Predictive crypto trading: Why AI algorithms thrive in volatility

Keeping pace with fast-moving cryptocurrency markets is a challenge that every trader faces. The volatility often correlates to speedy decision-making, granular strategy adjustments, and a constant need for risk management. Here’s where AI and predictive analytics come into the picture.

These technological innovations are becoming game-changers, revolutionizing cryptocurrency trading by empowering traders with data-driven decision-making tools, automated strategies, and advanced risk management capabilities.

This blog post steps into the fascinating world of AI crypto trading and analytics, exploring how it is fundamentally changing the way trades are conducted. From the utilization of neural networks to enhance prediction accuracy to the ethical considerations surrounding AI’s influence on financial markets, we will take a closer look at a realm where machine learning and advanced algorithms dictate the pulse of cryptocurrency trading.

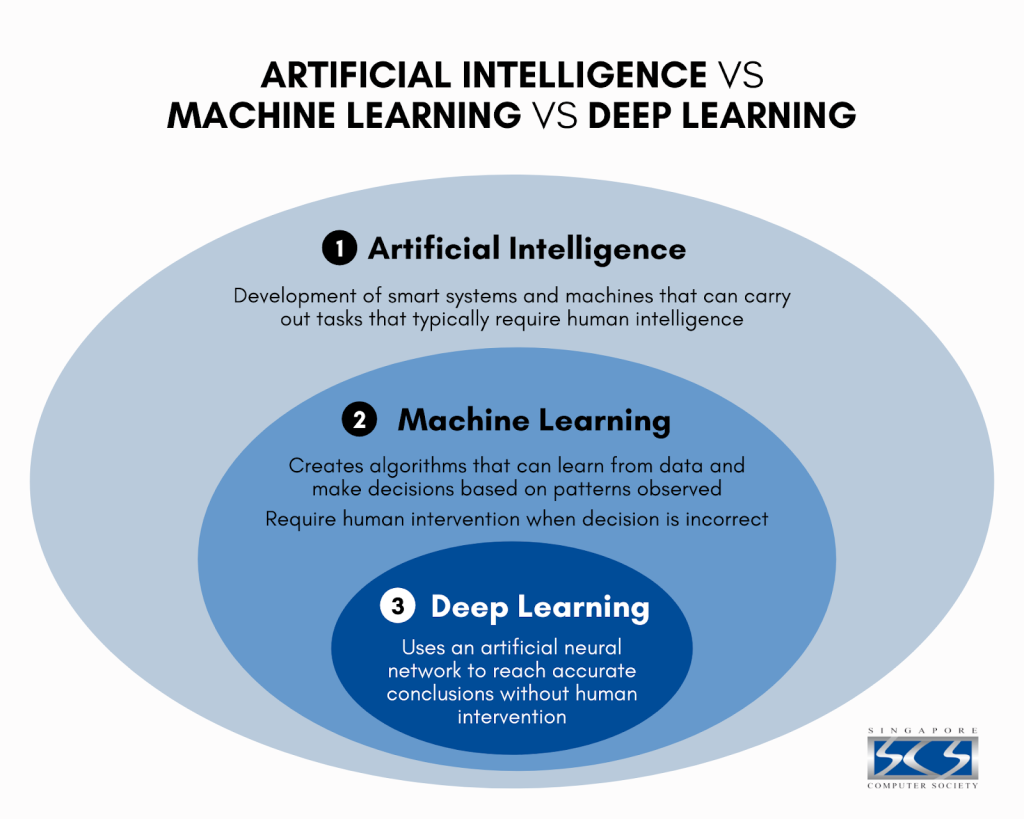

AI and machine learning in crypto trading

When we think of machine learning, we usually imagine Netflix suggestion algorithms or voice recognition on our smartphones. Yet, this transformative technology has a far wider reach—it’s making a powerful impact on the frontier of AI in crypto.

Seasoned trading veterans and newcomers alike are turning to AI-powered trading bots that incorporate machine learning. These revolutionary tools can analyze colossal volumes of market data, recognize intricate patterns, and ultimately make predictions about lucrative trading opportunities. They’re incredibly efficient, executing trades faster and more accurately than a human could ever manage. But, there’s more to this technological marvel.

By introducing concepts such as neural networks and deep learning into the equation, the precision of these predictions can be taken to an unprecedented level. This fusion of AI and machine learning is unlocking possibilities that were once left to financial fiction, putting the power into the hands of every diligent trader out there.

AI-powered trading

AI-powered trading is more than a cool concept; it signifies a paradigm shift in the world of cryptocurrency. AI-powered trading bots execute trades based on predefined conditions and perform at a pace and precision that humans can’t match, opening a new sphere of opportunities in high-speed, efficient trading.

These automated systems eliminate the need for constant monitoring and manual inputs, removing large amounts of strain, stress, and human error from the process. They make rational and timely decisions based on their superior processing capabilities, working tirelessly around the clock, a feature particularly beneficial in the 24/7 cryptocurrency markets.

Moreover, AI-powered trading doesn’t just bring speed; it brings accuracy. These advanced systems accurately predict market movements, apply risk management rules, and execute trades perfectly in line with programmed strategies. And the best part? They perform all these complex actions at split-second speeds.

Now, imagine combining this prowess of AI trading with the predictive power of machine learning. The result is amplified potential, refreshing profitability, and transformative success in crypto trading.

The power of predictive analytics

On the other hand, predictive analytics, another cornerstone of AI cryptocurrency trading, is having a profound effect on trading strategies and decision-making. It unlocks the power of data by using both historical and real-world, real-time data to deliver forecasts about future market trends and movements.

This data-driven approach offers a significant advantage to traders. Utilizing predictive analytics reduces uncertainty and guesswork when strategizing for the future. It allows traders to augment their intuition with actionable insights derived from large volumes of data. This means traders can now make better informed, confident decisions that align with evolving market trends.

Moreover, predictive analytics can identify potential trading opportunities and risks before they’re apparent to the human eye, allowing traders to capitalize on market trends and adapt their strategies quickly. This proactive approach to trading can often make the difference between profit and loss in the fast-moving cryptocurrency market.

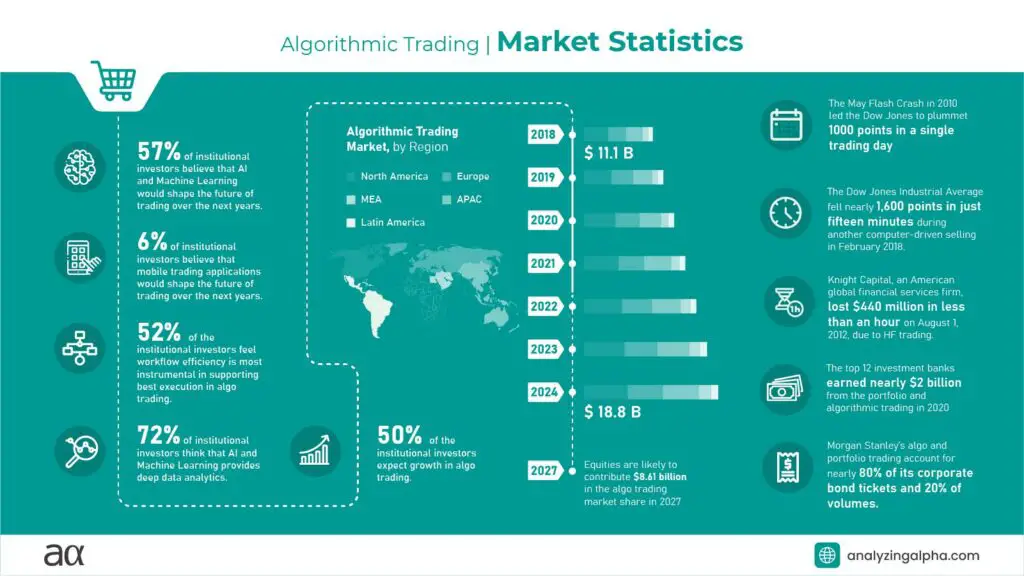

But how exactly does AI fit into the predictive analytics equation? Well, AI-driven analytics are what pull these valuable predictions from raw data. Algorithms process massive amounts of market data, sifting through noise, identifying patterns, and deriving meaningful trends. The significance of AI’s role in enhancing the potential of predictive analytics, therefore, cannot be understated.

Risk management in cryptocurrency trading

Any seasoned trader knows that risk management is at the heart of successful trading. The unpredictable swings of the cryptocurrency market make it particularly crucial. And this is where AI steps in with a solution.

AI has the remarkable ability to analyze data, learn from it, and make informed predictions. In the context of crypto trading, this means spotting potential risk factors before they become full-blown issues. When this predictive capability is paired with a robust risk mitigation strategy, it can lead to more significant profits by offsetting potential losses.

By continuously learning from market behavior and adjusting its predictions accordingly, AI plays a crucial role in adapting trading strategies in real-time, further enhancing the efficiency of risk management. This combination of AI and risk management provides an exhaustive shield against the inherent risks of trading in volatile markets.

AI-driven trading and portfolio management

Portfolio management in trading involves the delicate task of balancing the risk and return of a group of financial assets. In crypto trading, where volatility often rules the roost, effective portfolio management can mean the difference between substantial returns and significant losses. Enter AI-driven trading, an innovation that is reshaping portfolio management.

AI algorithms, coupled with predictive analytics, provide valuable foresights into market trends, help identify profitable trading opportunities, and shed light on potential risks. This data-guided approach enables portfolio managers to optimize the diversification of assets in their portfolio, balancing risk and reward based on predicted market movements.

In risk management, AI’s predictive capabilities power robust strategies that protect investments from potential market downturns. By forecasting risk and automatically reacting to market changes, AI ensures timely, data-guided decisions that can protect assets and secure returns.

In essence, when it comes to crypto portfolio management, incorporating AI-driven trading strategies is like having an expert advisor by your side—capable of making precise, timely, and data-backed decisions that enhance portfolio performance.

Machine learning and its role in trading

Machine learning, a vital subset of Artificial Intelligence, introduces adaptability and continuous learning to the trading environment. It’s a type of AI that enables computers to learn from data, discern patterns, and refine predictions without needing explicit programming, offering a dynamic edge to trading predictions.

In the context of crypto trading, machine learning models train on vast datasets, including historical pricing, transaction volumes, and various other market indicators. By crunching this data, identifying patterns, and learning from both successful and unsuccessful trades, these models help forecast future market trends and price variations more accurately over time.

Two prime examples of machine learning techniques commonly employed in the trading sphere are supervised learning and unsupervised learning. In supervised learning, models are trained on labeled data to predict future outcomes—an ideal approach for predicting price movements. Unsupervised learning, on the other hand, discovers hidden patterns and relationships in unlabeled data—perfect for identifying new trading opportunities or undetected risks.

But machine learning’s utility doesn’t just stop at predictions. It also aids in automating trading strategies, executing real-time trades, managing risk, and much more, effectively reshaping the way traders engage with the financial markets.

Neural networks and deep learning

Neural networks and deep learning form the backbone of many AI models, extending the reach and accuracy of AI predictions. These powerful techniques enable AI systems to recognize and interpret complex patterns, thus enhancing the accuracy of trading predictions.

Neural networks function much like the human brain, using interconnected layers of nodes (or “neurons”) to process data and generate outputs. While they can be trained to perform a variety of tasks, one notable application in trading is their ability to process vast amounts of market data and identify non-linear relationships that other algorithms might miss.

Deep learning, a subset of machine learning, uses neural networks with multiple layers (hence “deep”) to model and understand complex patterns. It’s particularly useful in analyzing unstructured data, such as market sentiment from social media or news articles, making it a valuable tool for AI-powered trading bots and predictive analytics.

These advanced techniques help to model the ever-changing dynamics of the cryptocurrency market and augment the decision-making ability of AI trading systems. By understanding trends at a granular level, traders can augment their strategies with deep data insights, therefore increasing their chances of success.

Reinforcement learning in autonomous trading strategies

Traders often rely on experience and hard-learned lessons to fine-tune their strategies. But what if a machine could learn the same way, but much faster? Reinforcement learning, a subset of machine learning, does exactly that.

At its core, reinforcement learning is all about learning from mistakes. In a trading context, AI algorithms equipped with reinforcement learning perform a myriad of trades, learning from each success and failure. Over time, these algorithms improve, making better trading decisions based on the wealth of experience they’ve amassed.

The result? Autonomous trading strategies that continuously adapt and evolve, managing to stay a step ahead even in the most turbulent markets. And as these strategies improve, they offer the tantalizing potential of better returns on investment.

Sentiment analysis in trading

Sentiment plays a critical role in trading decision-making. Public opinion can sway the market, making sentiment analysis a significant factor in AI-powered trading. The primary role of sentiment analysis is to gauge market sentiment and align trading strategies accordingly.

AI, particularly Natural Language Processing (NLP), plays a crucial role in analyzing sentiment. By processing data from various sources like social media and news outlets, AI can understand market sentiment at any given moment. This capability assists traders in adapting their strategies to align with the market mood—pushing when the sentiment is bullish, and showing restraint when the sentiment is bearish.

In addition to responding to current sentiment, AI can also forecast changes in sentiment. By analyzing sentiment trends, AI can help traders predict upswings and downturns in market mood, further enhancing their trading strategy’s effectiveness.

The transforming power of sentiment analysis in AI-powered trading is immense. It allows traders to become proactive rather than reactive, aligning with the market sentiment swings, and making more informed, timely decisions.

Emotionless trading: Mitigating biases with AI

Emotions are an integral part of human nature, but when it comes to trading, they often lead to irrational decisions. Fear, greed, and even excessive excitement can cloud judgement, leading to impulsive decisions and unfavorable outcomes.

This is where AI steps in, bringing a level of rationality to trading. AI trading bots analyze the market based on logical parameters and data-driven insights, keeping emotions out of the equation entirely. This emotionless approach results in unbiased decision making, which, in volatile markets like cryptocurrencies, can make a significant difference.

Moreover, AI’s ability to systematically examine and interpret complex data sets, align strategies with market trends, and promptly respond to market shifts ensures that trading decisions are grounded in solid data and logic. This helps keep costly emotional biases at bay, offering traders more consistent returns and reduced risk of potential losses.

Overall, by neutralizing emotional biases, AI significantly enhances trading accuracy, consistency, and profitability.

Real-time data analysis in AI trading

In the dynamic world of crypto trading, real-time data is a game-changer. Real-time data analysis, enhanced by AI, offers enhanced agility, precision, and efficiency, improving trading outcomes significantly.

AI-powered systems can process and analyze real-time data from across the globe in the blink of an eye, something human traders simply cannot match. AI systems can monitor multiple markets simultaneously, recognize patterns, and make informed, precise trading decisions based on current market conditions.

The power of real-time data goes beyond just speed. It enables traders to respond to market changes instantaneously, adjusting strategies on the fly, and capitalizing on fleeting opportunities that might otherwise be missed. This ‘live action’ analysis ensures traders’ strategies remain aligned with market movements and trends, providing valuable momentum that can lead to improved trading performance.

In essence, real-time data analysis, when combined with AI’s processing prowess, significantly enhances traders’ ability to make informed decisions promptly and accurately, contributing to more effective, profitable trading.

Further reading

Start capitalizing on the intersection between AI and Web3 with these comprehensive Chainstack resources:

- Solana trading and sniping pump.fun bot: Learn how to create a fully coded Python bot directly interacting with the pump.fun programs & accounts, not relying on any 3rd party APIs.

- Exploring the new Chainstack ChatGPT plugin: Start retrieving blockchain data effortlessly using natural language with the official Chainstack ChatGPT plugin, regardless of your skill.

- A look into generative NFTs: Learn about how generative art blends with blockchain technology and NFTs to unlock new financial prospects for artists using AI and more.

- BonusTrade.AI on Chainstack: Explore how BonusTrade.AI unlocks real-time crypto market insights with reliable low latency high performance Chainstack infrastructure.

- Brave new adventures in AI+Web3 with Eldarune and Chainstack: See Eldarune successfully tackle multichain performance bottlenecks for a superior AI-driven Web3 gaming experience.

Bringing it all together

The advent of AI and predictive analytics has ushered in a new epoch in cryptocurrency trading. They’re not just tools but game-changers, leveling the proverbial playing field and enabling traders to navigate the choppy seas of the crypto market with unmatched precision.

From real-time trade executions to data-driven predictions, AI streamlines the trading process and brings increased certainty to an inherently unpredictable terrain. With the reinforcement learning’s ever-improving algorithms, traders can watch their strategies evolve and adapt. Aside from its powerful tools, AI also introduces a new ethical dimension to the financial markets, raising vital questions that demand our immediate attention.

As we look forward, the possibilities seem boundless. If the current trends are any guide, the convergence of AI and predictive analytics will continue transforming the world of crypto trading in unforeseen ways, opening doors to advancements that, until recently, we could only dream of.

Power-boost your project on Chainstack

- Discover how you can save thousands in infra costs every month with our unbeatable pricing on the most complete Web3 development platform.

- Input your workload and see how affordable Chainstack is compared to other RPC providers.

- Connect to Ethereum, Solana, BNB Smart Chain, Polygon, Arbitrum, Base, Optimism, Avalanche, TON, Ronin, Plasma, Hyperliquid, Scroll, Aptos, Fantom, Cronos, Gnosis Chain, Klaytn, Moonbeam, Celo, Aurora, Oasis Sapphire, Polygon zkEVM, and Bitcoin mainnet or testnets through an interface designed to help you get the job done.

- Fast access to blockchain archive data and gRPC streaming on Solana.

- To learn more about Chainstack, visit our Developer Portal or join our Telegram group.

- Are you in need of testnet tokens? Request some from our faucets. Sepolia faucet, Hoodi faucet, BNB faucet, zkSync faucet, Scroll faucet, Hyperliquid faucet.

Have you already explored what you can achieve with Chainstack? Get started for free today.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains