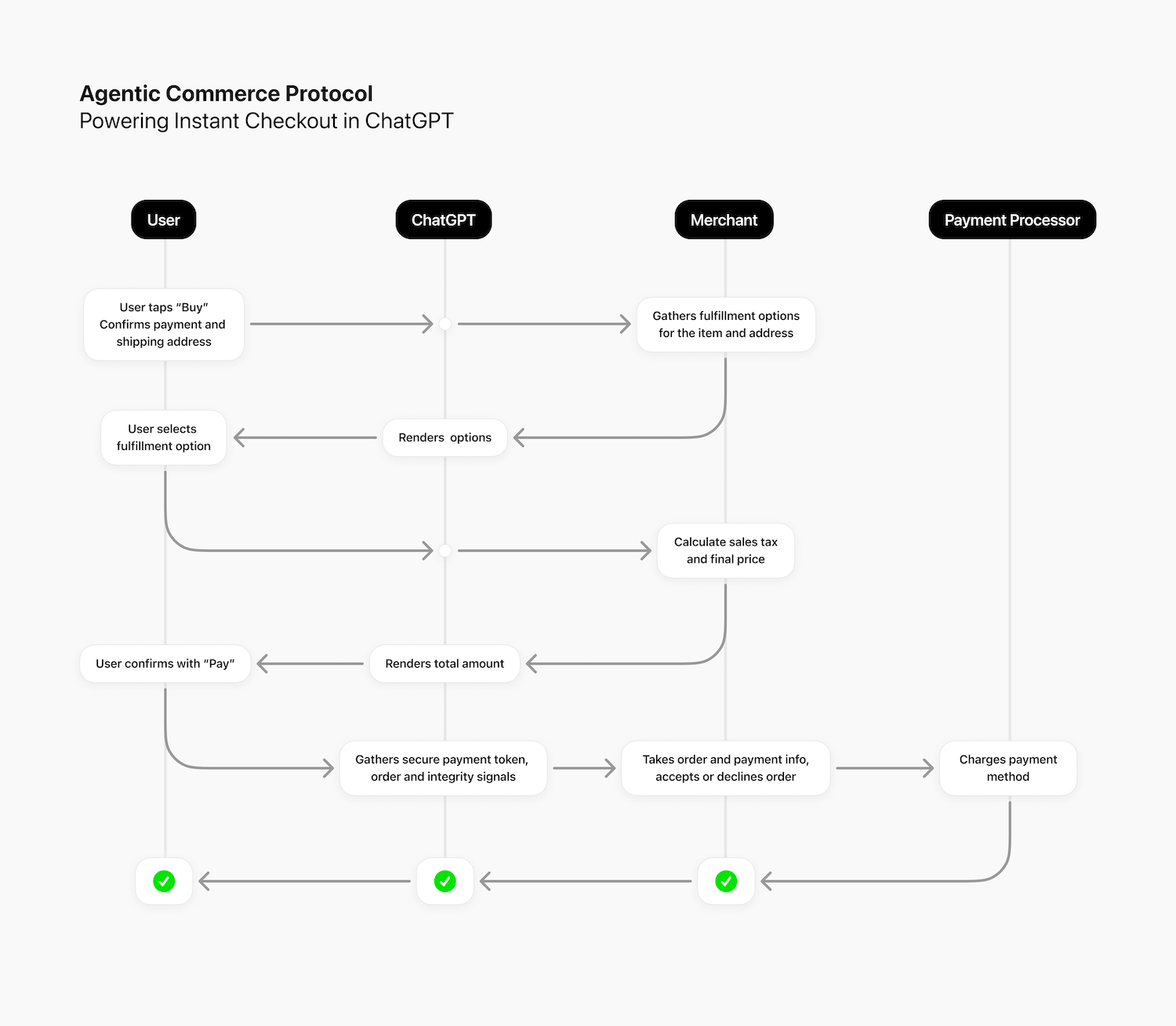

When OpenAI and Stripe unveiled ACP in September 2025, they made a pragmatic bet that agent commerce needed to work with existing payment infrastructure, not replace it. The protocol shipped alongside Instant Checkout in ChatGPT, giving users a working implementation from day one.

ACP builds on established payment rails rather than creating new ones. Merchants keep their current payment processors, agents access a new channel without merchants rebuilding checkout flows, and traditional payment methods like cards and digital wallets continue working as they do today. The innovation sits in Shared Payment Tokens, which let users delegate payment credentials to AI agents without exposing raw card data.

End-to-end data flow of the Agentic Commerce Protocol (OpenAI)

The merchant-first approach means businesses maintain direct customer relationships throughout the purchase. No intermediary platform sits between buyer and seller. While the protocol specifications are open source under Apache 2.0, the production implementation currently runs exclusively through Stripe’s infrastructure.

Agent Payments Protocol (AP2)

Google took the opposite approach. Rather than optimize for speed to market, AP2 attempts to solve the trust and verification problem that emerges when autonomous agents start spending money. The protocol launched in September 2025 with 60+ partners, including Mastercard, PayPal, American Express, Coinbase, and Salesforce, but no working product.

AP2 treats agent payments as fundamentally different from human payments. When people check out, their presence serves as authorization. When agents act autonomously, that authorization needs to be cryptographically provable. The protocol introduces three mandate types to handle this. Cart Mandates work like traditional checkouts, where users approve specific items. Intent Mandates pre-authorize future purchases within defined parameters, such as spending limits or product categories. Payment Mandates compress this authorization data into credentials that flow through existing payment networks without requiring infrastructure changes.

The architecture separates responsibilities across roles. Credential providers handle sensitive payment data. Agents execute shopping tasks. Merchants process orders. Issuers authorize based on mandate context. Everything uses W3C Verifiable Credentials for tamper resistance. On paper, it’s comprehensive. In practice, it’s untested. No consumer can use AP2 yet despite its impressive partner roster.

x402

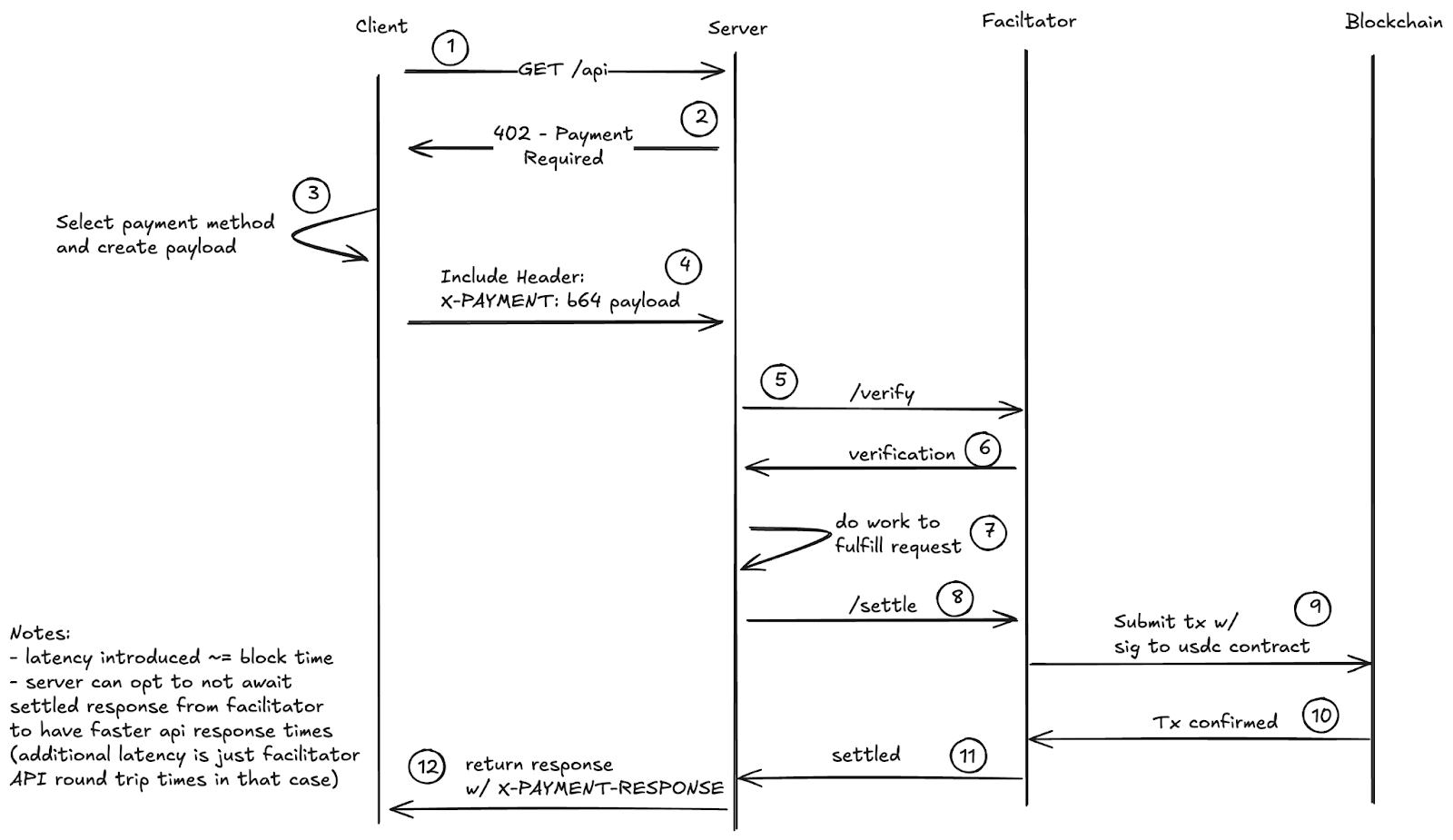

Coinbase released x402 four months before either ACP or AP2 appeared. The protocol revives HTTP status code 402, originally reserved for “Payment Required” but never implemented. Instead of building complex authorization flows, x402 makes payment a native HTTP operation.

The mechanics are deliberately simple. Request a paid resource, receive a 402 response with payment terms, send payment, get the resource. All payments settle in stablecoins on blockchain networks. Facilitators handle the onchain complexity so neither merchants nor buyers need to run nodes or manage wallets directly.

x402 protocol flow (Coinbase)

By October 2025, x402 processed 500,000 weekly transactions across Base, Solana, and BNB Chain. The protocol works standalone for pure crypto commerce and extends AP2 for projects that want Google’s trust layer with onchain settlement. It’s currently the only protocol with meaningful transaction volume.

Complementary or competing?

Two camps are forming around different architectural choices, each with distinct trade-offs for implementation.

| ACP | AP2 | x402 | |

| Function | End-to-end commerce flow | Trust/verification layer | Stablecoin “transport” |

| Backed by | OpenAI, Stripe | Google, Mastercard, PayPal, Amex, Coinbase, Salesforce (60+ partners) | Coinbase |

| Payment types | Traditional rails + stablecoin-ready | All types (cards, banks, crypto) | Crypto-native |

| Integration | Requires Stripe | Works with any processor | Requires facilitator |

Whether these protocols interoperate or fragment the ecosystem remains unclear. An agent could theoretically use ACP for fiat transactions and x402 for crypto payments, or AP2 mandates could verify purchases across both systems. Without defined interoperability standards, merchants may need to implement multiple protocols depending on which agents and payment methods they want to support.

The blockchain infrastructure layer

Protocols define how agents authorize payments. Blockchains determine where those payments actually settle. The infrastructure layer has become a battleground between purpose-built chains designed specifically for payments and existing networks adapting to capture agent commerce.

Tempo (Stripe + Paradigm)

Tempo represents the cleanest expression of payments-first architecture. Rather than adapt existing infrastructure, Stripe and Paradigm are building a Layer 1 blockchain optimized entirely for settlement. The chain raised $500M at a $5B valuation in October 2025 and is currently in private testnet with design partners including OpenAI, Anthropic, Shopify, Visa, and Deutsche Bank.

The architecture targets 100,000+ TPS, but throughput matters less than payment-specific optimization. General-purpose chains tolerate variable gas fees and probabilistic finality because DeFi users accept these trade-offs. Payments require predictable costs and instant settlement, which demands different architectural choices from the consensus layer up.

Google Cloud Universal Ledger (GCUL)

GCUL takes the opposite approach by positioning itself as a credibly neutral infrastructure. Rather than optimize for specific use cases, Google built an institutional L1 that uses Python smart contracts instead of Solidity. The platform is currently in private testnet with CME Group and targets a 2026 launch.

GCUL eliminates these reconciliation processes by providing a shared ledger where all parties verify transactions directly. The atomic settlement capability particularly targets capital markets, where multi-day settlement cycles require working capital and complex collateral management. Google frames GCUL as infrastructure not tied to specific tokens or vendors, which addresses institutional hesitancy to build on platforms controlled by potential competitors.

Base and existing infrastructure

Base offers a third path by leveraging existing Ethereum infrastructure rather than building new chains. As Coinbase’s Layer 2, it operates on the Optimism OP Stack and serves as the default settlement layer for the protocol. This gives developers a working solution today rather than waiting for purpose-built infrastructure to launch.

The pragmatic appeal is clear. Base inherits Ethereum’s security model and existing stablecoin liquidity while offering lower costs and faster finality than L1. For developers building on Coinbase’s stack, it’s the path of least resistance with native wallet integration and familiar tooling. The trade-off is accepting infrastructure designed for general-purpose smart contracts rather than purpose-built payment optimization.

Other settlement layers

No single chain will capture all agent payment settlements. Multiple networks are positioning themselves for different slices of the market:

- Solana has incorporated x402 support and optimizes for high-frequency microtransactions where sub-second finality matters.

- BNB Chain introduced x402 BNB in October 2025, a unified protocol layer that enables single-signature, sign-to-pay transactions and agent governance. The implementation leverages EIP-7702 delegated execution and EIP-712 witness signatures to automate token transfers, gas sponsorship, and policy enforcement in one operation for seamless and gasless payments.

- Ethereum remains highly relevant, holding roughly 50% of all stablecoin value in circulation despite not being specifically optimized for payments.

- Circle’s Arc and Tether’s Plasma represent stablecoin issuers building their own payment-focused chains, betting on controlling their settlement infrastructure rather than relying on external platforms.

The question of which chains will dominate agent commerce settlement remains open. Purpose-built infrastructure like Tempo may offer better performance, but existing chains like Base and Ethereum provide working solutions today with established liquidity. The answer likely depends on whether payment optimization matters enough to justify migrating from existing infrastructure, or whether general-purpose chains can adapt quickly enough to close the gap.

Current state of adoption

The market is forming around different strategies without clear dominance. OpenAI and Stripe’s ACP collaboration appears vertically integrated, but the protocol is open-source under Apache 2.0 and implementable by other processors. ACP aims to be a universal abstraction layer for agent commerce. The competing vision combining AP2, x402, and GCUL remains more conceptual than formalized. Tighter integration enables faster shipping while broader participation distributes risk.

Chains are positioning for settlement without winners. Base serves Coinbase developers with a working infrastructure. Solana targets high-frequency microtransactions. Tempo and GCUL promise payment optimization but remain in private testing. Developers face fragmentation without established standards.

Three questions will determine outcomes: whether interoperability emerges or fragmentation persists, whether purpose-built chains justify migration from Base, Ethereum, and Solana, and whether x402 bridges ecosystems or adds incompatibility. Transaction volume will answer these questions more definitively than announcements.

Conclusion

The infrastructure layer for autonomous commerce materialized in months, not years. Whether payments settle through ACP on Tempo or x402 across multiple chains matters less than the capability itself now existing. The technical primitives for agent-initiated transactions are functional, even if fragmented.

2026 will clarify whether this infrastructure converges around shared standards or splits into specialized implementations for different transaction types. The pragmatic play is maintaining optionality across protocols and chains until actual usage patterns emerge. What looked like competing visions may prove complementary once transaction volumes reach a meaningful scale across protocols.

Whether you are testing agent payment flows on Base, deploying microtransaction workloads on Solana, or running stablecoin transport layers across Ethereum and BNB Chain, Chainstack gives you the performance and consistency required for production systems. Deploy RPC endpoints in seconds and scale globally with automated orchestration, uptime guarantees, and developer-friendly tooling.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains