Chainlink: Realizing cross-chain communication with Chainstack

Bridging real-world data to smart contracts for a secure, decentralized cross-chain future

In the pulsating heart of the blockchain ecosystem, Chainlink stands as an architect of bridges—creating vital connections between blockchain networks and the wider world of data. It is a role of profound importance, empowering smart contracts, the very foundation of blockchain applications, to transcend their limitations and engage with an expanded universe of information.

Chainlink’s decentralized oracle network brings an added layer of versatility, efficiency, and motion to smart contracts. It breaks down the barriers that have traditionally isolated blockchain from the broader digital landscape, facilitating interaction with real-world data and traditional systems.

At Chainstack, we recognize and champion this game-changing potential. As seasoned veterans in managed blockchain solutions, we have always sought to make the complex simple and the formidable accessible. This ethos dovetails with Chainlink’s mission, creating a connection that is both transformative and symbiotic—robust infrastructure meets defining network.

So, settle in with a hot beverage as we delve into the pioneering Chainlink model that is redefining cross-chain integration—a design that paves the way for wider adoption, fosters innovation, and ushers in a new era of decentralization:

What is Chainlink?

As technology evolves, so does the desire for seamless integration and communication across diverse platforms. This need is particularly evident in the digital finance space, where networks have long operated in isolation—until now. Enter Chainlink, a trailblazer in fostering connectivity and collaboration between diverse blockchain environments.

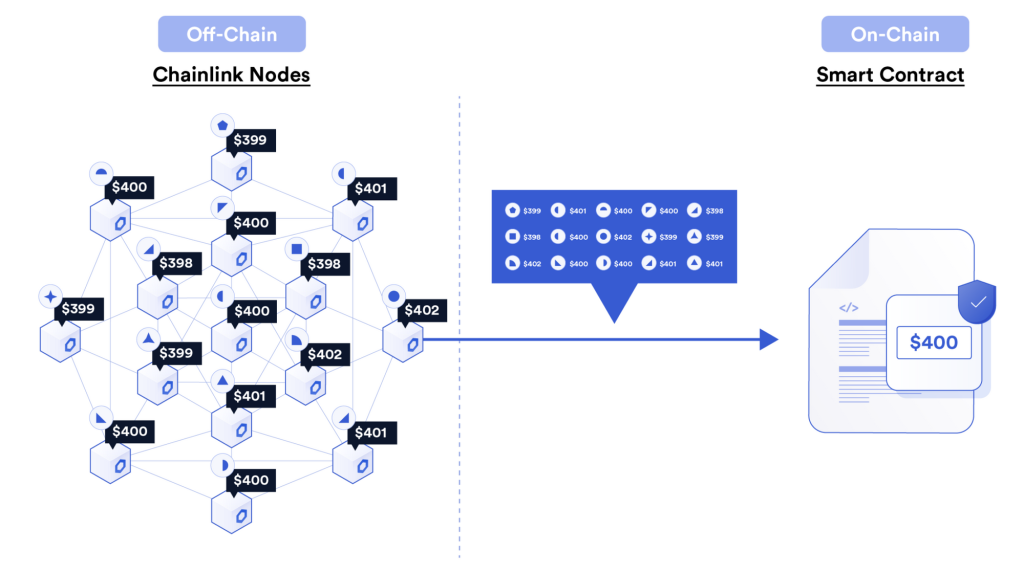

At its core, Chainlink is a decentralized oracle network, a crucial cornerstone in the skyrocketing DeFi sector. Chainlink’s network stands as a resilient fortress that provides accurate, tamper-resistant real-world data to smart contracts, effectively eliminating any single point of failure.

This robust oracle network has been instrumental in powering the large majority of DeFi DApps, bridging the gap between blockchain environments and off-chain data, thereby enhancing overall security and dependability. In turn, this made the protocol a key contributor to the DeFi boom.

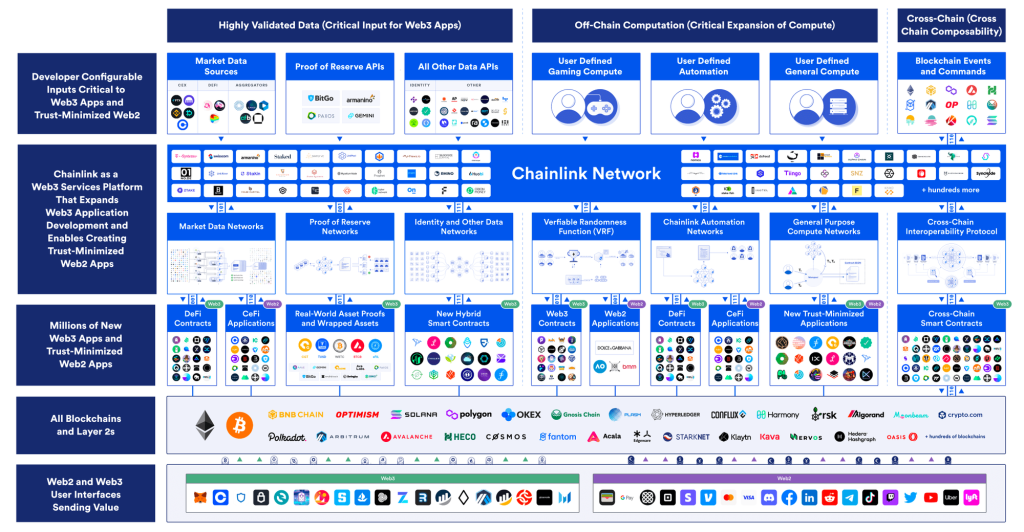

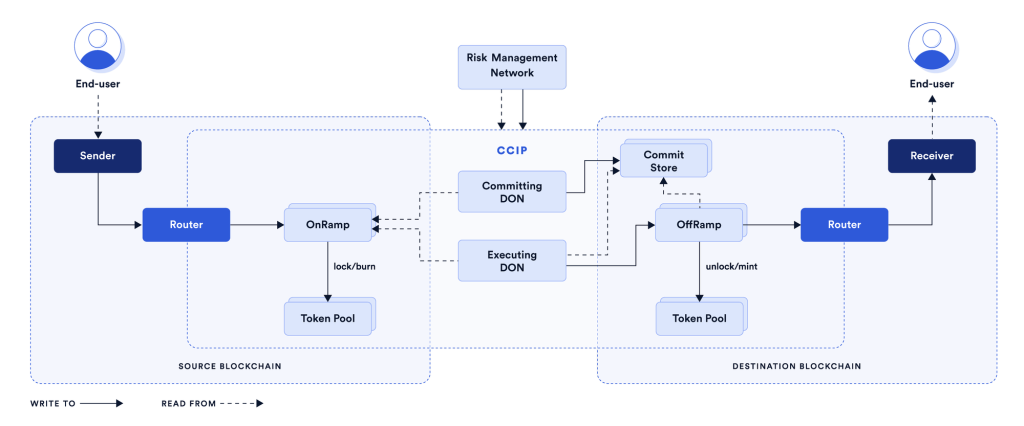

With Chainlink’s Cross-Chain Interoperability Protocol (CCIP), developers worldwide now have a standardized blueprint to construct secure cross-chain services and apps. The CCIP, with a universal messaging interface, allows smart contracts to communicate effortlessly across multiple blockchain networks, mitigating the necessity for developers to write tailor-made code for each specific integration. It’s akin to giving a master key to developers, which opens up endless doors in the multi-chain ecosystem.

Creating a cross-chain interoperability standard

Chainlink doesn’t stop at creating a formidable oracle network—it reaches beyond, aiming to transform digital finance as we know it. Central to its innovation is the Cross-Chain Interoperability Protocol (CCIP), a global standard that has just made its way to mainnet and facilitates developers in building secure and efficient cross-chain services.

A testament to Chainlink’s forward-thinking approach, CCIP provides a universal smart contract messaging interface, effectively eliminating the need for developers to create custom integration for individual blockchain networks. This simplifies the functionality of blockchain networks, providing unparalleled ease of operation and opening up a new category of DeFi DApps for the thriving multi-chain ecosystem.

Gone are the days when developers had to pen down custom code to build chain-specific integrations. Everything now lies within the confines of just a few lines of code.

Community-driven risk management and off-chain consensus

Chainlink’s ability to continuously deliver cutting-edge solutions doesn’t stop at simply building bridges between diverse blockchains or transforming data delivery. Its strategic foundation lies in creating robust systems that thrive on accepting, managing, and mitigating risk.

One of the distinguishing factors of Chainlink is its expansive network of leading node operators, the largest of its kind in the industry. These operators form the backbone of the Active Risk Management (ARM) Network—a game-changing trustless approach to risk management

This independent assembly of nodes proactively monitors blockchain networks, detects anomalous activities, and takes preventative actions to mitigate financial loss, ensuring a trust-minimized process. Operating in such a manner elevates the accessibility of blockchain technology to unprecedented levels and represents a decentralized leap toward making these systems more secure and user-friendly.

The operators, combined with the upgraded Off-Chain Reporting (OCR 2.0) protocol, serve as the ultimate platform for executing off-chain consensus, bringing a new level of reliability to cross-chain transactions. And by aggregating attestations from hundreds of off-chain nodes, OCR 2.0 significantly reduces gas costs for users and reinforces the transaction process.

Thanks to the ARM Network and OCR, Chainlink establishes itself as a future-proof solution, offering benefits like reorg protection, extendability, and a standardized interface for developers’ ease.

Crowd-sourcing reliable off-chain data

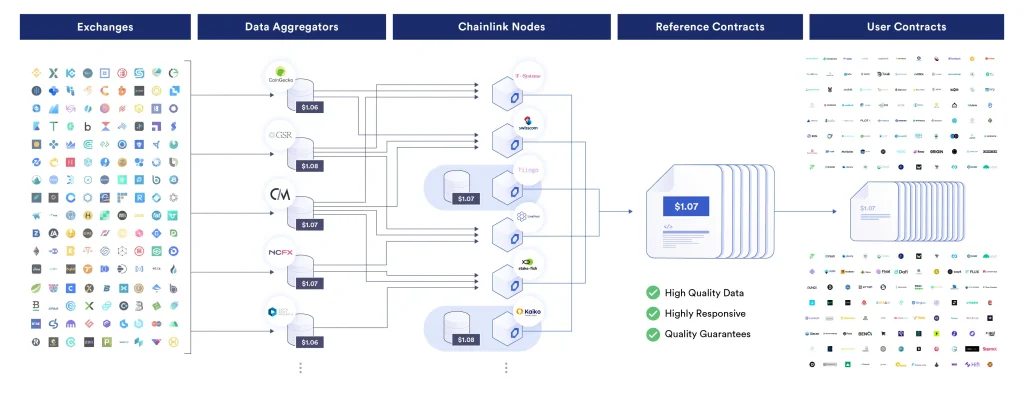

Chainlink Data Feeds serve as a sturdy conduit for reliable, off-chain data into smart contracts, fueling versatile use cases in DeFi and beyond. This solid infrastructure operates thanks to a globally distributed network of independent and reputable node operators, reinforcing its reliability and security. Chainlink Data Feeds collate data from multiple high-quality and authenticated APIs, eliminating the potential risk of a single point of failure and ensuring data accuracy.

These feeds provide end-to-end security for smart contracts, thanks to operators who run audited and time-tested software. This high level of security aids in securing billions of dollars in the ecosystem. Moreover, the transparent and immutable nature of on-chain data allows for real-time auditing, ensuring trust in the data provided.

Maintained by a thriving open-source community, Chainlink Data Feeds represent an accessible, shared data resource for hybrid smart contracts, supporting all blockchain networks. The wide range of use cases includes market data, off-chain data, lending and borrowing, mirrored assets, stablecoins, asset management, options and futures, and proof of reserve, among others.

Fostering transparency with Proof of Reserve

Chainlink Proof of Reserve plays just as pivotal a role in the ecosystem, offering reliable, timely, and secure monitoring of reserve assets under the premise of #ProofNotPromises. Powered by the ARM Network, this concept has earned Chainlink the trust of industry leaders due to its unmatched security, reliability, and compatibility.

The Proof of Reserve system offers automated verifications for decentralized applications, reducing risk, and improving efficiency. These automated checks can function as oracle-triggered circuit breakers, reducing the risk of systemic failures and preventing unexpected fractional reserve activity.

Consequently, this enhanced transparency extends to various stakeholders, including asset issuers, DeFi developers, and users. Issuers can provide solid guarantees that they can’t mint more tokens than they hold in reserves.

DeFi developers can incorporate Chainlink Proof of Reserve as a safety switch, preventing cascading user losses from the minting of unbacked tokens. And let’s not forget that DeFi users can obtain vital transparency into their risk exposure, fostering greater confidence in the backing of on-chain tokens collateralized by off-chain reserves.

The applications of Chainlink’s Proof of Reserve system span various use cases, such as:

- Digital assets: Ensuring that digitized assets like stablecoins, CBDCs, and wrapped cross-chain assets are properly backed.

- Financial instruments: Serving as a failsafe to prevent undercollateralization and as a means to create transparent on-chain financial instruments.

- Cross-chain asset data: Providing collateralization data for any cross-chain asset across multiple chains.

Pioneering provable randomness

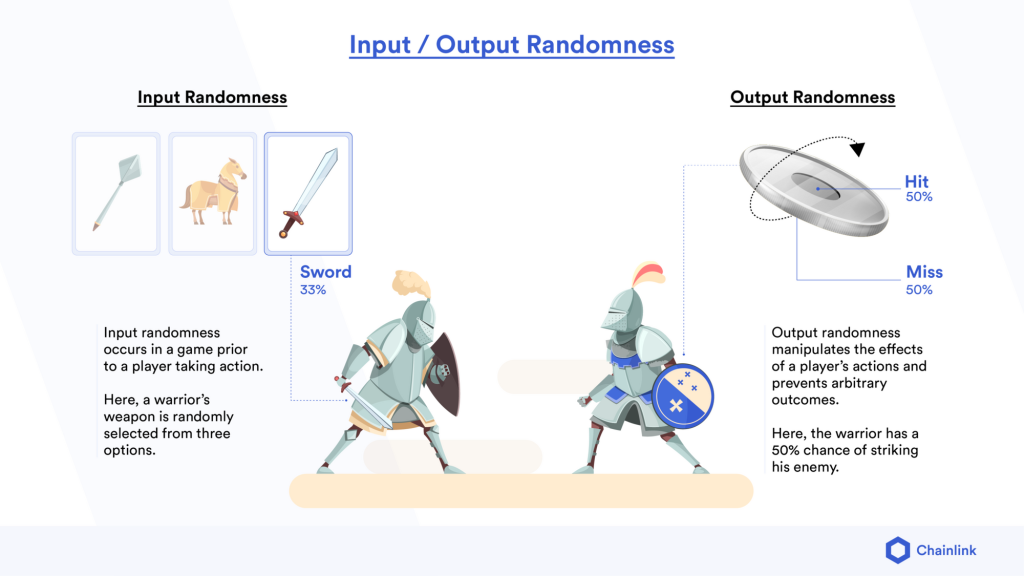

Chainlink’s dynamic offerings extend beyond bridging diverse blockchains and transforming data delivery, as it strategically develops robust systems that thrive in complex situations. The key to these extensive capabilities is Chainlink’s ingenious Verifiable Randomness Function (VRF) – a cryptographically secure source of randomness tailored for blockchain-based applications.

The core of VRF lies in providing Random Number Generation (RNG) for smart contracts, allowing developers to create enhanced user experiences leveraging random outcomes. This high level of security leads to increased trust among users, ensuring fair and tamper-proof outcomes that can be verified independently. Some of the possible use cases for Chainlink VRF include:

- NFTs: In the realm of NFTs, VRF enables the distribution of rare tokens and assigning randomized attributes. This provides players access to auditable evidence of the fairness of their assets’ creation and distribution process.

- Gaming: For gaming, Chainlink VRF creates enhanced gaming experiences by introducing randomness in elements such as map generation, critical hits, matchmaking, card draw orders, and random encounters/events. Moreover, it introduces rich, unpredictable scenarios for player versus player battles, and other gaming environments, perfectly balancing strategy and fun.

- Events: Additionally, Chainlink VRF can manage order processes for distributing highly coveted items such as event tickets or selecting participants for public sales and presales of luxury items.

These capabilities—VRF, Proof of Reserve, Data Feeds, OCR 2.0, and the ARM Network too, illustrate how Chainlink is steadily enhancing functionality and reducing complexity, thus making blockchain systems not only secure but also readily accessible to anyone willing to take part in this growing digital economy.

Boundless integration for TradFi, DeFi, and beyond

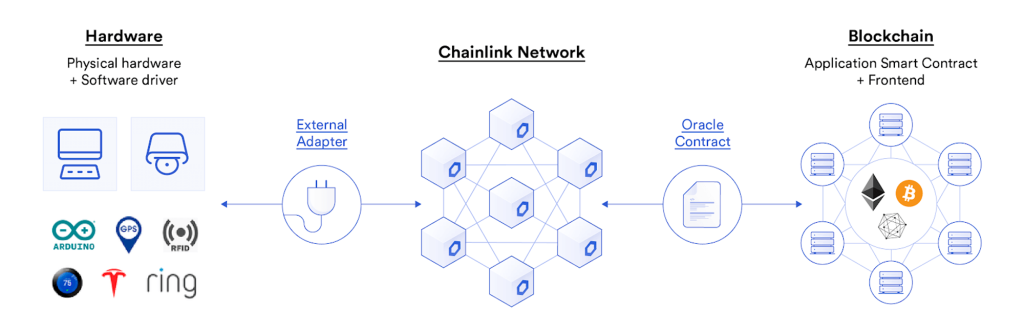

Another universal advantage of Chainlink is its versatility. With a chain-agnostic interface, transferring tokens to any Chainlink-integrated blockchain network has been made hassle-free, making it an ideal choice for future-proof applications.

By fostering blockchain integrations that are based on Chainlink’s robust Decentralized Oracle Networks (DONs), developers are empowered to build applications that resonate with Chainlink’s motive of secure interoperability across chains.

Furthermore their team’s ongoing work on an extensive list of adapters and supported integrations targeted to increase the scope and utility of blockchain operations. This growing collection is yet another testament to Chainlink’s mission to foster a secure and harmonious multi-chain environment, personifying the pioneering spirit of innovation sweeping across the blockchain sector.

Its focus does not remain limited to creating an integrated multi-chain environment, however. Instead, it goes beyond, reshaping how the world perceives blockchain networks and their connection to traditional finance.

Perhaps the most notable example of such is the adapter for the SWIFT bank messaging system, currently undergoing trials with more than a dozen major financial institutions and FMIs. The aim is to evaluate how companies can utilize their established SWIFT infrastructure to effectively orchestrate the transfer of tokenized value across a variety of public and private blockchain networks and includes major players like:

- Australia and New Zealand Banking Group Limited (ANZ)

- BNP Paribas

- BNY Mellon

- Citi

- Clearstream

- Euroclear

- Lloyds Banking Group

- SIX Digital Exchange (SDX)

- The Depository Trust & Clearing Corporation (DTCC)

Bearing all of this in mind, it is apparent that Chainlink has solidified its position as the torchbearer in the blockchain landscape, forging a path towards a more unified and interconnected future for all networks, DApps, and even the Web2 ramps that bind everything together.

Chainlink and the future of decentralized finance

Picture a world where DeFi applications seamlessly integrate with real-world data, shattering the walls that once limited their expansion. Imagine a network devoid of single points of failure. Envision an ecosystem where hundreds of independent nodes collectively ensure the security of your most valued transactions. That’s exactly what Chainlink offers, and then so much more.

Whether it’s cross-chain yield harvesting, providing low-cost transaction computations, or enabling multi-chain collateralized loans—Chainlink is leading the charge as pioneer. It is shaping a trustless, decentralized, and highly secure digital finance standard that is not just universal and chain-agnostic but is also geared to expand the multi-chain ecosystem and increase the utility of user tokens.

Chainlink’s offerings fit together much like pieces in an intricate puzzle, forming a sweeping picture of what a united and interconnected future can hold for blockchain technology. The integration of these features significantly enhances the development, scalability, and security of DeFi applications, driving the next wave of financial innovation in Web3. Some of the most notable use case examples include:

- Money markets: Chainlink facilitates efficient loan management by utilizing Price Data Feeds for evaluating user debt and collateral. This prevents toxic loans and safeguards against undercollateralization. It also utilizes Proof of Reserve to audit off-chain asset-backed tokens, protecting users from fractional reserve activities.

- Cross-chain collateralized loans: Chainlink makes it possible for collateral to be deposited and thus processed on a high-throughput chain, with the results bridged to a higher-cost trusted chain for settlement. This directly translates to lower gas costs for the typically pricey complex smart contract calls involved in the process.

- Options and futures: Chainlink’s Price Data Feeds support the operation of advanced financial instruments, ensuring platform solvency by integrating real-time price data to determine liquidation timings and dynamically set the funding rate to maintain net-neutral exposure.

- Decentralized exchanges: Chainlink’s Price Data Feeds help optimize liquidity allocation and enhance capital efficiency. Automation features allow for seamless execution of limit orders, creating a more powerful trading experience, while CCIP provides secure and frictionless cross-chain token transfers.

- Stablecoins: Chainlink employs Price Data Feeds to safeguard the minting of decentralized and algorithmic stablecoins, ensure peg stability, and enhance confidence in stablecoin usability by liquidating positions, adjusting bonding curves, and recalibrating incentive mechanisms.

- Yield farming: Chainlink’s Price Data Feeds enable rewards in DeFi applications to be tied to deposit values, providing predictability for users. The Verifiable Randomness Function introduces additional gamification, engaging users within the protocol.

- Insurance: Chainlink enables on-chain insurance agreements using Weather Data Feeds and other real-world datasets, offering users, such as farmers, the ability to hedge against adverse conditions and allowing anyone worldwide to acquire insurance and hedge risk.

- Climate markets: Chainlink connects carbon markets and brings transparency to the measuring and tracking of climate commitments, offering high-quality on-chain data sources through its enterprise-grade middleware.

- Dynamic NFTs: Chainlink enables the creation of dynamic NFTs that automatically update based on real-world data and event inputs related to specific brands or projects.

- Provable RNGs: Chainlink enables unpredictable gameplay experiences with a verifiable random number generator, allowing for the gamification of ordinary processes and proof of the integrity of the selection mechanism.

With such groundbreaking opportunities available as potential use cases, Chainlink epitomizes the future of decentralized finance – a future where boundaries are redefined, and seamless integration across diverse platforms becomes a reality. Thus, the company’s radical offerings are not only forming the bedrock of countless DApps already but blazing a trail for future development within the domain.

Tackling challenges across multiple protocols together

Navigating the intricate world of blockchain technology often brings its fair share of challenges. Our partnership with Chainlink exemplifies this reality, underscored by our unwavering commitment to problem-solving and collective strides in the continuously evolving decentralized landscape.

We worked closely with Chainlink during a pivotal period in their development, as they prepared for the launch of CCIP. During this time, we focused on solving issues across multiple networks, on both mainnet and testnet deployments. This allowed the Chainlink team to dedicate its full attention to refining CCIP prior to the official release, pushing the boundaries of what is possible within Web3.

Along this journey, we encountered and tackled a variety of challenges with one notable example being recurring issues on a dedicated Polygon testnet node. After investigating, we discovered the root cause to be related to eth_call operations. Our response was to increase rpc_evmtimeout and upgrade both testnet nodes, which allowed for more efficient and reliable node performance.

Another challenge we faced together was brought to light by higher latency on the BNB mainnet. We initiated a complex disk-swapping operation, transferring data, enabling Fast Snapshot Restore (FSR), creating a new volume, and performing the swap. This led to full recovery of the node and its optimal operation moving forward, enabling Chainlink to continue working seamlessly.

One of the most demanding challenges was dealing with persistent synchronization issues with a dedicated BNB testnet node running on the Erigon client. Our resourceful solution involved doing FSR on a two-week-old snapshot, which ultimately resolved the issue for the better.

In the face of all these challenges, Chainstack proved to be a reliable partner, promptly providing the support and technical prowess that Chainlink needed to preserve its exceptional momentum. Thanks to this, the Chainlink development team was able to dedicate its full attention to the launch of CCIP and thus successfully deliver an outstanding release to the community.

Resolution summary

- Collaborative problem-solving: We worked diligently with Chainlink to resolve issues on both mainnet and testnet deployments across multiple networks as they emerged, allowing them to focus on perfecting the CCIP in preparation for its official release.

- Enhanced system resilience: When recurring errors plagued a dedicated Polygon testnet node, we dug deeper into the issue to discover the root cause in eth_call operations. Our response, including an increase of the rpc_evmtimeout and an upgrade of both testnet nodes, ensured a robust and efficient node performance for Chainlink.

- Optimized performance and recovery: Confronted with high latency on the BNB mainnet, we took the lead in an intricate disk-swapping operation. By enabling FSR, creating a new volume, and conducting the swap, we ensured the full recovery and optimal performance of the node, maintaining Chainlink’s operational integrity.

- Overcoming synchronization challenges: Some of the most notable obstacles we encountered were related to persistent synchronization issues on a dedicated BNB testnet node running on Erigon. Our resourceful solution, leveraging FSR on a snapshot taken two weeks prior proved to be a viable option, marking a considerable milestone in our collaborative journey.

- Reliable and prompt support: In the face of all these challenges, Chainstack proved to be a dependable partner, promptly providing support and technical expertise whenever needed. Our unwavering support allowed Chainlink to remain focused on the release of CCIP, testifying to our shared aspiration of constant innovation in the blockchain space.

Bringing it all together

Our work with Chainlink showcases how two organizations can unite to create a more robust, dynamic, and efficient blockchain landscape. The challenges we faced and subsequently solved through our partnership served to strengthen our collective resilience and ingenuity in driving Web3 forward.

Chainlink’s groundbreaking work on decentralized oracle networks, cross-chain interoperability, risk management, and off-chain data access sets the stage for a future where blockchain technology is more accessible and adaptable. Meanwhile, Chainstack, with our commitment to high-performance infrastructure you can rely on, stands at the ready to extend support to Chainlink every step of the way, ensuring the smooth sailing that their team needs to focus on its pioneering work.

Ultimately, the partnership between Chainlink and Chainstack stands as a testament to what can be achieved through shared learning, collaboration, and the relentless pursuit of progress. And should we look towards the future, we cannot help but be excited for we see a world where cross-chain is the norm, breaking down the silos of the past and ushering in a new era of decentralization.

Power-boost your project on Chainstack

- Discover how you can save thousands in infra costs every month with our unbeatable pricing on the most complete Web3 development platform.

- Input your workload and see how affordable Chainstack is compared to other RPC providers.

- Connect to Ethereum, Solana, BNB Smart Chain, Polygon, Arbitrum, Base, Optimism, Avalanche, TON, Ronin, zkSync Era, Starknet, Scroll, Aptos, Fantom, Cronos, Gnosis Chain, Klaytn, Moonbeam, Celo, Aurora, Oasis Sapphire, Polygon zkEVM, Bitcoin and Harmony mainnet or testnets through an interface designed to help you get the job done.

- To learn more about Chainstack, visit our Developer Portal or join our Discord server and Telegram group.

- Are you in need of testnet tokens? Request some from our faucets. Multi-chain faucet, Sepolia faucet, Holesky faucet, BNB faucet, zkSync faucet, Scroll faucet.

Have you already explored what you can achieve with Chainstack? Get started for free today.

Ethereum

Ethereum Solana

Solana TON

TON Base

Base BNB Smart Chain

BNB Smart Chain Sui

Sui Unichain

Unichain Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Gnosis Chain

Gnosis Chain Scroll

Scroll Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains