Monad & Berachain: Blockchain usage weeks after mainnet

2025 saw a range of developments in the blockchain industry, from multiple cryptocurrency price highs and drops, including a Bitcoin all-time high in October 2025, to the popularity of AI agents, prediction markets, and stablecoins.

Monad and Berachain were the most prominent blockchain mainnet launches of 2025, each amid different market conditions and during unique developments in blockchain use cases. Berachain launched in early February 2025, during a period of growing institutional and government adoption. Monad launched in late November 2025, as outlined in a previous deep dive, during a weakening on-chain activity and a visible bear market.

This article compares the usage levels of Monad and Berachain, examines the potential impacts of their launch strategies and market conditions on their usage, and analyzes how their levels compare to earlier launches of now-mainstream blockchains like Base and Sui.

Before mainnet, there was testnet

Before launching on the mainnet, both Monad and Berachain launched a testnet, a separate network for testing their respective chains, which were successful enough to propel a mainnet launch

The usage levels of testnet serve as a baseline for how many users may use the mainnet. Testnet provides developers and users the opportunity to test, experiment with, and validate a version of the network and the applications built on it before the main network releases. Many also make testnet transactions in hopes of being included in an airdrop of the protocol’s cryptocurrency token when mainnet launches.

Monad launched testnet on February 9, 2025, nine months before their mainnet launch. Berachain ran its testnet for over a year before launching mainnet in February 2025. Both Monad and Berachain sent an airdrop of their mainnet tokens to testnet users, but did not explicitly state beforehand that they would do so.

From February to September 2025, Monad recorded daily transactions ranging from 5 million to 8 million. On October 14, 2025, Monad announced an airdrop to testnet users who used the test before that date. Testnet transaction volume then dramatically increased to 80 million transactions a day, peaking 9 days later at 196 million transactions a day.

Eventually, the Monad Foundation chose to airdrop MON, the primary protocol token, to 288,676 testnet users (including developers who deployed on testnet and users who used products deployed there), as well as to community members worldwide. By the time of the mainnet launch, 76,021 users (assuming unique wallet addresses) had claimed 3.33 billion tokens.

Berachain’s Artio and bArtio testnets are now deprecated, so testnet transaction data is not readily available. A total of 500 million BERA tokens were allocated to the community, including 8.25 million tokens (1.65 percent of all tokens) for testnet users worldwide, excluding the United States. In total, across testnet users and community members, 1,336 users claimed tokens, significantly fewer than in Monad.

Testnet users who receive a mainnet airdrop are typically the first users of mainnet, as they are developers with an active product or users of a product that will migrate to mainnet. Generally, we can expect at least 76,021 wallets to trade 3.33 billion MON tokens in the initial days of the Monad mainnet launch, and 1,336 wallets to exchange 500 million BERA tokens during the first days of the Berachain mainnet launch, along with additional on-chain activity from new users and applications built on the chains.

Post-mainnet blockchain usage

The first few days of a mainnet launch typically see a lot of activity as testnet users use their newly airdropped tokens and as general market curiosity builds, but maintaining that momentum requires different market and adoption factors.

Sui and Base, blockchains that launched mainnet in 2023, two years before Monad and Berachain, saw mixed success after their mainnet went live.

Sui

Sui, a high-performance Layer-1 blockchain that uses a unique object-centric model to enable parallel transaction processing, reached its daily transaction volume peak in July 2023, two months following its mainnet launch in May 2023. Since reaching a daily peak of 66 million transactions on July 27, 2023, the daily transaction volume has decreased to an average of 1 million, then recovered to an average of 1.5 million, with some spikes in October 2023, April 2024, and October 2024.

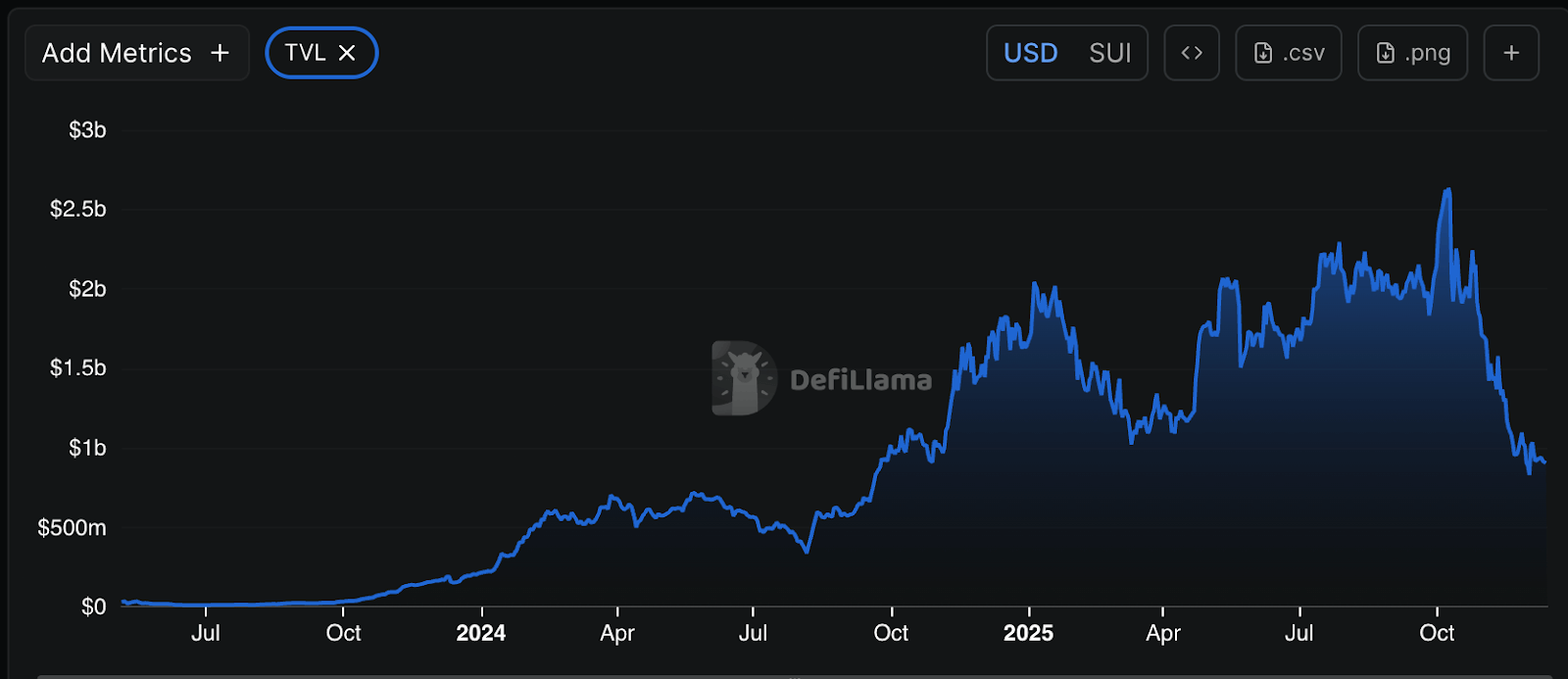

Decentralized finance (DeFi) fueled the growth spikes in October 2023 and October 2024. Total value locked (TVL), or the total amount of cryptocurrency assets deposited, staked, or “locked” or secured on Sui, peaked in October 2023, rising 341 percent from three months prior. In October 2024, Sui began supporting USDC, a stablecoin pegged to the US dollar and backed by Circle, and Deepbook, a high-throughput, low-latency decentralized exchange with a fully on-chain order book.

Though Sui has not seen the same day-to-day transaction levels, its TVL has remained consistent or grown through the two years, indicating that users are still locking their SUI tokens on the chain.

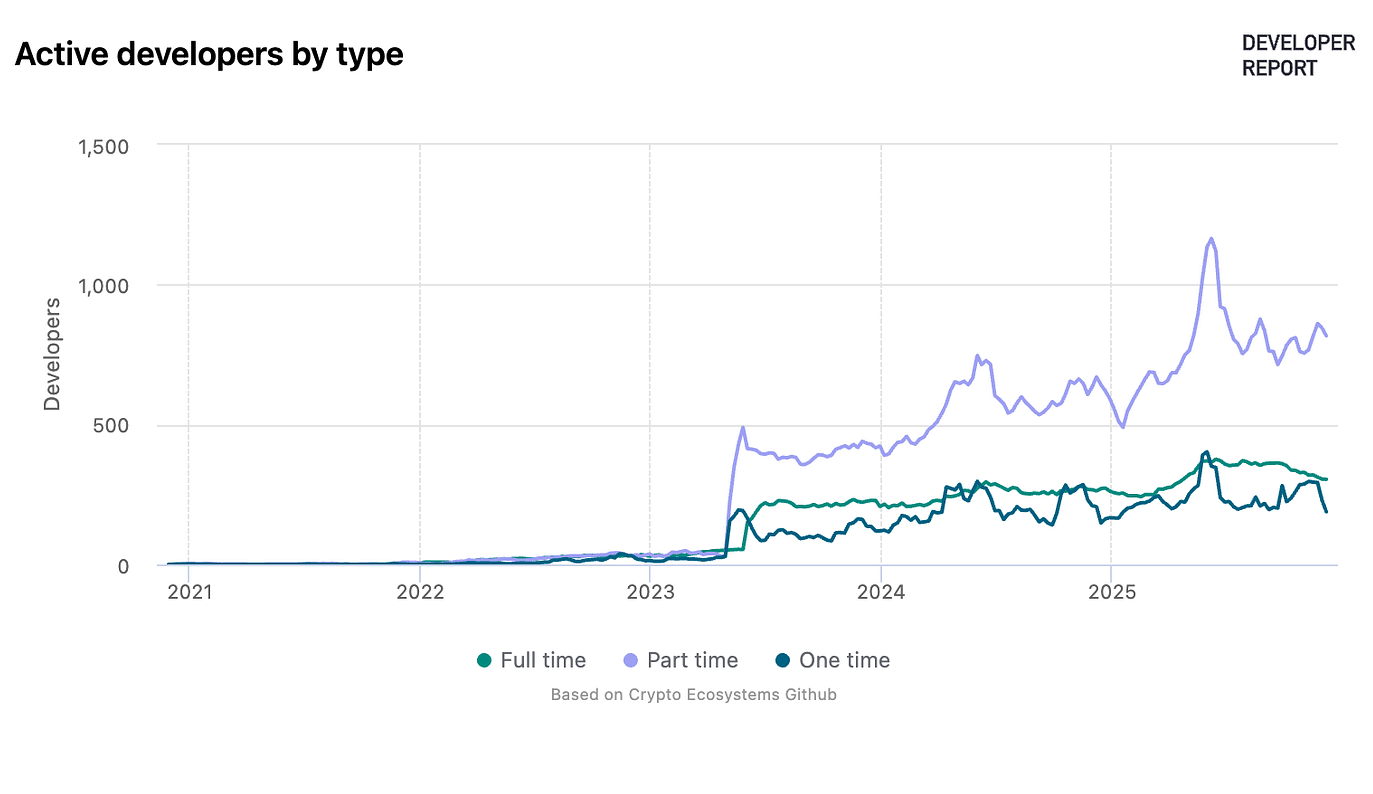

DeFi remains a significant focus, but community efforts also drove growth as they did in April 2024. Move, a programming language for writing smart contracts on Sui, launched in beta and led to major developer events, including the Sui Basecamp Conference and the Sui Overflow Hackathon. As part of these developer events, Sui saw a peak in part-time and one-time developers but struggled to convert them long-term and did not see another increase until June 2025, after Sui Overflow 2025 ended.

Sui has not seen the same usage levels as when it was first launched, but it has experienced growth spikes driven by major DeFi and community efforts, and its TVL has either remained stable or grown.

Base

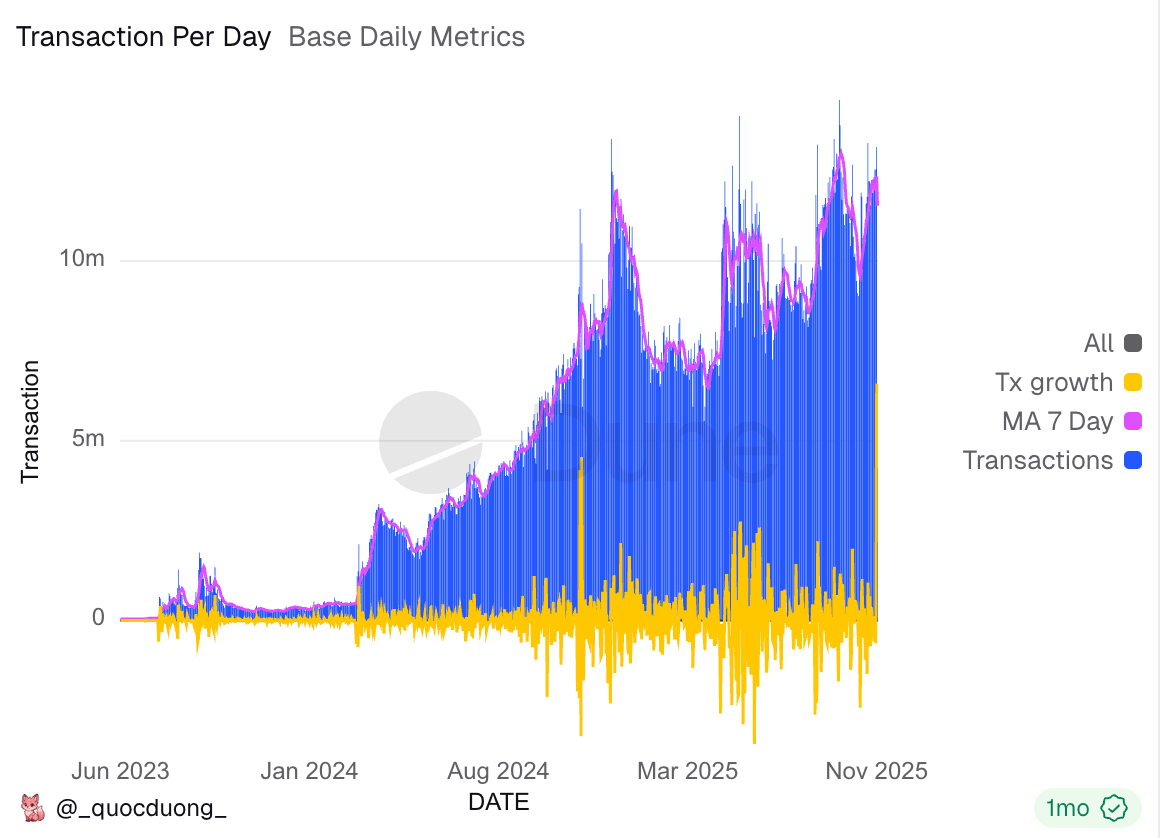

Unlike Sui, Base, an Ethereum Layer 2 blockchain built by Coinbase, has seen consistent growth since its mainnet launch.

As a Layer 2 scaling solution, Base processes transactions off-chain and then settles or finalizes them on Ethereum, the Layer-1 blockchain on which it runs. In contrast to Sui, Base does not have a native protocol token (It uses the Ethereum (ETH) token on its network), and standard DeFi metrics such as TVL do not apply in the same way. However, Base had an advantage because it attracts already established Ethereum users looking for cheaper, faster Ethereum-compatible solutions.

Like Sui, Base also experienced a drop in transaction volume two months after its launch in August 2023. Then, in March 2024, it saw substantial daily transaction growth and continues to reach new peaks. Base also benefited from the growing popularity of DeFi during the period, with its TVL steadily increasing.

Base maintained its growth throughout 2024 and 2025 due to its deep integration with its creator, Coinbase, the world’s second-largest centralized exchange. Coinbase actively migrated many functions to Base, including stablecoin exchanges, wallet defaults, and developer tools. The close connection with Coinbase strengthened Base’s trust and led to adoption by other major companies, including payments on Shopify and stablecoin deposits by JPMorgan Chase. Institutional support builds developer trust when selecting Base as the chain for developing a web3 product.

Post-mainnet hype or success?

Though Berachain launched this year and Monad a few weeks ago, their growth patterns show similarities but also unique differences, driven by market conditions and launch approaches compared to Base and Sui.

Both achieved tremendous initial success, significantly exceeding the number of active addresses compared to the testnet airdrop users and TVL levels.

Monad and Berachain had more active addresses during their mainnet launches and in the weeks afterward than during their testnets.

MON token was airdropped to 76,021 wallet addresses. At its peak, 149,248 wallet addresses interacted with MON token. Over the past three weeks, an average of 89,414 wallet addresses used the token, surpassing the initial number of wallet addresses included in the airdrop by 17.62 percent.

BERA token has also exceeded expectations. BERA token was airdropped to 1,336 wallet addresses. 48,854 wallet addresses interacted with BERA at its peak. Over three weeks, an average of 13,558 addresses used the token, surpassing initial airdrop addresses by 914.82%.

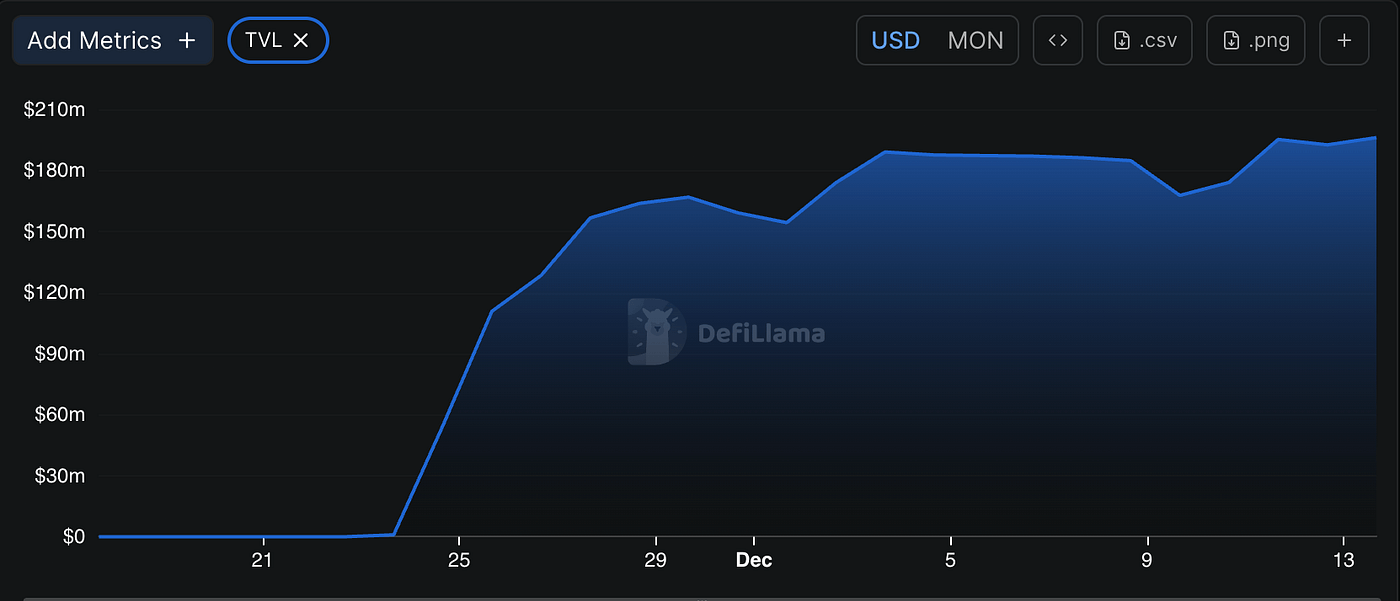

Compared to Sui, Monad and Berachain both reached high TVLs much faster, demonstrating a maturity in the DeFi market over the past two years.

| Chain | Days to achieve a $100 million TVL | Days to achieve a $200 million TVL |

| Sui | 188 days | 237 days |

| Monad | 2 days | Not yet |

| Berachain | First day | First day |

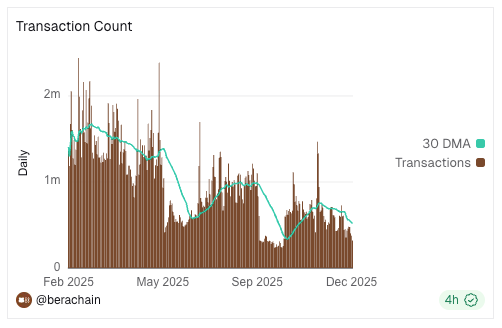

Berachain quickly reached a high TVL due to its proof-of-liquidity structure, which strongly incentivizes specific token lockups. They managed to reach and sustain initial transaction volumes and TVL (of BERA tokens) for at least 3 months after the mainnet launch, longer than both Sui and Base.

Since then, their transaction volume and TVL have decreased by 93 percent (from $2.97 billion at their peak to $195 million now) since the first three months of mainnet.

Though there are no definitive reasons explaining the trends, Berachain might have maintained its usage levels for so long as it benefited from the period of strong DeFi interest, as Sui and Base did during the same time period. Researchers infer that expiring token rewards and their proof-of-liquidity structure, which highly reward only certain staking behaviors, not all, discouraged users from holding their tokens on Berachain.

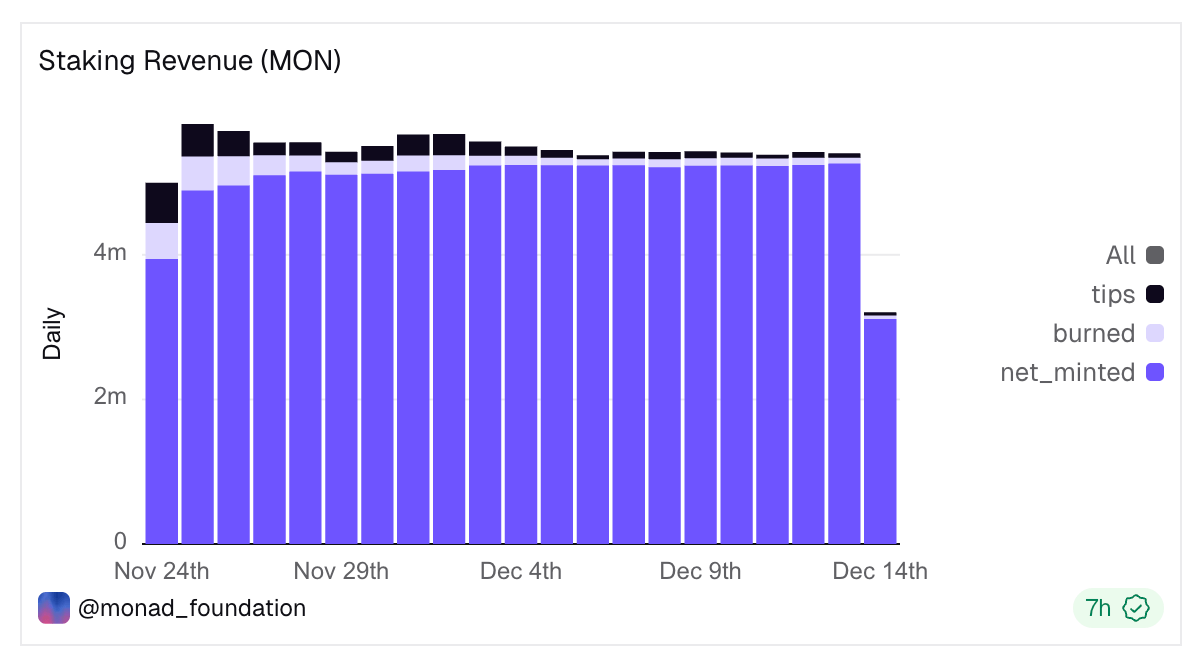

Monad launched only three weeks ago, but has already experienced stable TVL, much like Sui.

Though transaction volumes have decreased since its launch last month, the TVL of MON token has remained steady, hovering just below $200 million. Consistent staking rewards encourage users to stake MON tokens in similar amounts, thereby stabilizing TVL.

Monad still achieved a near $200 million TVL much more quickly than Sui, despite not having a liquidity-driven model like Berachain.

One factor is that the MON token also launched on Solana, one of the most popular networks. Unlike the other chains mentioned, MON token transactions can happen on Monad or on Solana. Throughout the three weeks, Solana users accounted for more than ten to fifteen percent of all active MON token holders.

Despite Solana users accounting for a substantial share of MON token holders, this did not translate into strong, sustained growth. The TVL of the MON token on Solana accounts for only 5.1 million, less than 2.5 percent of the total TVL. This confirms data showing that Solana users holding MON tokens are transacting in small amounts, mostly under 1,000 MON (equivalent to less than 20 USD).

Monad has shown mixed initial success, but as exemplified by Base and Sui, it can supercharge its growth through valuable DeFi mechanisms, community efforts, and institutional partnerships. It is relatively early in this process; its ongoing integration snapshot shows new integrations with apps and developer tools that could drive its growth in the next couple of months or years.

Conclusion

The first few weeks of a mainnet launch do not necessarily determine its long-term success, as shown by TVL metrics for Sui and Base.

All blockchains analyzed, Monad, Berachain, Sui, and Base showed transaction activity growth during the first few weeks of mainnet launch due to initial hype. Though daily transaction activity for Monad, Berachain, and Sui is variable, specific metrics, such as TVL, tend to remain stable as long as staking rewards stay unchanged.

The usage level of a blockchain increases with developer activity, DeFi market conditions, and institutional adoption, which build up over time. Base has gained the most trust and prominence among developers and institutions, enabling it to sustain growth since its mainnet launch two years ago.

You can get started with Monad, Berachain, Sui, Base, or more than 70+ chains today via Chainstack. Chainstack gives you the performance and consistency required for production systems. Deploy an RPC endpoint in seconds and scale globally with automated orchestration, uptime guarantees, and developer-friendly tooling.

Resources

- Monad Mainnet Dashboard (Monad Foundation on Dune Analytics)

- Berachain Mainnet Dashboard (Berachain Foundation on Dune Analytics)

- Base Comprehensive Dashboard on Dune Analytics

- Chain Overview Sui Dashboard on Dune Analytics

- Helius Data on Monad on Solana

- SuiVision Statistics

- DeFiLama on Monad, Berachain, Sui

- Developer Report by Electric Capital

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains