What is Unichain: Choosing Unichain RPC for production

Familiar EVM surface, different failure modes. We map where Unichain helps and where Unichain RPC choices across requests, WebSockets, and rate limits decide whether trades land on time.

Unichain is an Ethereum Layer-2 from Uniswap Labs, built to scale DeFi without changing how Ethereum developers work. It is an Optimism OP Stack rollup, meaning it runs as a separate chain anchored to Ethereum but inherits Ethereum security via optimistic fault proofs.

“the home for DeFi and liquidity across chains” – Uniswap Labs

Unichain architecture differs in several innovations. First — by moving execution to L2 while still preserving Ethereum’s decentralized security model — it achieves low transaction costs (≈ 95% cheaper fees than Ethereum mainnet). Second, it delivers high throughput and fast blocks.

Launched with 1-second block times, it introduces 200–250 millisecond “sub-blocks” for near-instant confirmations.

Another key component is Unichain’s provable block building. Block production is handled by a Trusted Execution Environment (TEE) based sequencer co-developed with Flashbots. This TEE sequencer enforces fair transaction ordering and even filters out failing ones, which improves UX (no more paying gas for reverted trades) and mitigates malicious MEV strategies.

In addition, Unichain will soon activate the Unichain Validation Network (UVN) – a decentralized set of validators who stake UNI tokens and independently verify each L2 block. The UVN will provide faster economic finality and further decentralize the chain beyond a single sequencer.

In short, its design is optimized for on-chain markets. It’s EVM-equivalent (fully Solidity and Ethereum tooling compatible), built on the Optimism Superchain framework for native cross-chain interoperability, and open source so that its technical advancements (like the TEE builder and UVN) can be adopted by other rollups.

Why Unichain is built for DeFi

Unichain’s role is to act as a high-performance DeFi hub. Uniswap Labs frames it as “the home for DeFi and liquidity across chains,” a response to Ethereum’s limits on cost and speed.

In practice, the chain is tuned for trading and liquidity work: cheaper transactions, faster confirmations, and a design that helps pull liquidity into one place instead of scattering it across networks.

Where Unichain improves on Ethereum L1

- High fees on Ethereum L1: Unichain cuts costs by ~95%, so swaps and multi-step interactions stay viable at scale. Cheaper txs also make higher-frequency and micro flows practical on-chain.

- Slow confirmation times: With one-second blocks and planned ~200 ms sub-block confirmations, pending times shrink. Quotes go stale less often and front ends stay in sync with chain state.

- Fragmented liquidity across chains: As part of the Optimism Superchain, Unichain supports native cross-chain messaging and ERC-7683 intents. You get single-click swaps between Unichain and other chains without manual bridging.

- MEV and unfair trading: A TEE-based sequencer with attestable ordering cuts front-running and paid reverts by enforcing ordering rules and catching obvious failures early. The Unichain Validation Network adds independent checks and faster economic finality.

Essentially, Unichain is a high-speed, low-cost venue for trading and liquidity. It targets CEX-like responsiveness while keeping Ethereum’s security and open access. For builders, that means cheaper transactions, short confirmation targets, and an execution path tuned for on-chain markets.

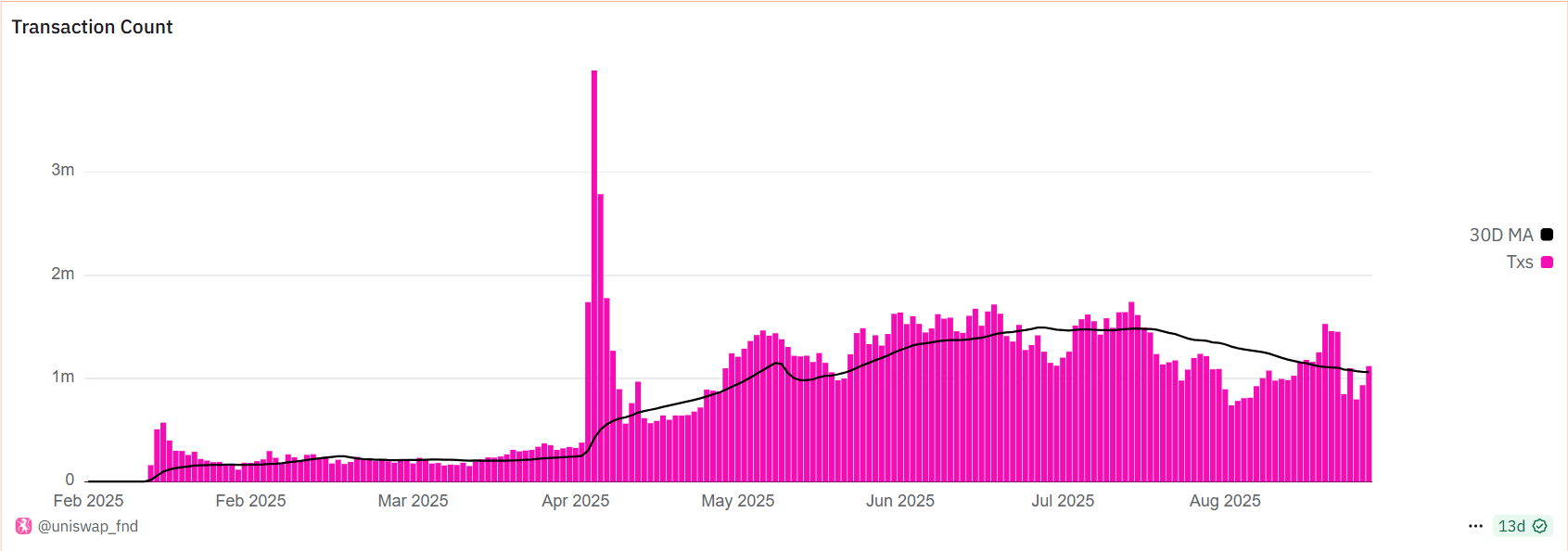

On testnet, it processed ~95 million transactions and 14+ million contract deployments in under four months. Around mainnet launch, roughly 100 projects were building or deploying, including exchanges, stablecoin issuers, yield protocols, and Uniswap. Incentives are user-aligned, with 65% of sequencer revenue allocated to community validators. Therefore, you get cheaper swaps and quicker settlement while staying on a network built for open, on-chain finance.

Developer tooling on Unichain

Developers coming from Ethereum won’t need a new toolbox. Unichain is EVM-compatible, so your usual stack works once you point it at a Unichain RPC endpoint and set the network in your config.

- Development frameworks and libraries: Set Unichain RPC and chain ID in Hardhat/Foundry and deploy as usual; Truffle/Remix follow suit. OpenZeppelin (Uniswap v4 Hooks included) works out of the box, and Thirdweb supports Unichain. Same Solidity/Vyper — switch networks, don’t rewrite.

- Block explorers: Unichain is indexed by explorers such as Blockscout and Uniscan. You can search addresses and tx hashes, verify source, and trace L1↔L2 activity—handy for debugging deploys, following event emissions, and sharing reproducible links with teammates.

- Wallets: MetaMask works once you add the Unichain RPC URL and chain ID. Many wallets include Unichain out of the box, so the connect flow doesn’t change. Teams with custody requirements can wire Unichain into enterprise wallets and keep standard WalletConnect paths in their apps.

- Data indexing and analytics: The Graph supports Unichain, so you can build subgraphs, index events, and query them over GraphQL for dashboards or app state. Other indexers (e.g., SubQuery, Goldsky, GhostGraph) offer alternative pipelines. On the analytics side, Dune includes Unichain datasets for querying trades, pools, and usage and for publishing public dashboards.

How to choose Unichain RPC

Public Unichain RPC is fine for quick tests. It’s rate-limited and HTTP-only, so it won’t carry a trading front end or a bot that needs live state. For production, use managed Unichain RPC you can treat as core infra.

With Chainstack, you can get a fully managed Unichain RPC node in a minute and skip the overhead of maintaining your own. Endpoints come ready to use, and you get features that matter when traffic grows:

- Global Nodes keep latency steady with geo routing, so reads and writes don’t jitter when users move or load shifts.

- WebSockets enable event and new-block subscriptions instead of blind polling, which helps UIs and bots stay current.

- The platform handles growth behind a stable endpoint so you can scale without rewrites.

- 1 request = 1 Request Unit. If you want to stop watching counters, Unlimited Node is a flat subscription for unlimited requests.

- Access rules allowlist by IP or Origin to lock down your endpoint in production.

- Create a project, add a Unichain node in Console, copy HTTPS and (where available) WSS, and ship. Docs cover ethers.js/web3.js reads, event subs, and Hardhat/Foundry deploys.

Wrapping up

Unichain covers speed and cost; you decide reliability. Point your stack at Unichain RPC you can treat as core infra, subscribe to new blocks and events where it helps, and keep the rest simple. If you want a fast start, create a node on Chainstack and get back to trading logic.

FAQ

Unichain is an Ethereum layer 2 from Uniswap Labs, built on the Optimism OP Stack and tuned for low-cost, fast DeFi.

Yes. Your Solidity or Vyper contracts and the usual Ethereum tooling work on Unichain with a network config and a Unichain RPC endpoint.

Point your client to a Unichain RPC URL and set the chain ID. Use the public endpoint for quick checks, then move to managed Unichain RPC for production.

No. It is rate-limited and HTTP only, so it is fine for tests but not for apps that need live state or consistency under load.

Blockscout and Uniscan index Unichain. You can look up addresses and transactions, verify source, and trace L1 to L2 activity.

Stable latency, WSS for subscriptions, clear limits, and controls to secure your endpoint. You should be able to treat the endpoint as core infra.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains