What Is the Aptos Blockchain? Architecture & Ecosystem

In recent months, Aptos has been gaining increasing attention across the Web3 ecosystem. Developer activity is rising, new applications are launching, and the network’s stablecoin market capitalization continues to grow—positioning Aptos as an emerging settlement and execution layer.

But what exactly is Aptos, and why is it attracting renewed interest from builders, institutions, and infrastructure providers?

Aptos is a Layer 1 blockchain designed for high throughput, low latency, and safe upgrades. Its core design combines parallel transaction execution, the Move programming language, and formal verification to support production-scale applications.

This guide covers:

- Architecture: How parallel execution, pipelined processing, and Move-based resource semantics enable scalable and safe execution

- Transaction model: The five stages from submission to finality (see Lifecycle of a Transaction)

- Performance: 22k+ TPS sustained, $1.07M peak daily revenue, $1.7B in stablecoins, and 99.99% uptime

- Ecosystem: DEXs, liquid staking, RWAs, gaming, and Aptos’ trajectory toward becoming a global trading engine

- Developer tools: Move Prover, Aptos CLI, SDKs, wallets, and modern onboarding infrastructure

Let’s explore how Aptos’ architectural choices enable production-ready applications while differentiating it from earlier Layer 1 networks.

What is Aptos?

Aptos is a Layer 1 blockchain designed with scalability, safety, reliability, and upgradeability as core architectural principles developed by former Meta (Facebook) employees Avery Ching and Mo Shaikh, drawing directly from their experience working on Meta’s Diem (formerly Libra) blockchain initiative.

The Aptos blockchain is built to address fundamental limitations observed in earlier blockchain systems, particularly around execution bottlenecks, state management, and long-term protocol evolution. Many of its design decisions reflect lessons learned during the development of Diem, a project that prioritized security, formal verification, and performance at global scale.

At the protocol level, Aptos introduces a high-performance execution model built around the following core concepts:

| Core Concept | Description |

|---|---|

| Parallel execution | Aptos uses a high-performance execution model that processes independent transactions concurrently rather than sequentially, significantly increasing throughput and reducing latency under high network load. |

| Move language | Aptos natively integrates the Move programming language, originally developed for the Diem project, enabling fast and secure transaction execution. Move enforces strict resource ownership and asset semantics at the language level, preventing common smart contract vulnerabilities by design. |

| Formal verification | The Move Prover allows developers to formally verify smart contracts by proving correctness of logic and invariants, adding an additional layer of security against unintended or malicious behavior. |

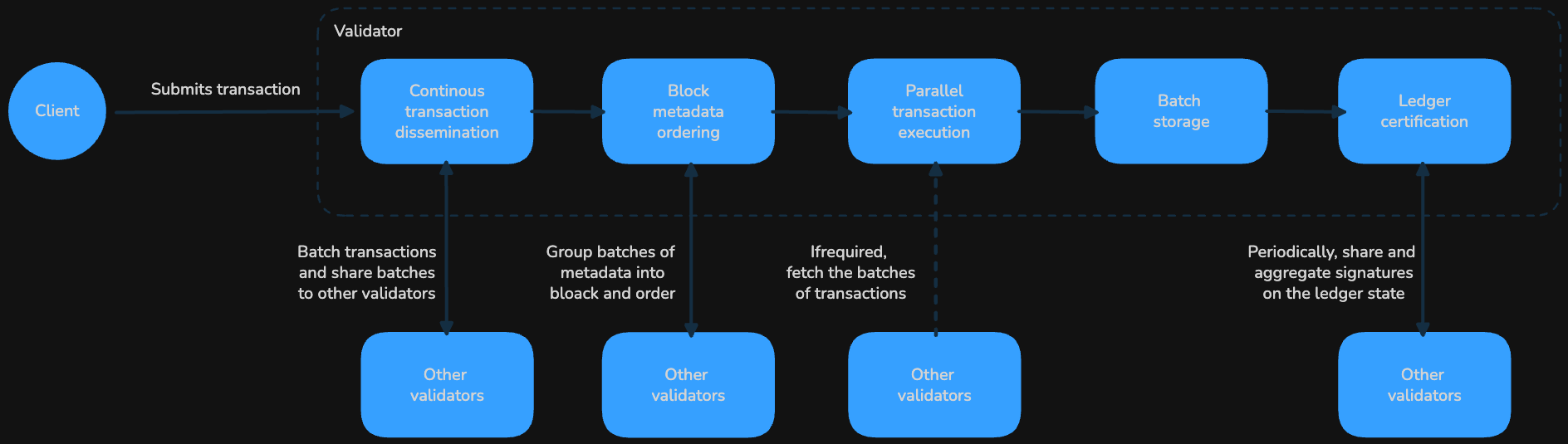

| Pipelined processing | Aptos employs a modular, pipelined architecture in which transaction dissemination, ordering, execution, storage, and ledger certification operate concurrently, maximizing hardware efficiency and system throughput. |

| Atomic execution | The network supports fully atomic parallel execution without requiring developers to specify read/write sets in advance, enabling complex transactions to execute efficiently while preserving correctness. |

| Flexible data | Aptos introduces an advanced data model that enables flexible key management, hybrid custodial options, and transaction transparency prior to signing, improving user safety and trust. |

| Continuous upgrades | A modular protocol design and embedded on-chain change management allow Aptos to deploy frequent, non-disruptive upgrades without requiring hard forks or network downtime. |

| APT token | The APT token is used for transaction fees, staking, and governance, aligning economic incentives across validators and ecosystem participants. |

The name “Aptos” comes from the Ohlone language and means “The People”. This reflects the project’s broader goal of building resilient, high-performance blockchain infrastructure that serves a global, user-centric decentralized economy.

Aptos Blockchain Architecture

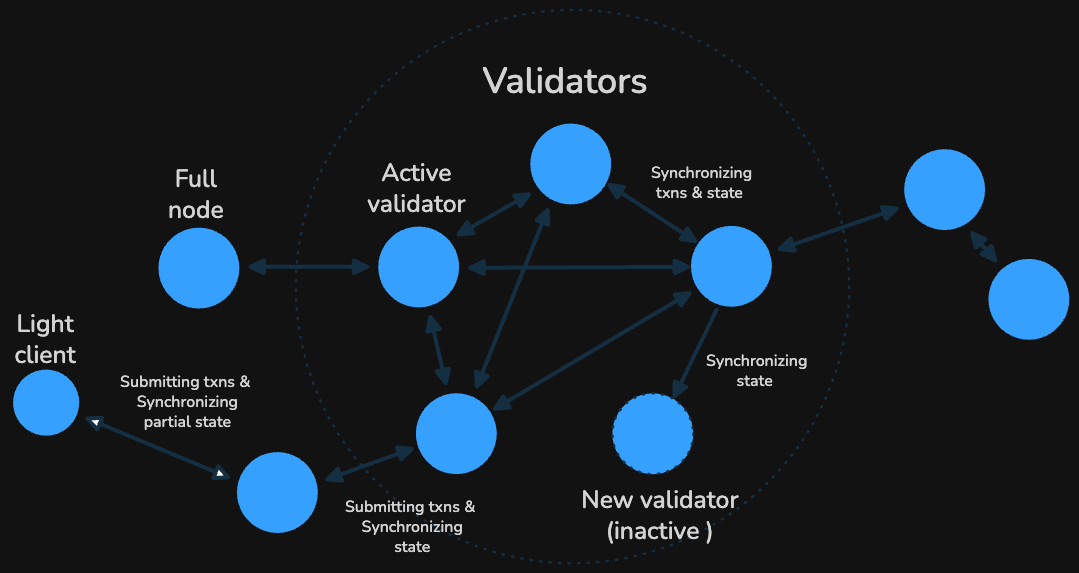

The Aptos blockchain leverages a proof-of-stake (PoS) consensus mechanism and is powered by a network of validators which process transactions and update the system. Its design enables complex operations to run efficiently while maintaining safety and upgradeability. Understanding Aptos requires looking at the types of nodes in the network, the components within validator nodes, and how transactions flow through the system.

Node Types

Aptos supports multiple types of nodes, each serving distinct roles in the network.

Validator Nodes

- Validators are responsible for executing transactions, participating in consensus, and maintaining the integrity of the blockchain.

- Their operations include proposing and committing blocks, executing transactions, and updating the global state.

Fullnodes

- Fullnodes provide access points for clients to interact with the blockchain.

- They validate and relay transactions, serve historical blockchain data, and act as intermediaries between clients and validators.

- Fullnodes can truncate historical data to optimize storage and performance while still maintaining correctness.

Light Clients

- Light clients maintain only the current validator set and a minimal portion of the blockchain state.

- They are optimized for efficiency and resource-constrained environments, enabling faster queries without processing the full transaction history.

The Aptos-core software can be configured to run as a validator node or as a fullnode, depending on whether the node will participate in consensus or primarily serve client requests.

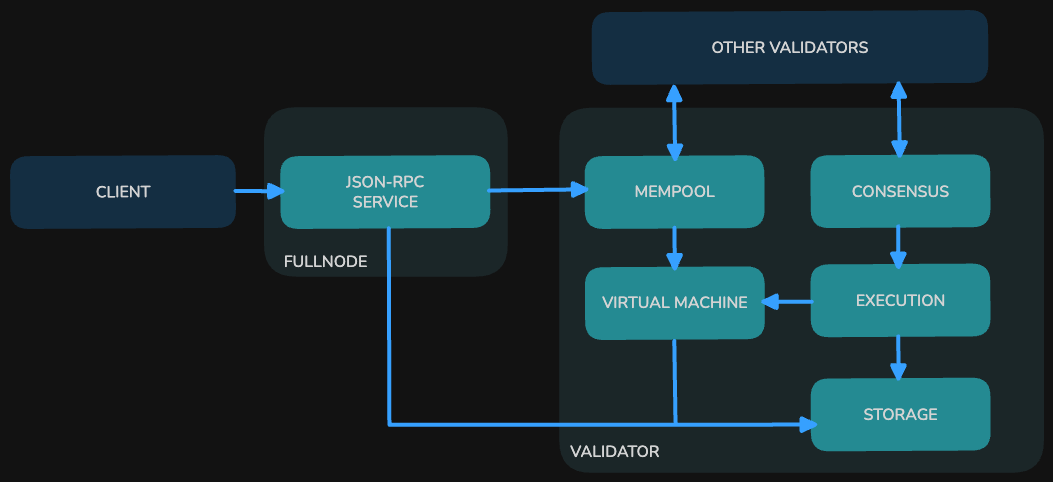

Validator Node Components

Validator nodes are modular and consist of several key components that interact to process transactions efficiently.

REST Service

- Entry point for clients submitting transactions or querying blockchain state.

- Forwards submitted transactions to the mempool and relays read requests directly to storage.

Mempool

- Temporary buffer for transactions waiting to be executed, but not yet agreed upon.

- Shares transactions with other validators via the shared-mempool protocol.

- Performs initial validation such as sequence number checks before transactions are considered for consensus to protect against DoS attacks.

Consensus

- Orders transactions into blocks and coordinates agreement across validators.

- Pulls transactions from the mempool, proposes blocks, executes them speculatively, and commits results once quorum agreement is reached.

Execution

- Coordinates the execution of transactions using the Move Virtual Machine (VM).

- Maintains a transient “scratchpad” state to compute block execution results prior to committing.

- Supports atomic and parallel execution of transactions while ensuring correctness.

Virtual Machine (VM)

- Validates and executes transaction scripts written in Move bytecode.

- Performs signature verification, sequence number checks, balance validation, and ensures transaction integrity.

Storage

- Persists committed transactions, execution results, and account state.

- Receives inputs from both execution and the VM for read and write operations.

- Supports efficient pruning of temporary or obsolete data to optimize resource usage.

Lifecycle of a Transaction

A transaction in Aptos passes through a clear, five-stage lifecycle:

- Accepting

- The client submits a signed transaction to a fullnode’s REST service.

- The REST service forwards the transaction to the mempool for validation (sequence numbers, signatures, balances).

- Sharing

- The mempool shares transactions with other validators through the shared-mempool protocol.

- Incoming transactions from other validators are also validated before being added to the local mempool.

- Proposing

- A leader validator selects a batch of transactions from its mempool and proposes a block to other validators via the consensus component.

- Executing & Consensus

- Transactions are executed speculatively in the execution component using the VM.

- The execution results are submitted to consensus, which coordinates agreement with other validators.

- Once a quorum agrees, the block is marked ready to commit.

- Committing

- Execution writes the finalized transaction results to storage.

- Account sequence numbers and balances are updated.

- The block becomes part of the permanent blockchain ledger.

Accounts

Accounts on Aptos represent access control over a set of assets, including tokens and NFTs, which are modeled as Move resources. Each account is identified by a 32-byte address, derived from the authentication key, and can be created explicitly or implicitly by transferring APT tokens. Unlike some blockchains, Aptos accounts are explicit, enabling advanced features such as key rotation and native multisig.

Authentication & Keys:

- Multiple authentication schemes: Supports Ed25519, Secp256k1 ECDSA, and K-of-N multisig for flexible single or multi-key account management.

- Aptos keyless accounts: Uses ZK proofs hide the link between Google/Apple/etc. logins with on-chain accounts and make self-custody usable for real people.

- Key rotation: Accounts can rotate authentication keys, replacing potentially compromised keys without changing the account address.

- Authentication key vs account address: The authentication key may change, while the account address remains fixed, ensuring continuity.

Explicit Account Types:

- Standard accounts: Typical user accounts with public/private key pairs.

- Resource accounts: Autonomous accounts without private keys, used to store resources or publish modules.

- Objects: Collections of resources representing a single logical entity.

Resources

Aptos organizes on-chain state using Move modules and resources, stored within accounts. This differs from Ethereum, where each smart contract maintains its own storage.

Resources vs Instances:

- Struct definitions in Move modules define abilities like

keyorstore. - Resources are struct instances with the

keyability, stored under accounts. - Stored instances with the

storeability can exist inside resources.

APT Coin Storage

/// A holder of a specific coin type and associated event handles.

struct CoinStore<phantom CoinType> has key {

coin: Coin<CoinType>,

}

/// Main structure representing a coin/token in an account's custody.

struct Coin<phantom CoinType> has store {

value: u64,

}

/// Custom resource example

struct CustomCoinBox<phantom CoinType> has key {

coin: Coin<CoinType>,

}

- CoinStore is a resource under an account; Coin is the transferable instance.

- Instances can be stored in other resources if the definition allows, providing flexibility for custom logic.

Resource Organization & Permissions:

- Resources are defined within modules deployed at specific addresses, e.g.,

0x1234::coin::CoinStore<0x1234::coin::SomeCoin>. - Modules dictate permissions: access, modification, and removal of instances require authorization via the module.

- Ownership is tied to storing a resource in an account or module logic.

Efficiency & Parallel Execution:

- Storing data under individual accounts reduces read/write conflicts and enables parallel execution of transactions, improving throughput and performance.

- Resources can be queried via Aptos Explorer or fullnode APIs, supporting lightweight access and verifiable state.

To stay up to date with the latest developments and improvement proposals in Aptos, refer to the Aptos Governance for voting and Aptos Improvement Proposals (AIPs) repository for documentation of all AIPs.

Performance and Scalability

Aptos is engineered for real-world scale, prioritizing consistent performance, low latency, fast finality, predictable fees, and high reliability all intentionally aligned with mainstream user expectations. Applications built on Aptos can feel responsive and intuitive, closer to traditional web experiences, without sacrificing decentralization or security.

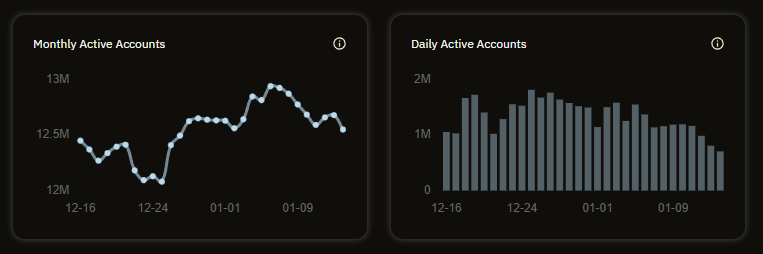

Network Health

Aptos has maintained 99.99% uptime since mainnet launch in October 2022, reflecting a strong emphasis on operational stability and fault tolerance.

- Record transactions in 24 hours: 533 million

- Peak daily application revenue: $1.07M

- Sustained throughput: 22,000+ transactions per second on mainnet

- Theoretical throughput ceiling: ~250,000 TPS

- Median block time: ~44 milliseconds

- Growing daily active accounts across DeFi, payments, gaming, social applications and more

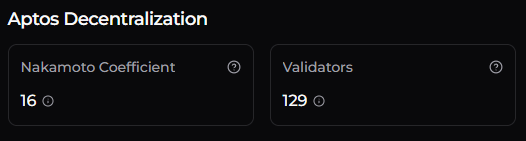

- Active Nodes: ~129 validators spread across the world

The Nakamoto Coefficient measures the minimum number of validators required to disrupt consensus. A higher number indicates stronger decentralization and security.

User Experience

Aptos is designed to deliver a consistent and affordable user experience regardless of network demand. Transaction fees remain predictable and low, making the network suitable for payments, gaming, social applications, and high-frequency DeFi activity.

| Transaction Type | Network Fee |

|---|---|

| Simple transfer | ~$0.0001 |

| DEX swap | ~$0.001 – $0.005 |

| Complex DeFi transaction | ~$0.01 – $0.05 |

Low and stable fees eliminate the need for users to time transactions around congestion, significantly improving usability for non-technical users and consumer applications.

Stablecoins

Aptos has over $1.7 billion in stablecoin market cap, positioning it as a viable settlement layer for payments, trading, and on-chain financial infrastructure.

Native and integrated stablecoins include:

- USDT: Native issuance by Tether

- USDC: Native issuance by Circle, CCTP enabled

- USD1: Issued by World Liberty Financial

- USDe: Synthetic dollar via Ethena

In short, Aptos is optimized not just to scale technically, but to scale usage, supporting millions of users and high-volume applications on a single, unified Layer 1 designed for the masses.

Use Cases

Since its mainnet launch in October 2022, Aptos has attracted sustained interest from developers, enterprises, and institutional participants. Backed by Andreessen Horowitz (a16z), Multicoin Capital, and Yzi Labs (ex-Binance Labs), Aptos has evolved into a network supporting institutional finance, consumer applications, and high-throughput on-chain systems. What sets Aptos apart today is not just what exists, but what can be built on it right now from institutional assets to high-volume consumer apps.

Wallets

Native account abstractions reduce reliance on smart-contract wallets, simplifying onboarding to support consumer-scale.

- Petra Wallet: Browser and mobile wallet built for Aptos, with Gmail/Apple login

- Aptos Connect: OAuth-based onboarding that allows users to create and use Aptos accounts via Google, Twitter, or Facebook, reducing friction for mainstream users

DEXs

Aptos hosts a diverse trading ecosystem, ranging from on-chain trading engines, derivatives, and AMM/CLOB systems to orderbook-based and perpetual DEXs.

- Thala: AMM and liquidity hub

- Panora: Aggregates liquidity for optimized trading.

- Hyperion: Deep liquidity for stablecoins and BTCFi assets

- Tapp: Modular DEX with composable hooks for custom trading logic

- Decibel: Fully on-chain perpetual CLOB (currently on devnet)

- Merkle Trade: Perpetuals and leveraged trading

- Bitnomial: First regulated Aptos-based futures in the U.S

Aptos is evolving into a high-throughput execution layer for both retail and institutional markets.

Lending, Yield & Staking

Aptos supports a growing set of lending markets, yield aggregators, and liquid staking protocols.

- Echo Protocol: Cross-chain asset protocol enabling BTC exposure on Aptos via aBTC, currently the largest BTC asset on the network.

- Aries Markets: Core lending and borrowing protocol supporting leverage and margin strategies.

- Amnis Finance: Pioneering liquid staking protocol with 42M+ TVL, issuing stAPT and amAPT so users can earn staking yield while retaining liquidity.

- Kofi Finance: A next-generation liquid staking protocol, enabling users to stake APT and receive kAPT, with enhanced rewards available through stkAPT.

These protocols benefit from fast liquidation cycles and low-cost execution.

Real World Assets (RWA)

Aptos is already being used as infrastructure for institutional-grade asset issuance and settlement.

- Securitize: Tokenized securities platform running BlackRock’s BUIDL (USD Institutional Digital Liquidity Fund).

- Ondo Finance: Issuing USDY, a yield-bearing U.S. dollar token

These deployments demonstrate Aptos’ suitability for large-scale, regulated asset issuance and settlement.

On-Chain Media, Entertainment & Gaming

Aptos is increasingly used for high-volume consumer and entertainment applications that require frequent state updates and low fees.

- NBCUniversal × Aptos Labs Backlot Club: On-chain fan engagement platform

- Playground Drops: Collectibles and community engagement for creators

- getSTANapp: Gaming and creator platform with 30M+ users, handling high-volume collectibles and AI-powered engagement

What’s Next

Based on current adoption patterns, Aptos is increasingly positioned for:

- Global trading engine and liquidity infrastructure

- Tokenized ETFs and structured financial products

- Institutional settlement and hot storage infrastructure

- High-throughput consumer and gaming platforms

A full list of ecosystem projects can be found in the official Aptos Ecosystem Directory: https://aptosnetwork.com/ecosystem/directory

Builder Tools for Aptos Development

Aptos provides a rich and growing developer ecosystem with tools that make building, testing, and deploying applications faster and safer. From smart contract development to node operation, the tooling stack supports both professional teams and independent developers.

Development & Smart Contract Tools

- Move Language & Move Prover: Secure, resource-oriented smart contract language with formal verification

- Move On Aptos book: Complete guide to get started with Move language maintained by @aptos-labs

- Move VS Code Plugin: IDE integration for syntax highlighting, error checking, and smart contract analysis. Maintained by the Move core team (source code)

- Aptos CLI: Deploy modules, interact with accounts, submit transactions, and manage local testnets

- Aptos SDKs (JavaScript, Python, Rust):** Build frontends, backend services, and on-chain logic

- Move Playground: Test Move contracts online with instant feedback and state visualization

- AptosFaucet: Provides free APT for testing and development

These tools let developers quickly build, test, and verify contracts before deploying to mainnet.

Wallets & Onboarding Tools

- Petra Wallet: Browser/mobile wallet for end-users

- Aptos Connect: OAuth-style Web3 login integration

- Aptos Wallet Adapter: Modular adapter for building wallet integrations with dApps

- Wallet Adapter by Pontem: React/Vue wallet provider supporting multiple Aptos wallets

- Aptos Name Service: Human-readable account addresses for simpler UX

With these tools, developers can onboard users seamlessly and connect apps to multiple wallets.

Conclusion

Aptos represents a modern approach to Layer 1 blockchain design, combining a resource-oriented programming model, parallel execution, fast finality, and a production-ready ecosystem. From its Diem-inspired foundations and Move-based architecture to its growing DeFi, stablecoin, and institutional adoption, Aptos is built to support high-throughput, real-world applications without sacrificing safety or upgradeability.

With mature developer tooling, native account abstractions, and reliable infrastructure, builders can focus on shipping products rather than working around protocol limitations. Whether you’re building consumer apps, financial infrastructure, or high-performance on-chain systems, Aptos provides a scalable and developer-friendly foundation that is designed for the masses.

Now you have the context to start building on the Aptos ecosystem and with a reliable RPC provider like Chainstack, you can deploy and scale your first Aptos application with confidence.

Start for free, connect your app to a reliable Aptos RPC endpoint, and experience how easy it is to build and scale on Aptos with Chainstack – one of the best Aptos RPC providers.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains