75% of retailers gearing up to accept crypto via payment gateways by 2024

In this ever-evolving digital era, we constantly encounter new technologies challenging our traditional systems, compelling us to adapt and innovate. One such innovation that has captured everyone’s attention is the rise of cryptocurrencies, democratizing how we perceive and handle money.

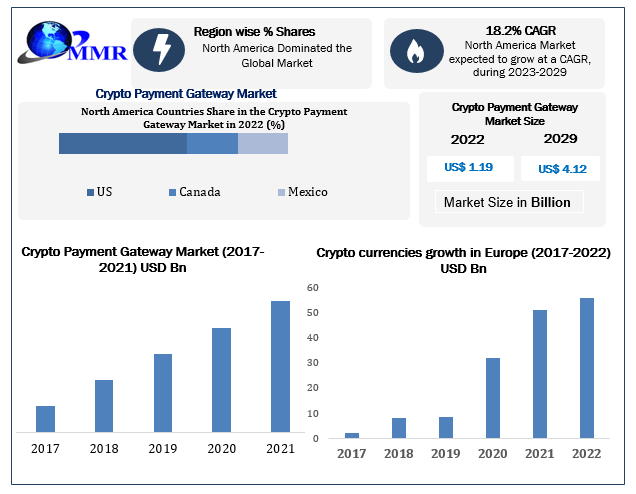

As the cryptocurrency market continues to mature, providing mechanisms that facilitate everyday transactions using these new forms of currencies have become a growing necessity. It is within this scenario that crypto payment gateways have emerged. So, without further ado, let’s dig into the world of crypto payment gateways and explore their impact on the industry as a whole. But first let’s take a closer look at the market and specifically the merchants which these gateways would power.

The retail shift towards cryptocurrency

The paradigm of the retail industry is shifting at a rapid pace, driven by evolving consumer preferences and the profound technological advances that accompany the digital age. A recent survey by Deloitte in June revealed a significant move by retailers towards embracing cryptocurrency as a valid method of transaction.

According to the report titled “Merchants getting ready for crypto,” an astonishing 75% of retailers are gearing up to accept cryptocurrency or stablecoin payments in the imminent two-year window. This not only signifies the growing legitimacy and acceptance of digital currencies but also demonstrates the industry’s agility in adapting to new-age payment methods.

Deloitte’s comprehensive study polled 2,000 senior executives from a diverse range of retail subsectors. From cosmetics to electronics, fashion to transportation, and even food and beverage sectors, there appears to be a unified movement towards crypto integration.

As consumers become more crypto-savvy, merchants are realizing the potential benefits such as reduced transaction fees, increased payment speeds, and access to a broader global market. The transition signifies not just an adoption of new payment forms but also a broader understanding and acknowledgment of where the future of commerce might be headed.

What are crypto payment gateways?

A crypto payment gateway is a platform that facilitates the transferring of cryptocurrencies and makes these transactions possible in daily life. While the conventional money transfer systems rely on regulated middlemen like banks or credit unions, crypto payment gateways stand as the facilitators for these payments to take place using cryptocurrencies.

These platforms work in a way that they accept payments in the form of crypto tokens from the customer’s digital wallet and processes this payment to the seller. Typically, this is done by converting the tokens into a more conventional currency, saving the seller from the extra complexity of dealing with them directly.

How crypto payment gateways work?

Crypto payment gateways essentially act as a bridge connecting cryptocurrencies with the conventional financial systems, offering a seamless and safe way to transact using crypto tokens.

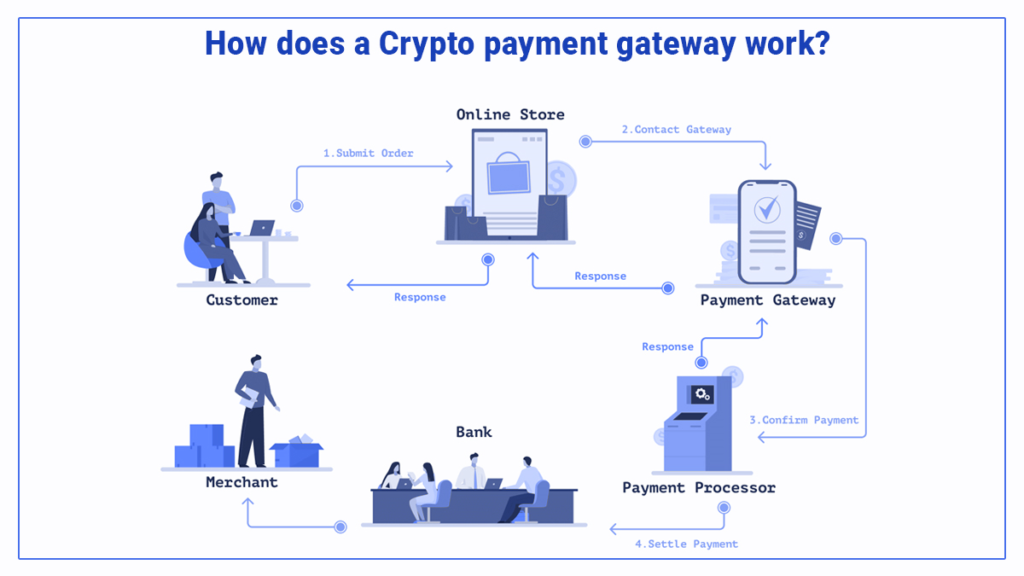

To better understand how crypto payment gateways facilitate transactions, consider the following sequence of actions:

- The transaction begins with the customer choosing to pay using a cryptocurrency token of their choice.

- On selecting this option, the crypto payment gateway generates a unique address for the transaction.

- This address, a unique string of alphanumeric characters, is connected to the transaction that is about to ensue.

- The customer then transfers the necessary sum of tokens to this address.

- Once the transaction is verified by the blockchain network, the crypto payment gateway converts the received tokens’ value into a more widely accepted currency like the US Dollar or Euro. This conversion happens almost instantaneously, shielding the seller from dealing with any cryptocurrency conversion.

- Finally, after the conversion, the amount is transferred to the seller’s account. Here, the seller receives the payment as they would with any conventional transaction.

Crypto payment gateway advantages for merchants

Cryptocurrencies and their payment gateways have rapidly gate-crashed the financial world, and for good reasons. These platforms provide merchants with several key advantages that give them an edge in today’s competitive marketplace:

- Global access: Crypto payment gateways erase geographical boundaries. Given the global accessibility of cryptocurrencies, any individual or business, irrespective of their location, can make transactions. This represents a vast, untapped customer base with whom merchants can engage without worrying about the limitations of traditional banking networks or the high costs of cross-border transactions.

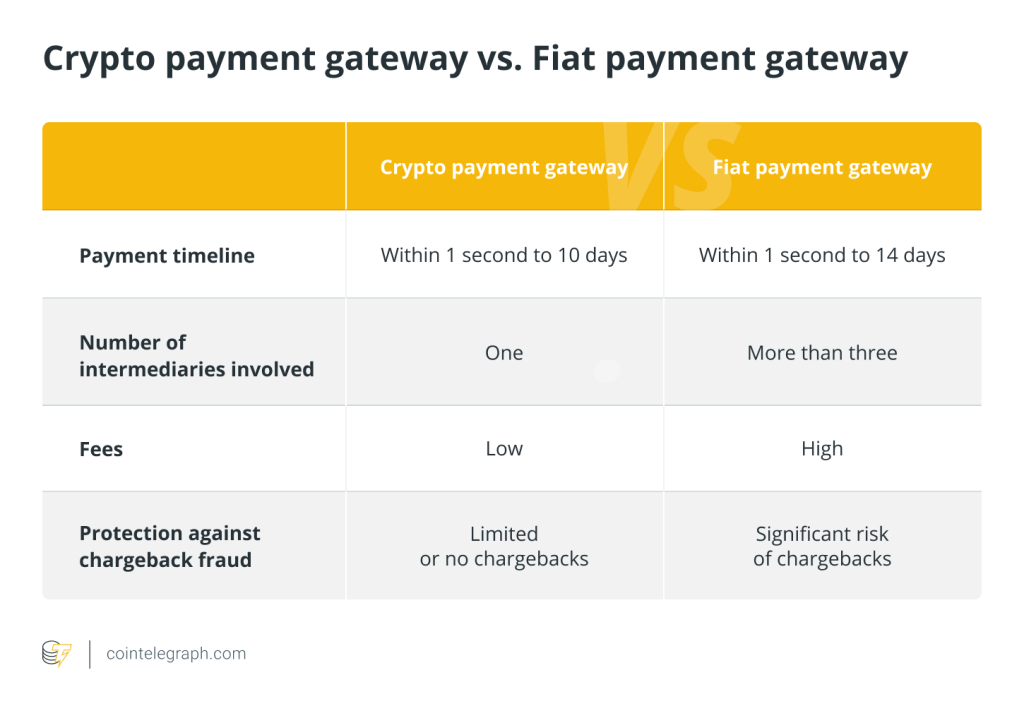

- Lower transaction costs: Traditional financial systems and payment networks usually involve fees and intermediaries. Crypto payments, being peer-to-peer, cut out the middleman, resulting in reduced costs for both merchants and consumers. Further, crypto payment gateways generally offer lower transaction fees than standard credit card networks.

- Near-instantaneous transactions: Cryptocurrencies do not rely on standard banking hours. Crypto payment gateways can process transactions at any time, offering near-instantaneous transaction validation and settlement, a crucial advantage in today’s fast-paced e-commerce world.

- Enhanced security and privacy: Crypto payment gateways leverage the inherent security features of blockchain technology, such as encryption and decentralization, significantly mitigating the risk of fraud and hacking. Additionally, unlike traditional payment modes that require consumers to share sensitive personal and financial information, crypto payments can be made while preserving the user’s anonymity.

- Volatility mitigation: Though it’s true that cryptocurrencies can be subject to severe price volatility, many crypto payment gateways offer instant conversions, allowing merchants to accept crypto payments and instantly convert them to a stable fiat currency. This allows the benefits of accepting crypto without the risk of price fluctuation.

In the world of e-commerce, adopting crypto payment gateways seems less like a novelty and more like a necessity. However, like all technologies, they too come with their share of challenges.

Disadvantages: The flip side of crypto payment gateways

While crypto payment gateways undeniably come with a wealth of advantages, they are also accompanied by certain drawbacks that merchants should carefully consider:

- Dependency on a third party: Cryptocurrencies were initially designed to bypass intermediaries. In the case of payment gateways, the principle of decentralization is compromised to a certain extent as merchants have to trust and depend on the service provider.

- Service continuity risk: The provider’s ability to operate without interruptions is crucial as you might receive payments from different time zones, around the clock. Any disruption in service could potentially obstruct the merchant’s cash flow.

- Transaction fees: Even though you pay less than when using traditional payment methods, there is a small transaction fee you have to bear when using a crypto payment gateway.

- The risk of hacking: If your crypto payment gateway provider gets hacked, all the funds that you had in your account waiting to be transferred are at risk.

- Volatility risk: While most providers offer instant fiat conversion to mitigate this risk, the possibility of a drastic price fluctuations just before conversion can’t be entirely ruled out.

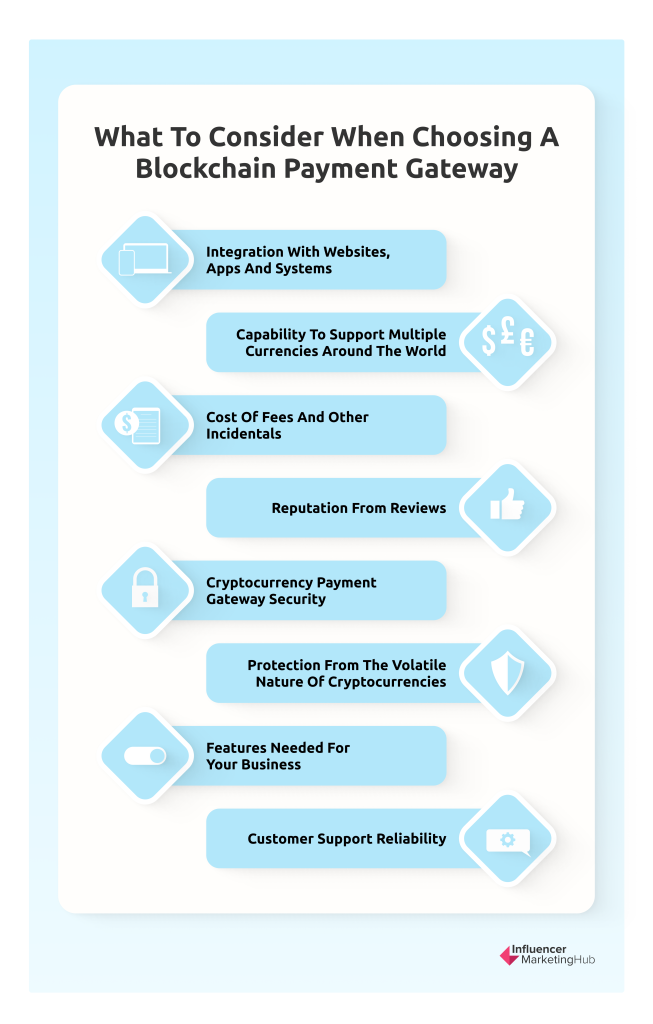

Despite these potential drawbacks, the benefits of accepting cryptocurrency via a payment gateway often outweigh the possible risks, and this is a decision each merchant must make on a case-by-case basis. How does one go about selecting a suitable crypto payment gateway, and are they all the same?

Centralized vs decentralized crypto processing solutions

Just as cryptocurrency was born out of a need for decentralization and autonomy from traditional financial institutions, so was the concept of decentralized crypto payment gateways. However, not all crypto payment gateways are created equal. There’s an important distinction between centralized and decentralized solutions; both come with their own sets of advantages and disadvantages:

Centralized crypto processing solutions

Centralized crypto payment gateways, much like traditional banking institutions, have a central authority such as a company or organization that oversees and governs transactions. They tend to be the more popular and well-known gateways, including offerings from Coinbase Commerce, Coinify, CoinGate, Circle, and Binance Pay Merchant.

Advantages of centralized solutions include ease of use, customer support, and existing trust relationships. However, they are subject to censorship, service availability, and they require trust in the provider’s ability to secure its platform against threats.

Decentralized crypto payment gateways

Decentralized crypto payment gateways take peer-to-peer transactions a step further. They connect the buyer directly to the seller without passing through a third party or middleman. Transactional data is publicly available on the blockchain, providing complete transparency.

Decentralized solutions such as Curra offer added security, privacy, and freedom, honoring the ethos of blockchain and its tenant of decentralization. They also lower the risk of service interruptions as they are not subject to decisions made by a central authority.

It’s evident that both varieties have their place in the digital world, and the choice between centralized and decentralized hinges largely on the specific needs and philosophy of the user.

Exploring centralized alternatives

While decentralized crypto payment gateways offer numerous benefits, their centralized counterparts have their own unique advantages. These gateways are typically user-friendly and come with robust customer support. Some popular centralized crypto payment gateways in the market are:

- Coinbase Commerce: A popular choice among businesses, Coinbase Commerce allows a business to accept multiple cryptocurrencies including Bitcoin, Ethereum, Litecoin, and others. It offers an easy integration with major e-commerce platforms and a simple interface to manage transactions.

- Coinify: This gateway allows businesses to accept Bitcoin and more than a dozen other cryptocurrencies in exchange for a small transaction fee. Merchants can receive payouts in their preferred local currency, mitigating volatility risks.

- CoinGate: Apart from standard features like integration with multiple e-commerce platforms and support for a wide range of crypto coins, CoinGate stands out with its ‘Trader’ feature, a tool for merchants to accept crypto at physical stores using a dedicated DApp.

- Circle: A payment gateway with an emphasis on stablecoin transactions, Circle is perfect for merchants seeking the advantages of accepting cryptocurrencies without dealing with their price volatility.

- Binance Pay Merchant: From one of the world’s biggest cryptocurrency exchanges comes this versatile payment gateway. It offers a host of features, including the ability to convert cryptocurrency to fiat in real time.

While these centralized solutions offer convenience and ease of use, there are decentralized counterparts that offer a more aligned vision with the essence of blockchain.

Who’s who in decentralized crypto payment gateways

In stark contrast to their centralized counterparts, decentralized crypto payment gateways exemplify the ethos of blockchain—decentralization, peer-to-peer transactions, and elimination of intermediaries. Here’s a look at some of the key players in the decentralized crypto gateway domain:

- Curra: As previously introduced, Curra is a prominent player in the decentralized crypto gateway market. Offering a seamless, secure transactional experience, Curra differentiates itself with its trustless, peer-to-peer nature. Curra provides an elegant, user-friendly solution for businesses looking to accept crypto payments but wanting to maintain the decentralized spirit of cryptocurrencies.

- NOWPayments: NOWPayments is another decentralized payment platform allowing its users to accept instant online cryptocurrency payments. The major standout of NOWPayments is the auto coin conversion feature, which rids users of the need to manage multiple wallets.

- CoinPayments: CoinPayments is a comprehensive platform offering shopping cart plugins, donation buttons, invoice creation capabilities, and an advanced Point of Sale (POS) system. It is well-regarded for its multi-cryptocurrency wallet, which adds a layer of convenience for the users.

- BTCPay Server: BTCPay Server is a self-hosted, open-source cryptocurrency payment processor designed with privacy and censorship-resistance at its core. It’s a tool that has a wide array of features, including direct peer-to-peer payments and complete control over your funds and information.

- CryptoWoo: CryptoWoo is a payment plugin that allows businesses to accept Bitcoin, Litecoin, and other cryptocurrencies directly into their wallets. It eliminates the need for a middleman and offers a high level of customization for the users.

These platforms epitomize the principle of decentralization, catering to users who seek to retain full control of their transactions while reaping the benefits of blockchain technology.

Making global payments easy

In a globalized world where cross-border commerce is commonplace, efficient and frictionless payment methods are crucial. Traditional payment systems, while largely effective, can pose significant challenges in international trade: currency conversion costs, delayed processing times, and the need for local banking relationships, to name a few.

Enter crypto payment gateways. By virtue of their inherent characteristics, these gateways offer a potent solution to streamline global payments:

- Breaking down borders: Cryptocurrencies, by their very nature, aren’t bound by geography. A customer from any part of the globe can smoothly transact with a merchant located elsewhere. Crypto payment gateways facilitate this transaction, thereby eliminating geographic barriers and handsomely expanding the customer base for merchants.

- Fast and efficient: Crypto transactions offer near-instantaneous processing, regardless of location. The hassles of time-zone differences or local banking hours are effectively sidestepped.

- Cost-effective: International transactions frequently involve significant costs related to currency conversion or transaction fees. Crypto payment gateways, by enabling peer-to-peer transactions, cut out these financial intermediaries and their attached costs.

- Overcoming regulatory hurdles: Certain countries have complex financial regulations that can deter global business. Crypto payment gateways can circumvent these regulatory hurdles, boosting the ease of international commerce.

Crypto gateways like Curra, Coinify, and others are fast becoming the chosen route for businesses seeking to capture the global market.

Reducing volatility risk

Price volatility is a concern often attached to the world of cryptocurrencies. It’s not uncommon for Bitcoin or other cryptocurrencies to experience significant price changes within a short period. This volatility can be particularly concerning for merchants who could potentially see the value of their received payments change drastically.

That’s where crypto payment gateways come in. These platforms, especially the centralized ones, offer what is known as automatic conversion. When a customer makes a payment in cryptocurrency, the payment gateway instantly converts the payment into the merchant’s preferred currency at the current exchange rate. This solution allows the merchant to receive the exact amount they expect with no risk of price fluctuation.

Furthermore, many crypto payment gateways offer settlement services, where the cryptocurrency transactions are regularly converted to a chosen currency and transferred to the merchant’s bank account. Both these features substantially mitigate the volatility risk, making the adoption of crypto payment solutions a viable option in mainstream commerce.

Even decentralized gateways are beginning to adopt these measures. Services like Curra are taking steps to neutralize the potential impact of volatility, ensuring that the merchants can comfortably accept cryptocurrencies.

What happens if a crypto gateway is hacked?

Cryptocurrencies have garnered a great deal of attention for their unparalleled security and transparency. However, like any technology, they are not entirely immune to hackers. If a crypto payment gateway is compromised, it could potentially result in the loss of the funds stored with the provider.

However, it’s important to note that crypto payment gateways incorporate state-of-the-art security measures to safeguard against such threats. Triple layer SSL encryption, two-factor authentication (2FA), multi-signature wallets, and other robust protocols form an intricate security framework to protect against cyber threats.

Moreover, many centralized payment gateways carry insurance to cover potential losses, adding another layer of protection for the merchants.

In the case of decentralized gateways like Curra, the risk is substantially mitigated as transactions are handled directly between the buyer and seller. This infrastructure minimizes the number of attack vectors, drastically reducing the chances of a successful hack.

In the unlikely event of a security breach, most platforms have detailed contingency plans that include prompt user notification, immediate shutdown of services to prevent further damage, and adequate measures to track and recover the stolen funds.

In conclusion, while there is a risk factor involved, the state-of-art security measures adopted by crypto gateways and the corrective actions taken post a potential breach underlines the efficacy of these gateways and instills confidence among users.

Bringing it all together

Embracing crypto payment gateways means opening doors to the future of financial transactions. These indispensable tools offer unparalleled benefits – universal accessibility, lower transaction costs, instant transfers, supreme security, and more. While certain challenges need navigation, the advantages they bring to the table for merchants worldwide are undeniable.

As more people embrace cryptocurrencies, the importance of these gateways continues to grow. Centralized and decentralized solutions each offer unique advantages that cater to varying needs. From ensuring swift international transactions to reducing volatility risk – the transformative potential of crypto payment gateways is immense.

With platforms like Curra paving the way in the decentralized market, businesses now have a plethora of options at their fingertips. The future of e-commerce and remote transactions undoubtedly lies within the crypto realm.

The journey into the world of crypto payment gateways is an enlightening one, presenting potential solutions that could ultimately shape the financial landscape. As we continue to navigate this exciting terrain, one thing is clear—crypto payments are not just a passing trend. They are here to stay, revolutionizing how we perceive and transact value.

Power-boost your project on Chainstack

- Discover how you can save thousands in infra costs every month with our unbeatable pricing on the most complete Web3 development platform.

- Input your workload and see how affordable Chainstack is compared to other RPC providers.

- Connect to Ethereum, Solana, BNB Smart Chain, Polygon, Arbitrum, Base, Optimism, Avalanche, TON, Ronin, zkSync Era, Starknet, Scroll, Aptos, Fantom, Cronos, Gnosis Chain, Klaytn, Moonbeam, Celo, Aurora, Oasis Sapphire, Polygon zkEVM, Bitcoin and Harmony mainnet or testnets through an interface designed to help you get the job done.

- To learn more about Chainstack, visit our Developer Portal or join our Discord server and Telegram group.

- Are you in need of testnet tokens? Request some from our faucets. Multi-chain faucet, Sepolia faucet, Holesky faucet, BNB faucet, zkSync faucet, Scroll faucet.

Have you already explored what you can achieve with Chainstack? Get started for free today.

Ethereum

Ethereum Solana

Solana TON

TON Base

Base BNB Smart Chain

BNB Smart Chain Sui

Sui Unichain

Unichain Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Gnosis Chain

Gnosis Chain Scroll

Scroll Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains