Bitcoin halving: What to expect from the fourth halvening event due to go live on April 24, 2024

Next month, on the 24th of April, 2024, Bitcoin’s ecosystem will experience yet another milestone event—the Bitcoin halving, also known colloquially as the halvening. As one of the most anticipated moments in the history of Bitcoin, halving is not a new phenomenon and has happened twice before 2020.

Every four years or precisely every 210,000 blocks, the number of new Bitcoins entering circulation witnesses a decline. This change in Bitcoin’s minting rate incites speculations of possible wealth accumulation, given that the tightened supply, in theory, should maintain the demand, and maybe even drive the price of Bitcoin up. Thus, the halving event triggers passionate debates extending to price predictions and market responses.

However, the impact of halving extends beyond immediate financial implications. The reduction in block rewards over time could significantly affect the operational structure of Bitcoin. Considering the dwindling rewards, there’s a chance of destabilization in Bitcoin’s security, challenging the economic incentives that underpin it.

As we stand on the cusp of the next Bitcoin halving, destined for the 24th of April, it’s about time we delve into the intricate workings of this complex topic.

The concept of block rewards in Bitcoin

Block rewards are an integral component of the Bitcoin ecosystem. New Bitcoins enter circulation as block rewards, and these are generated by miners who apply their computational power to earn, or ‘mine’, them.

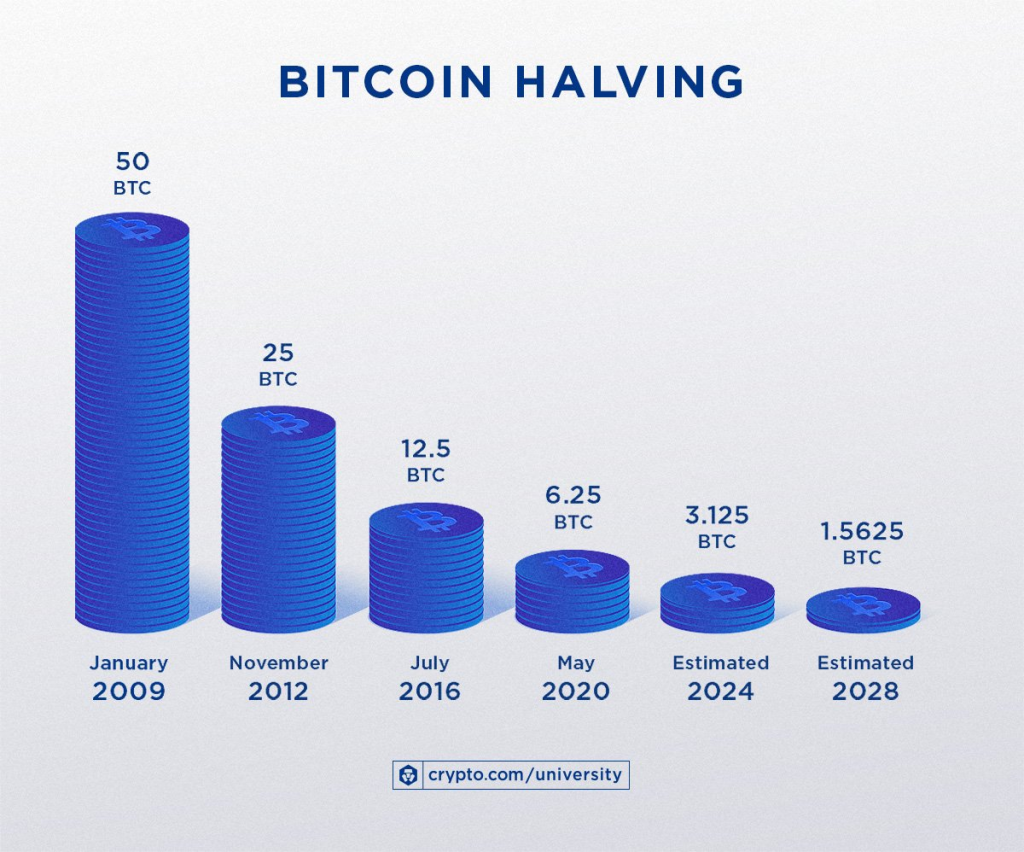

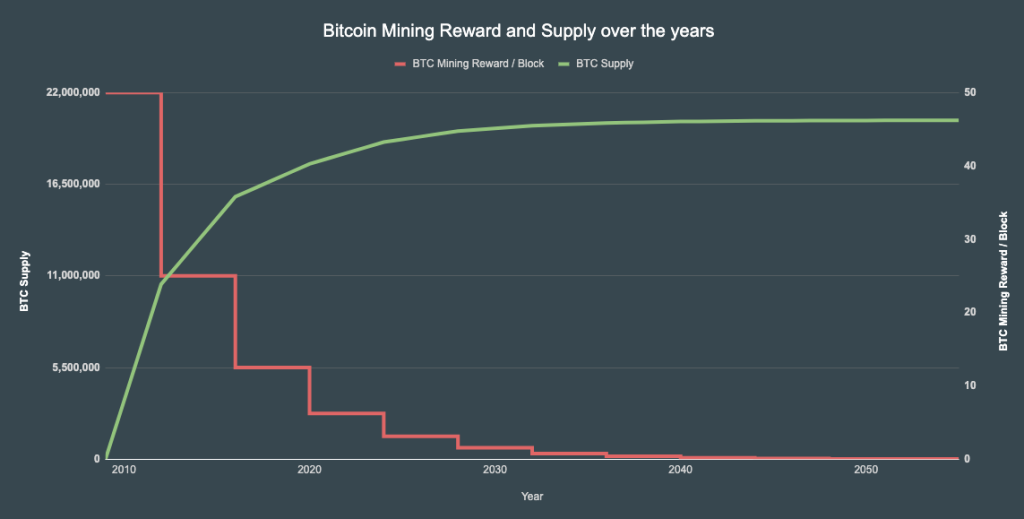

A fascinating aspect to note in this mechanism is the event, roughly every four years when the total number of Bitcoin that miners can potentially win is halved. In 2009 when Satoshi Nakamoto launched Bitcoin, successful miners were rewarded with 50 BTC every 10 minutes. Fast forward to three halvings later, only 6.25 BTC are being dispensed every 10 minutes. This process, driven by the enigmatic vision of Bitcoin’s pseudonymous creator, Satoshi Nakamoto, is set to end once the number of Bitcoins in circulation reaches 21M—a milestone anticipated to occur near the year 2140.

As of this moment, more than 18.5M BTC are circulating, and with the upcoming halving event slated for April 24th, the issuance rate will decrease even further. While there are concerns regarding the potential devaluation as a result of the finite distribution, supporters argue that scarcity is one of the defining factors contributing to Bitcoin’s store of value.

Bitcoin’s halving effect

The impact of Bitcoin halving is multi-dimensional. Starting with how it affects Bitcoin’s circulation, it’s noteworthy that halving is ultimately a mechanism implemented to control inflation. Since the introduction of Bitcoin in 2009, there have been three halving events (in 2012, 2016, and 2020). Each of these has corresponded with a decrease in the rate new Bitcoins enter circulation which in turn can lead to a price increase assuming demand remains constant.

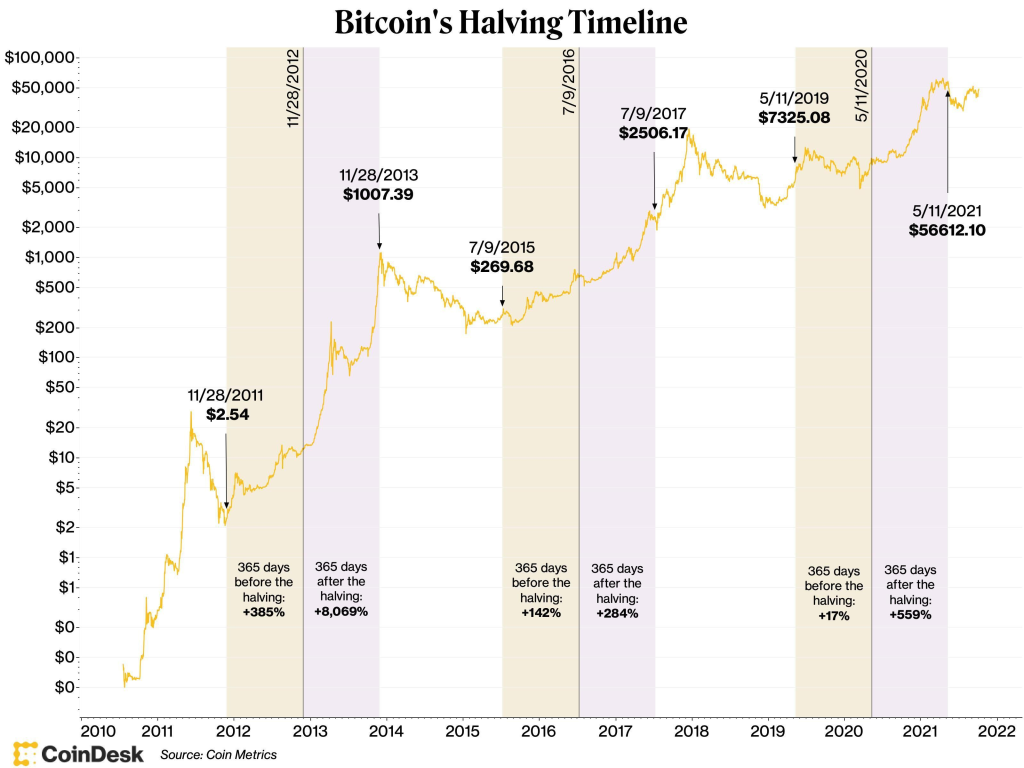

Focusing on Bitcoin’s price, history does appear to suggest that each halving event has marked the beginning of a price surge. The halving in November 2012 was followed by an impressive bull run, rocketing Bitcoin’s price successes. The same pattern recurred following the 2016 halving. However, it’s essential to be wary of the misconception that a price surge always succeeds in halving. Other factors like market demand, technological advancements, and global economic conditions have significant roles to play.

When engaging in debates regarding the price effects of Bitcoin’s halving, it’s crucial to keep in mind that cryptocurrency markets are notoriously volatile and unpredictable. Past trends may not necessarily dictate future outcomes. Scholars and analysts widely diverge in their forecasts, with some predicting significant price increases and others forecasting milder impacts or even a potential price drop.

What matters the most is the block being halved and its value. Including transaction fees, the block’s value is set by the market. However, as block rewards decrease and eventually disappear, the transaction fees’ role in Bitcoin’s price determination will become increasingly significant, adding another dimension to the halving impact.

Upcoming challenges for Bitcoin miners

This brings us to Bitcoin miners—the guardians of the Bitcoin network—and the absolute significance of block rewards for them. They expend considerable resources, in terms of hardware and electricity, to solve complex mathematical problems, thereby earning the privilege of adding a new block to the Bitcoin blockchain. The block reward, combined with transaction fees, offsets their costs and keeps the system lucrative for them.

However, when the rewards are halved, the miners’ revenue takes a hit. This leads to at least two potential outcomes: first, miners who operate with slim profit margins may be forced out of business. Second, miners may try to stay profitable by investing in more powerful and efficient hardware, thereby escalating the stakes in the ‘mining arms race’.

Formulating effective strategies post-halving becomes a focal point for Bitcoin miners. Some might lean on energy-efficient hardware, while some might look for geographical locations with cheaper electricity. It is indeed a challenge for them to mitigate costs while juggling the demanding protocols of the Bitcoin network.

The efficiency and costs of Bitcoin mining equipment play a significant role in the profitability of mining operations. One must optimize hardware design toward power efficiency while maintaining competitive processing capabilities. This operational balance has spurred several advancements in Bitcoin mining technology, making it more sophisticated and greener.

Several innovative solutions for post-halving revenue have emerged, such as the adoption of cutting-edge mining equipment and the use of renewable energy sources. The long-term sustainability of these solutions is yet to be tested, raising intriguing questions about the future evolution of Bitcoin mining.

Bringing it all together

Uncertainties and risks surround the big questions about Bitcoin halving. While exciting, the future of Bitcoin post-halving is predictably unpredictable. It heavily depends on factors like market demand, technological advancements, miner strategies, and changes in blockchain operability. Mining could become less profitable unless either the Bitcoin price remains high or advances in technology and efficiency can offset the drop in rewards.

Miners receive these rewards because they provide a vital function for the Bitcoin network. They validate the transactions and maintain the blockchain. Their contribution to the network is rewarded through these block rewards, and reducing rewards might theoretically jeopardize Bitcoin’s security by disincentivizing miners. Hence, it’s crucial to analyze and prepare for potential risks with each halving.

Each Bitcoin halving is unique. Factors such as the widespread acceptance of cryptocurrency, the impact of institutional investors, and the maturation of Bitcoin as an ‘asset class’, means the upcoming Bitcoin halving might truly be different this time.

In closing, Bitcoin halving is a price control mechanism interwoven into the fabric of Bitcoin’s blockchain protocol. It is a celebration of scarcity, a battle cry for decentralization, and a testament to the true nature of Bitcoin as a deflationary currency.

Power-boost your project on Chainstack

- Discover how you can save thousands in infra costs every month with our unbeatable pricing on the most complete Web3 development platform.

- Input your workload and see how affordable Chainstack is compared to other RPC providers.

- Connect to Ethereum, Solana, BNB Smart Chain, Polygon, Arbitrum, Base, Optimism, Avalanche, TON, Ronin, zkSync Era, Starknet, Scroll, Aptos, Fantom, Cronos, Gnosis Chain, Klaytn, Moonbeam, Celo, Aurora, Oasis Sapphire, Polygon zkEVM, Bitcoin and Harmony mainnet or testnets through an interface designed to help you get the job done.

- To learn more about Chainstack, visit our Developer Portal or join our Discord server and Telegram group.

- Are you in need of testnet tokens? Request some from our faucets. Multi-chain faucet, Sepolia faucet, Holesky faucet, BNB faucet, zkSync faucet, Scroll faucet.

Have you already explored what you can achieve with Chainstack? Get started for free today.

Ethereum

Ethereum Solana

Solana TON

TON Base

Base BNB Smart Chain

BNB Smart Chain Sui

Sui Unichain

Unichain Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Gnosis Chain

Gnosis Chain Scroll

Scroll Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains