Polygon’s Second Life: Rebuilding traction via payments

TL;DR

- 2023 was rough for Polygon: layoffs, a flat token, and L2 competitors pulling ahead. Rather than keep fighting for DeFi dominance, Polygon pivoted to payment infrastructure.

- The Polygon 2.0 vision reframed the network as an ecosystem of interconnected ZK chains. Rio and AggLayer turned Polygon into payments-grade infrastructure with instant finality, 5,000 TPS, and cross-chain liquidity that now supports OP Stack and Arbitrum Orbit, not just Polygon CDK.

- The pivot landed, with small USDC transfers more than doubled in early 2025, treasury funds moved onchain, and major payment processors plugged the network into mainstream commerce.

- Polygon is now where BlackRock, Franklin Templeton, and Stripe settle real money. If stablecoins become default rails for cross-border payments, Polygon is already ahead of the game.

The story behind this pivot starts with an unusually candid admission from Polygon’s leadership.

Introduction: the underdog admission

On Christmas Eve 2023, Polygon co-founder Sandeep Nailwal posted something unusual for a crypto founder. No hype. No promises of a supercycle. Just a blunt admission.

It had been a painful year. Layoffs hit 19% of the team, the token flatlined while competitors rallied, and Arbitrum had seized the TVL crown as Base and a wave of new L2s carved up whatever market share remained. Rather than keep fighting for DeFi dominance, Polygon had started building out payments infrastructure, assembling a dedicated team and retooling the network for a use case most L2s weren’t prioritizing.

The strategic pivot: why payments?

Polygon 2.0 vision (June 2023)

The groundwork started six months earlier. In June 2023, Polygon Labs unveiled Polygon 2.0, a four-layer architecture that would turn the network into an ecosystem of interconnected ZK chains rather than a single L2:

- A shared staking layer let validators secure multiple chains with one stake

- An execution layer enabled sovereign ZK chains to run independently while settling to Ethereum

- An interop layer built on the LxLy bridge aggregated ZK proofs from those chains into a single proof before posting to Ethereum

- A common proving layer standardized ZK proof generation across all chains in the ecosystem

The MATIC token would become POL, with a 2% annual emission split between validator rewards and a community treasury. Validators could now earn from multiple chains simultaneously rather than just one.

Reading the market

The stablecoin market was also shifting. Total market cap crossed $200 billion in late 2024 and hit $250 billion by mid-2025, but the growth wasn’t coming from DeFi speculation. Cross-border payments and remittances were driving volume, particularly in emerging markets. Tron had dominated that segment for years, but rising TRX prices created a problem. As TRX went from $0.12 in early 2024 to $0.32 by late 2025, USDT transfer fees on the network climbed from around $1.60 to over $4, with spikes as high as $9. For users sending $20 or $50 at a time, that math stopped working. Polygon built a dedicated payments team to go after that gap. No other major L2 had done the same.

Infrastructure upgrades: making Polygon payments-grade

The Rio upgrade (October 2025)

The vision needed infrastructure to back it up. In October 2025, Polygon shipped the Rio upgrade, the most significant overhaul to the PoS chain’s architecture since launch.

The core change was a new block production model called VEBloP, or Validator-Elected Block Producer. Instead of multiple validators producing blocks simultaneously, the network now elects a single producer for longer spans while backups stand ready to step in. This eliminates chain reorgs entirely. For payments, that matters. A transaction confirmed on Polygon stays confirmed. No rollbacks, no uncertainty about finality.

Rio also introduced stateless validation, allowing nodes to verify blocks without storing the full chain state. Hardware requirements dropped significantly, making it cheaper to run infrastructure. Throughput hit 5,000 TPS, with a roadmap targeting 100,000 TPS under what Polygon calls its GigaGas initiative.

AggLayer: the interoperability bet

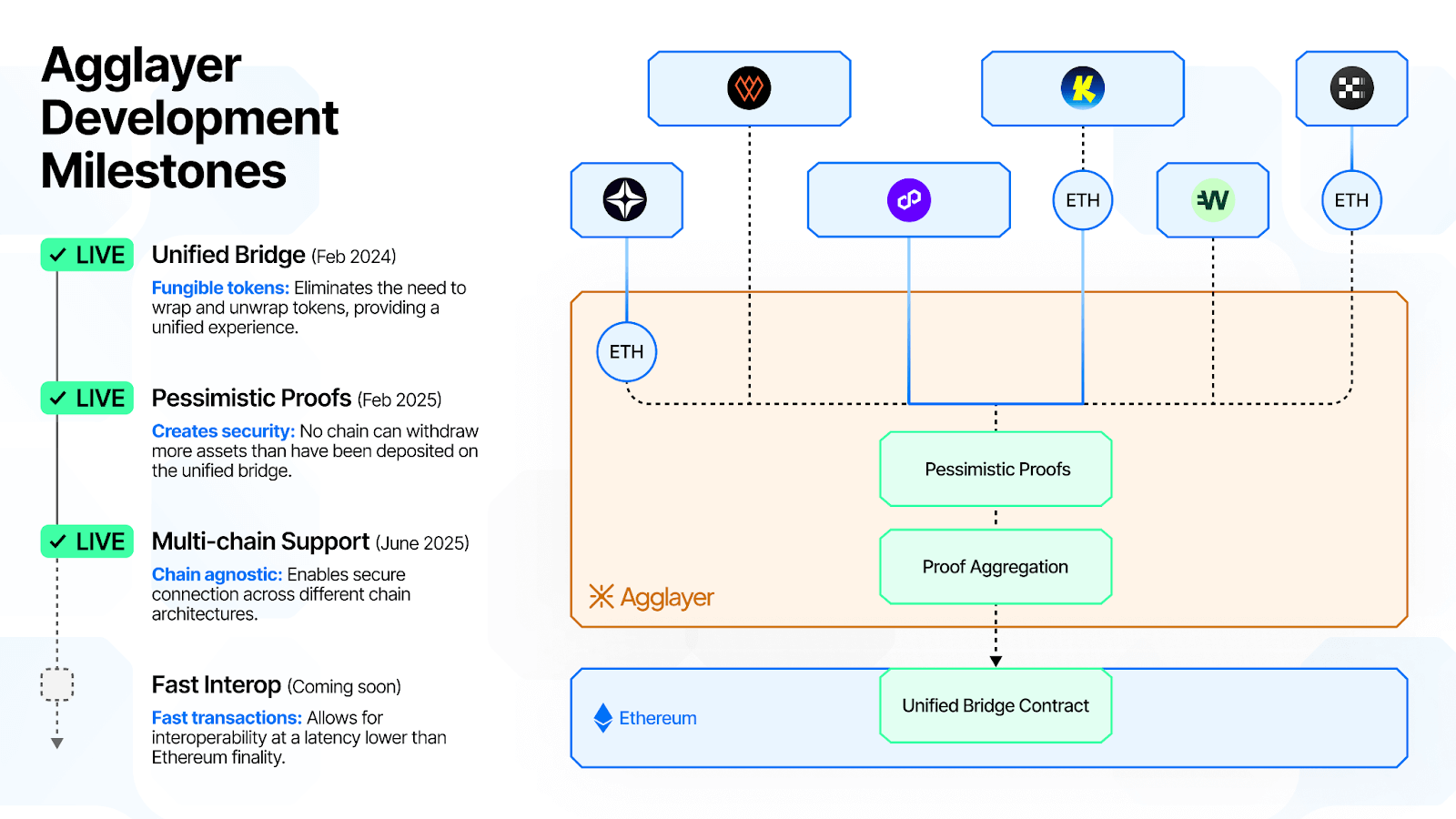

The other half of the infrastructure bet is AggLayer, Polygon’s interoperability layer. The Unified Bridge went live in February 2024 with two chains connected: Polygon zkEVM and OKX’s X Layer. Rather than requiring wrapped tokens for cross-chain transfers, the bridge lets native assets move between connected chains through a shared liquidity pool.

In February 2025, pessimistic proofs went live on mainnet, adding a verification layer that tracks deposits and withdrawals across all connected chains to prevent any single chain from draining the bridge. That opened AggLayer to chains beyond Polygon CDK. OP Stack support shipped in May 2025.

What changed

Polygon’s role in everyday USDC payments, institutional settlement and merchant access all shifted meaningfully in the last two years. The same network that once competed mainly on DeFi throughput is now tied directly into both retail users and TradFi.

Small value USDC transfers on Polygon grew sharply in 2025, with sub-$1,000 activity more than doubling the first half of the year and reaching hundreds of millions of dollars in monthly volume. Polygon now processes a large share of US based USDC transfers in the 100 to 1,000 dollar band, reflecting growing use by individuals and small businesses rather than large speculative flows.

Institutional settlement followed the retail usage. Franklin Templeton’s Franklin OnChain U.S. Government Money Fund (FOBXX) enabled peer-to-peer transfers of its BENJI tokens in 2024, turning a tokenized U.S. government fund into something that could move more fluidly onchain. In late 2025, BlackRock’s BUIDL fund deepened its presence on Polygon with a single 500 million dollar onchain deposit, cementing the network as a meaningful venue for tokenized U.S. Treasuries.

At the same time, stablecoin payments reached far beyond the crypto-native world. Integrations such as Stripe, DeCard and major payment processors tied Polygon based USDC and other stablecoins into existing card and checkout rails, making it possible to pay at hundreds of millions of merchants using familiar commerce flows. Polygon increasingly functions as the underlying infrastructure for stablecoin spending in everyday online and point-of-sale transactions, rather than only as a venue for DeFi activity.

The future outlook

The payment traction is real, but it hasn’t shown up in the token price. POL hit $1.29 in March 2024. By late 2025, it trades around $0.11, down roughly 90 percent even as network activity and institutional adoption climbed. The disconnect is hard to ignore.

Part of the explanation is branding. Polygon migrated from MATIC to POL in September 2024, pitching it as an upgrade, but a lot of retail holders never caught on. Co-founder Sandeep Nailwal has acknowledged that users outside crypto-native circles often don’t realize their old MATIC holdings are now POL. He has recently floated the idea of reverting to the MATIC ticker after hearing persistent complaints from retail traders in markets like the Philippines and Dubai.

The deeper question is whether payment infrastructure translates to token value at all. Most stablecoin transfers on Polygon are denominated in USDC, not POL. Fees are fractions of a cent by design. The network can keep growing without POL capturing much of the upside.

Conclusion

A year ago, the obvious way to track Polygon was TVL. That number still exists, but it’s not where the action is. Payment volume, stablecoin transfers, merchant integrations—those are the metrics that moved in 2025, and they’re the ones Polygon is now building around.

Whether that’s enough depends on what you’re measuring. As infrastructure for moving dollars, Polygon has a stronger case than it did in 2023. As a token bet, that’s less clear.

Reliable Polygon RPC infrastructure

Getting started with Polygon on Chainstack is fast and straightforward. Developers can deploy a reliable Polygon node for Polygon mainnet RPC access within seconds through an intuitive Console — no complex setup or hardware management required.

Chainstack provides low-latency Polygon RPC access, ensuring seamless connectivity for building, testing, and scaling DeFi, analytics, and stablecoin-powered payments infrastructure. With Polygon low-latency endpoints powered by global infrastructure, you can achieve lightning-fast response times and consistent performance across regions.

Start for free, connect your app to a reliable Polygon RPC endpoint for production, and scale with dedicated nodes designed for consistent low latency and high throughput.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains