Peanut.trade on Chainstack: running market-making at scale

Peanut.trade runs high-frequency trading, arbitrage, and market-making on decentralized exchanges (DEXs). It works with token teams to keep liquidity deep and prices stable across on-chain markets. At this scale, even a few seconds of lag or downtime can mean a missed trade and a partner losing confidence. That’s why infra sits in the critical path.

What is Peanut.trade?

Peanut.trade helps crypto projects and traders refine their on-chain trading tactics by running algorithmic trading strategies — from cross-exchange arbitrage to automated market-making — across multiple DEXs and blockchains. For token projects, this means deep liquidity and proper pricing. For arbitrageurs and liquidity providers, it means tools to exploit price gaps as soon as they open.

Because everything operates live across chains, here reliability is non-negotiable. Trade execution and price updates must clear without delay. Any slippage, stalled order, or imbalance in a pool directly affects partners depending on Peanut.trade’s market-making. That’s why reliable infra for Peanut.trade underpins every trade the platform executes.

From in-house nodes to Chainstack

Peanut.trade first ran its own nodes, tracking uptime, headlag, and latency.

As Solana and Base are resource-heavy, the team spent a growing amount of time patching, updating, and tuning. When trading volumes increased and new chains were added, that overhead escalated into a major pain point, pulling attention away from algorithm development and trading logic.

Peanut.trade also turned to third-party node providers to reduce the in-house overhead. This worked for a while, but new bottlenecks showed up quickly. Some providers couldn’t keep pace with high-frequency trade execution, especially under heavy network load. Others promised reliability on paper but still hit outages or rate limits — usually at the exact moments Peanut.trade needed low-latency access most.

Cost models added another layer of friction. Usage-based pricing looked simple until surges in on-chain activity — like token launches or volatile trading windows — drove API request counts through the roof. With usage-based pricing, higher volumes pushed bills up unpredictably.

After hitting those limits, Peanut.trade switched to Chainstack for steady uptime, cross-chain throughput, and predictable costs.

Why Peanut.trade chose Chainstack

With Chainstack Peanut.trade runs key operations across several blockchains, such as:

- Balance monitoring

- Wallet sync

- Transaction tracking and retrieval (getAccountInfo, getTokenBalance, getTransactions)

The team adopted Chainstack’s Unlimited Node plan with flat-fee pricing, covering all RPC and node operations without usage caps:

- Predictable pricing: The Unlimited Node plan removed per-request fees and throttling allowing them to make as many RPC calls and transactions as wanted across supported chains, for a fixed monthly rate.

- Easy deployment + management: The team spins up Dedicated Nodes for different networks from the console in a few clicks. So time can be spent refining trading strategies.

- Performance and uptime: Chainstack nodes sustain high throughput with low latency. Even under heavy load, Peanut.trade gets real-time data and fast execution.Consistent uptime, backed by SLAs and 24/7 monitoring, keeps operations live during volatile markets.

- Monitoring and insights: The console shows node usage, API metrics, and error rates, helping the team spot anomalies early and scale ahead of demand.

- Support: Support is rarely needed in production. During migration, the Chainstack team helped with tuning and integration.

With Chainstack’s multi-chain coverage, Peanut.trade now runs on Solana, BNB Chain, Base, and more — from one platform, aligning with their growth strategy.

Workload profile

Peanut.trade’s trading engine runs at a scale where node performance directly impacts execution. Over the last cycle, Peanut.trade processed more than 500 billion API requests across archive and full nodes.

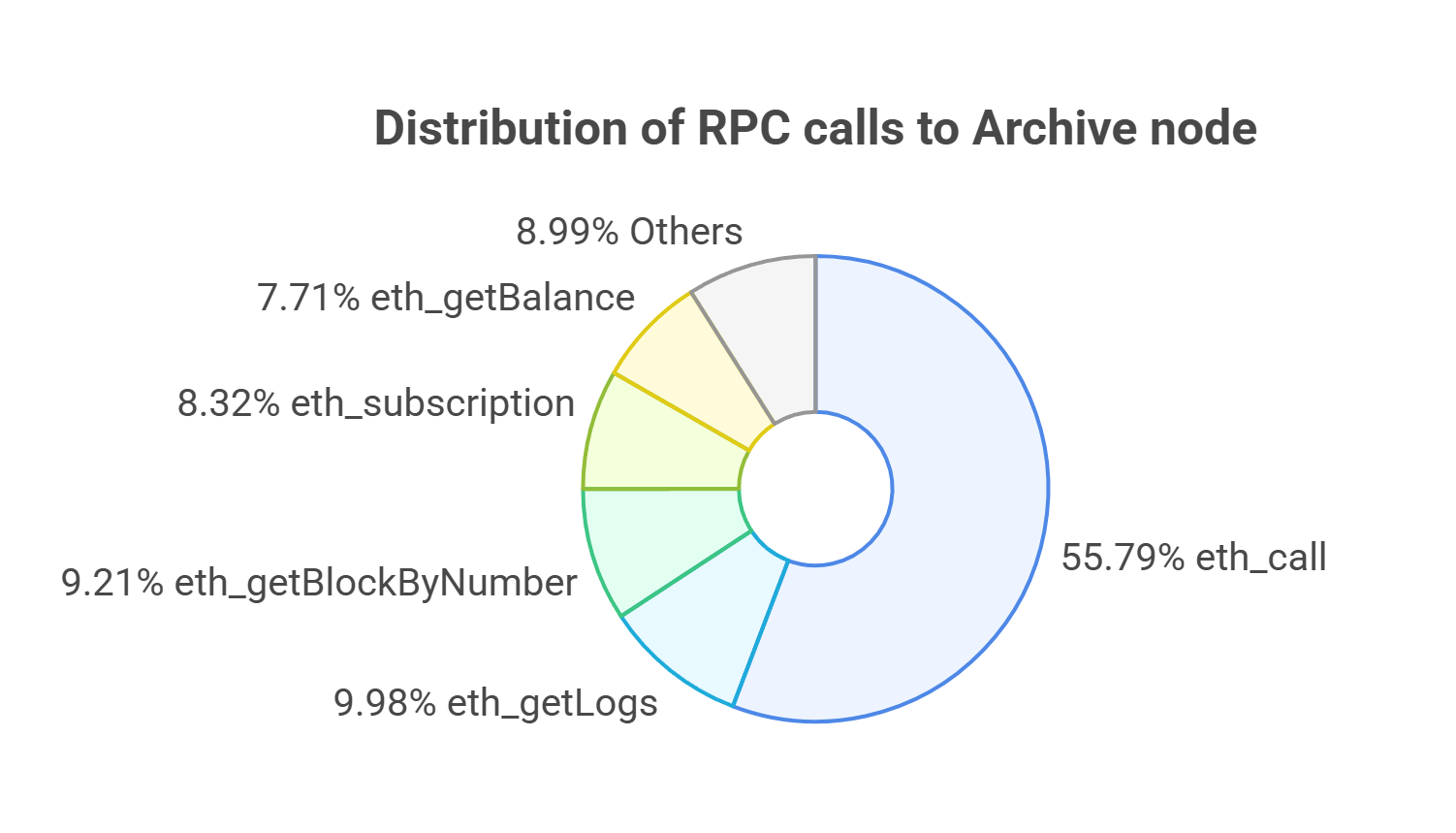

On archive nodes (≈157B requests):

eth_getBalance — 7.71%

eth_call — 55.79%

eth_getLogs — 9.98%

eth_getBlockByNumber — 9.21%

eth_subscription — 8.32%

On full nodes (≈260B requests):

eth_call— 21.57%eth_subscription— 14.26%eth_getBlockByNumber— 10.67%eth_getTransactionReceipt— 8.03%eth_getLogs— 6.33%

The bulk of requests were state lookups and subscriptions. Archive nodes were used for history and balances, full nodes for execution. Unlimited Node kept up without rate limits or billing spikes.

The bulk of requests were state lookups and subscriptions. Archive nodes were used for history and balances, full nodes for execution. Unlimited Node kept up without rate limits or billing spikes.

Results with Chainstack

Since shifting its infrastructure to Chainstack, Peanut.trade has seen clear gains in performance and efficiency. With 99.9%+ uptime, the system keeps bots live and able to react to market changes in real time.

Flat-fee billing also changed how the team manages costs. Spend is fixed each month, even when volumes jump. Compared to usage-based plans, spend is fixed each month, even when volumes jump, saving money and removing the need to track every call.

On execution, Peanut.trade’s algorithms now pull state and broadcast transactions with minimal latency. For arbitrage opportunities that may last only seconds, that consistency has meant more fills before spreads close and tighter markets on DEXs.

Internally, developers are no longer tied up maintaining nodes. Their focus is back on building strategies and adding features, which has sped up onboarding for new token projects and the development of trading tools.

Partners have noticed the change too. Token teams depending on Peanut.trade’s market-making see reliability around the clock. Being able to commit to liquidity with confidence has strengthened trust — and in on-chain markets, that consistency is what sets a provider apart.

What does Peanut.trade like about Chainstack?

Peanut.trade and Chainstack look at it from different angles but land on the same point — reliable infra in the trade path:

“With Chainstack, we’ve achieved consistently high uptime without the overhead of managing our own infrastructure. The Unlimited Node flat-fee model gives us cost predictability, and the performance is rock-solid — which is absolutely critical for on-chain market-making operations.” — Oleksandr Holofaiev, COO, Peanut.trade

From our side, it’s about keeping that path stable.

“On-chain trading and arbitrage are the lifeblood of decentralized markets, and Peanut.trade is at the forefront of this space. Their platform brings much-needed liquidity and efficiency to DEX ecosystems. We are proud to support Peanut.trade’s mission by providing the dependable, high-performance infrastructure they need to operate flawlessly 24/7.” — Eugene Aseev, Founder & CTO, Chainstack

Ethereum

Ethereum Solana

Solana TON

TON Base

Base BNB Smart Chain

BNB Smart Chain Hyperliquid

Hyperliquid Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains