Stablecoins on Solana in 2026: Growth, adoption, and usage

Institutions and government policies have driven on-chain growth in the past, but nothing like the growth of stablecoins in just a few weeks.

Stablecoins, blockchain tokens that are 1:1 backed by a fiat currency, have gained significant momentum since 2025 and continue to do so in 2026. Institutions and governments are using existing and issuing new stablecoins to appeal to customers interested in cryptocurrency, to tokenize real-world assets, and to incorporate the valuable characteristics of cryptocurrency (such as fast settlement) into the financial system.

Solana has become the most popular blockchain for using traditional stablecoins (USDC, USDT) and issuing, managing, and using new ones.

In this article, we analyze the Solana stablecoin market in 2026, including market size, adoption trends, transaction activity, and the role of USDC.

Why institutions and businesses are adopting stablecoins in 2026

Institutions, such as banks and hedge funds, and governments, are adopting stablecoins due to market trends, regulatory clarity, and to enhance the user experience with the traditional financial system.

Businesses are increasingly offering cryptocurrency as a payment option and providing stablecoin options for easy conversion between crypto and fiat. For example, PayPal allows customers to pay merchants in multiple cryptocurrencies. PayPal merchants can convert crypto to PYUSD on Solana and other chains, its USD-backed stablecoin, making it easy to manage and convert crypto funds into a US dollar-denominated cryptocurrency, and organize their revenue alongside other fiat currency payments like credit cards and cash. Stablecoins allow customers and users to interact with cryptocurrency while retaining the familiarity of fiat currency.

Other institutions are also capitalizing on the value-adds of cryptocurrencies, using stablecoins to modernize the financial system. WorldPay, one of the largest payment companies in the world, launched USDG on Solana to enable faster settlement, enabling companies and users to finalize transactions within seconds rather than days.

Favorable government regulation has also encouraged innovation and exploration in stablecoins. A recent article explained that the GENIUS Act, passed in July 2025, established the first legal framework for issuing and managing stablecoins in the United States. The law outlined the handling of the treasuries backing each stablecoin, monthly reporting guidelines, and anti-money laundering guidelines. With such legal clarity, institutions were confident in issuing compliant stablecoins to capture the three-trillion-dollar cryptocurrency market.

Governments are also launching their own stablecoins to increase transparency, as cryptocurrency transactions can be traced by anyone. The State of Wyoming launched its own stablecoin, FRNT, on Solana and other chains, citing the ability for citizens to easily track funds compared to fiat currency.

Why Solana is the leading blockchain for stablecoins

Institutions are particularly choosing Solana for its advantageous blockchain characteristics, including its speed and low costs.

Institutions are attracted to its rapid transaction finalization, currently 0.4 seconds and aiming to reduce it to 0.15 seconds, and cheap and predictable transaction fees of less than $0.01, according to Nick Ducoff, Head of Institutional Growth at the Solana Foundation.

Visa notes that they see the potential of Solana “become one of the networks that could help power mainstream payment flows” also due to its high availability, or number of independent participants or nodes that jointly operate the network to make it available for consumers to initiate transactions. 1,893 active validators confirm transactions and make blocks while 925 RPC nodes maintain a local record of transactions.

Solana stablecoin market growth (2023–2026)

Solana has seen multiple-fold growth in stablecoin trading volume and in new stablecoin issues since the start of 2025.

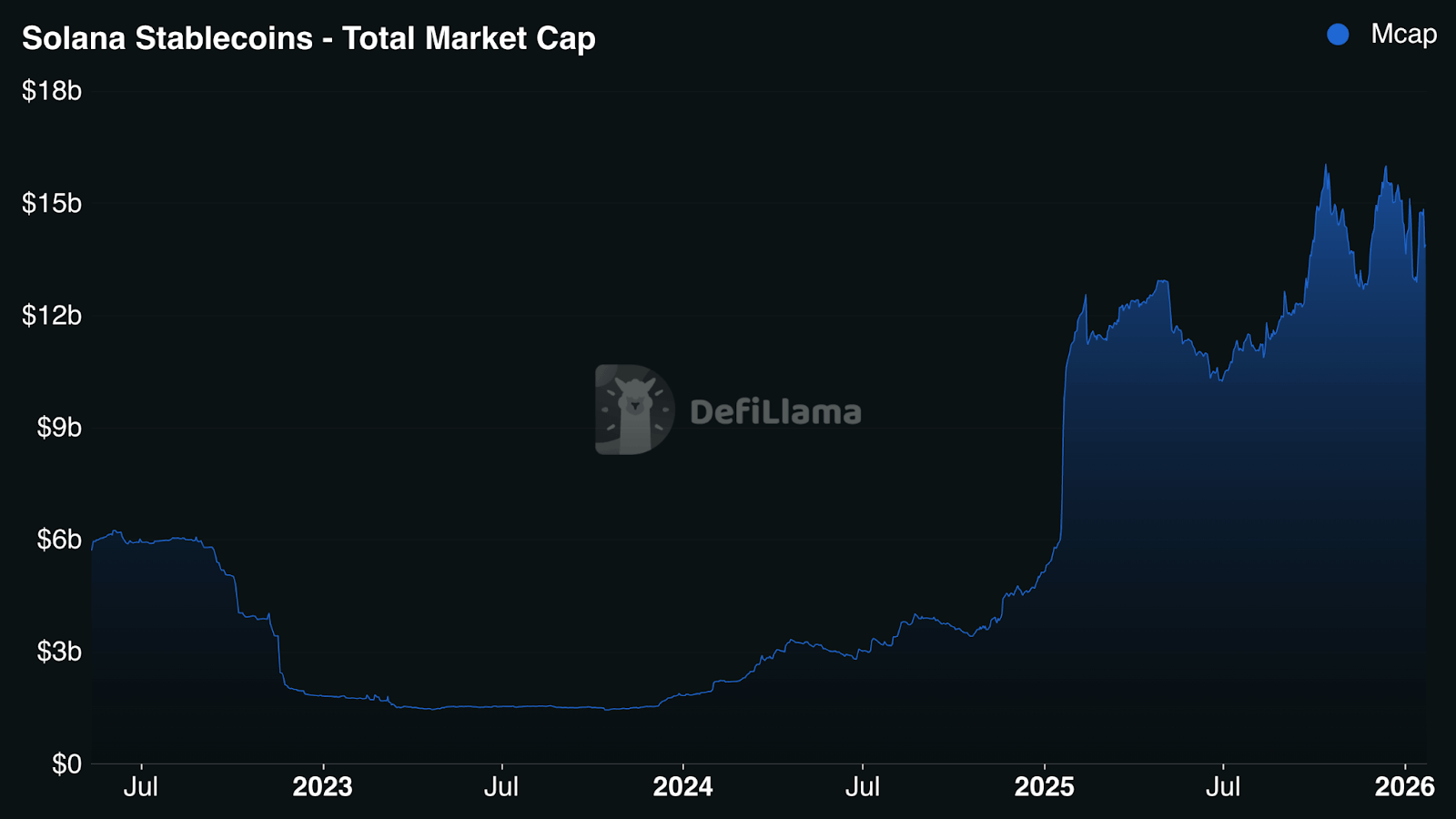

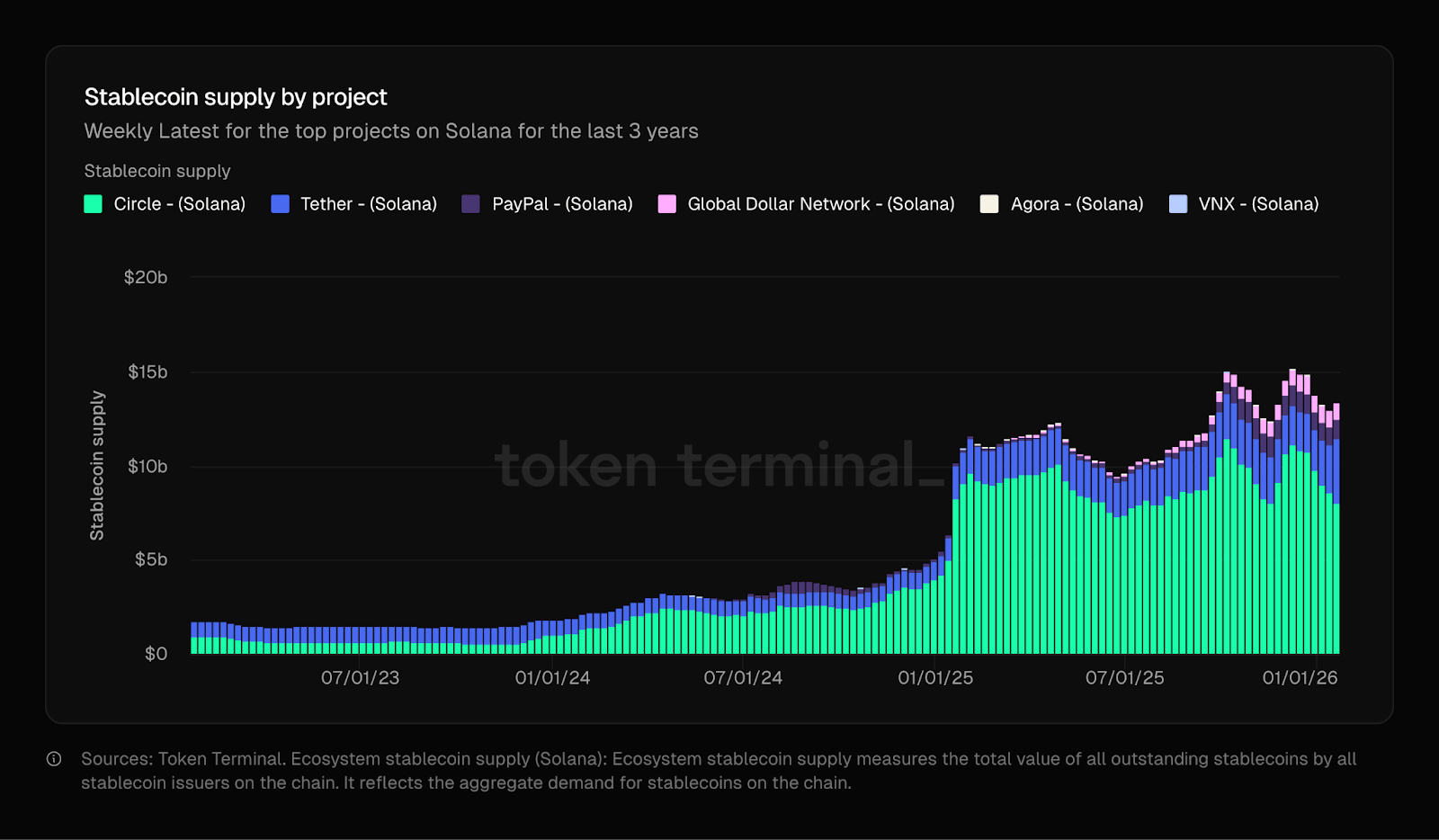

Solana stablecoin market cap growth

Stablecoins on Solana reached a market cap of over $14 billion by the end of 2025 and have remained steady since then, reaching over $14 billion by the end of January 2026. This is up three times the volume at the end of 2024, where the market cap hovered at $5 billion.

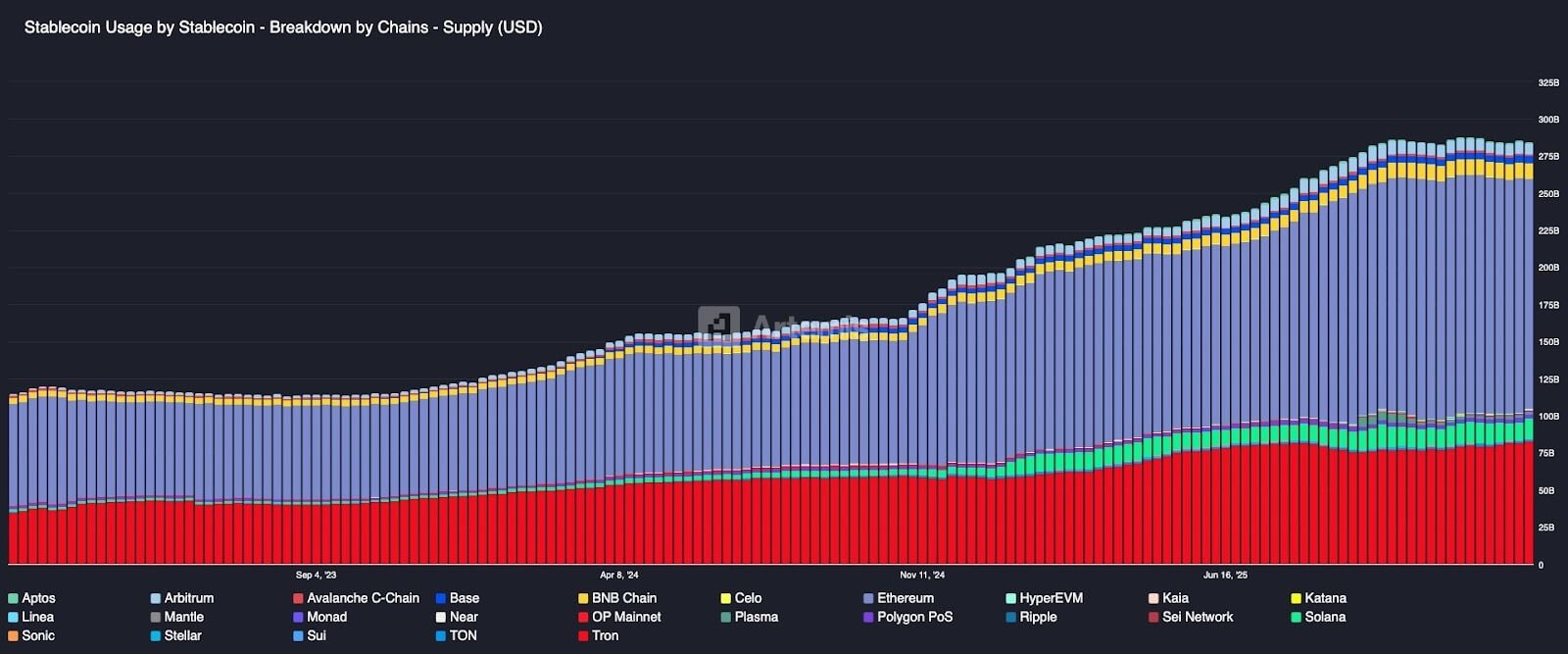

Other chains also saw multiple-fold growth, but not as massive as Solana. Ethereum, which accounts for more than half of all stablecoin market cap, saw a 1.6x increase, from $60 billion in 2024 to $166 billion today. Arbitrum saw two-fold growth, ending 2024 with a stablecoin market cap of $1.99 billion and, in January 2026, reaching a market cap of $4 billion.

With such rapid growth compared to even Ethereum, the most prominent chain for stablecoins, Solana now accounts for 4% of the $306 billion stablecoin market. Solana has slowly gained market share amongst all other chains in the past three years.

| Year-end | Total stablecoin marketcap on all chains | Total stablecoin marketcap on Solana | Solana market share |

| 2023 | $130.72B | $1.83B | 1.40% |

| 2024 | $204.82B | $5.01B | 2.45% |

| 2025 | $304.67B | $14.45B | 4.74% |

| End of January 2026 | $305.95B | $13.79 | 4.51% |

Why stablecoin adoption is growing faster on Solana

Solana has gained market share over the years due to the likelihood that users will trade stablecoins on the chain, the proliferation of new stablecoins, and the growing popularity of USDC.

Solana as the most active chain for stablecoin transactions

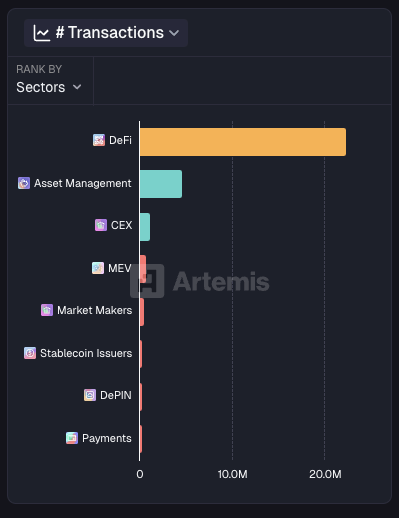

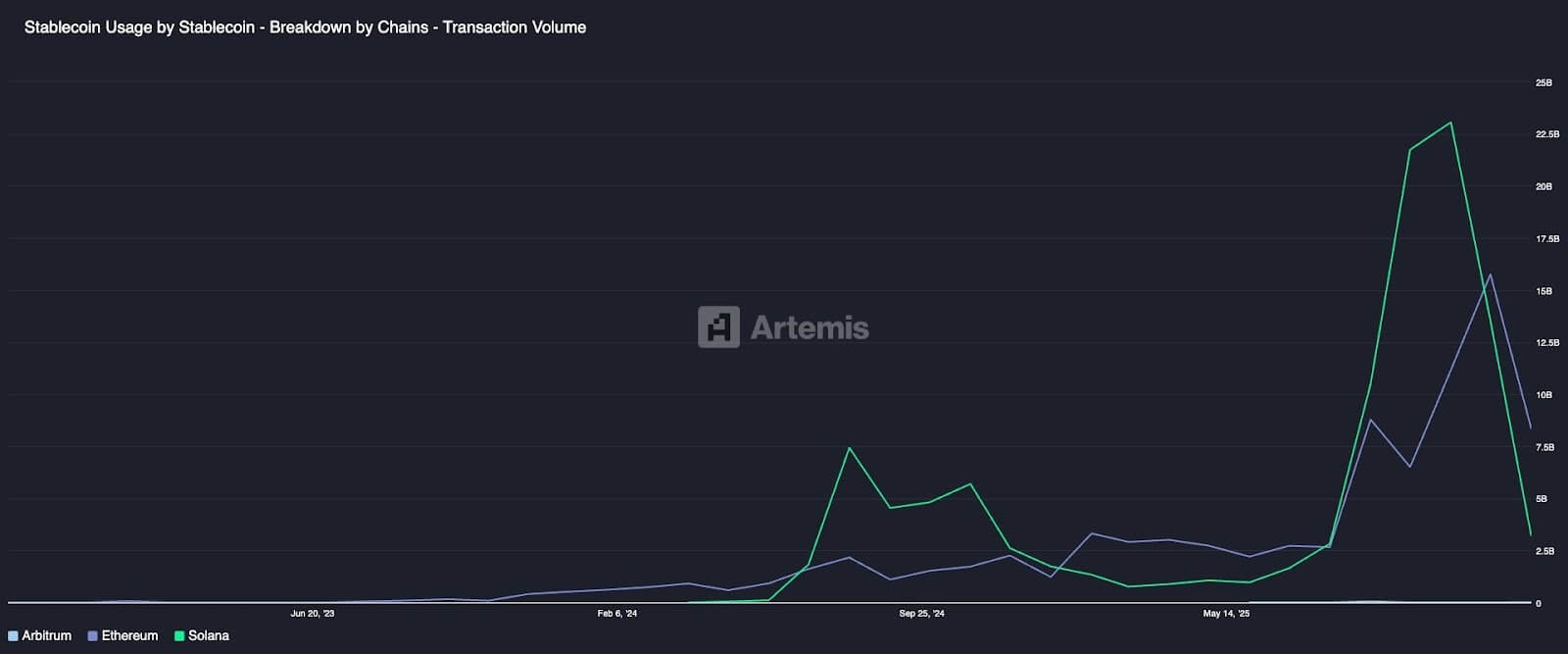

While other chains, such as Ethereum and Tron, have higher stablecoin market caps, Solana boasts a much higher stablecoin transaction volume. This suggests that users have a variety of DeFi and payment options for using stablecoins, attracting new users who seek to do more than merely hold them.

Despite having the third-highest stablecoin market cap among all chains, Solana was the most popular chain for stablecoin transactions over the past five years. In the past year, it ranked second. In comparison, Ethereum, despite having a stablecoin market cap 10 times that of Solana, ranked only 9th in stablecoin transactions last year.

A majority of stablecoin transactions on Solana were made on decentralized exchanges (DeFi), via asset management tools, or by stablecoin holders optimizing their positions. On Ethereum, DeFi also dominated, with transactions on centralized exchanges a close second, and asset management the least used for stablecoin transactions.

This suggests that stablecoin users on Solana are more likely to actively exchange and invest their stablecoins, creating utility that will attract more stablecoin holders to use Solana.

The number of stablecoin transactions by sector or platform/tool type – left graph as Solana and right graph as Ethereum. Source: Artemis – Solana and Ethereum

Growth of new and non-traditional stablecoins on Solana

Solana emphasized enabling institutions to issue their own stablecoins on the chain.

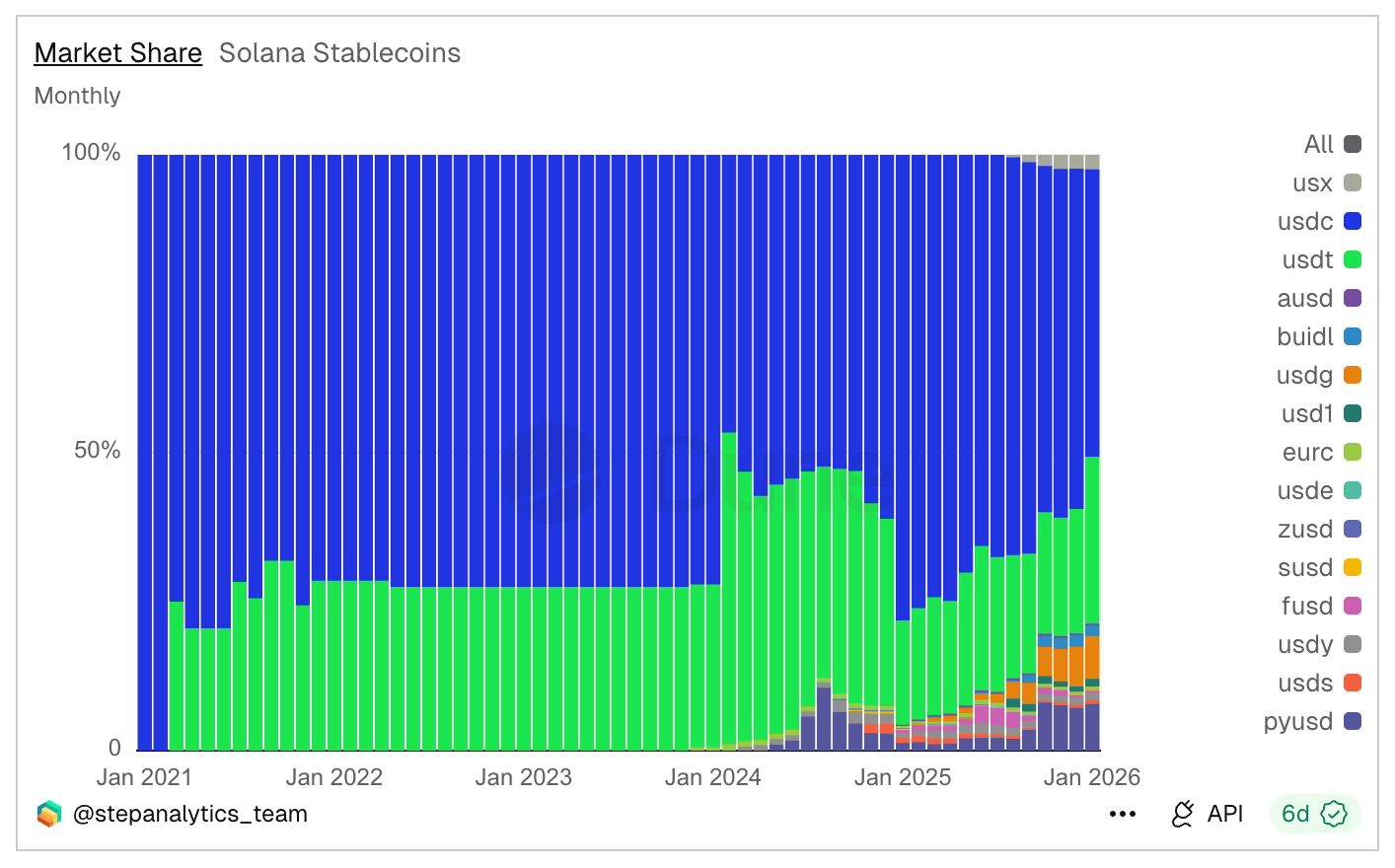

Solana has a higher ratio of individual stablecoins to its overall market cap than Ethereum does, with over 57 stablecoins listed on DefiLlama.

Non-traditional stablecoins have accounted for an increasing share of stablecoin activity on Solana. The transaction volume share of non-traditional, newer stablecoins on Solana grew from 4.4 percent in January 2025 to 23.7 percent in January 2026.

Some new stablecoins launched on multiple chains found the most success on Solana. For example, PYUSD, PayPal’s stablecoin, was first launched on Ethereum in 2023, but since July 2025, transaction volume of PYUSD on Solana has consistently surpassed that of Ethereum.

Traditional stablecoins USDC and USDT account for a slightly smaller share of Solana’s market cap than on Ethereum. The market caps of USDC and USDT (combined $131.2B) account for 82 percent of the stablecoin market cap on Ethereum, but less than 80 percent on Solana.

Why USDC dominance gives Solana an advantage over Ethereum

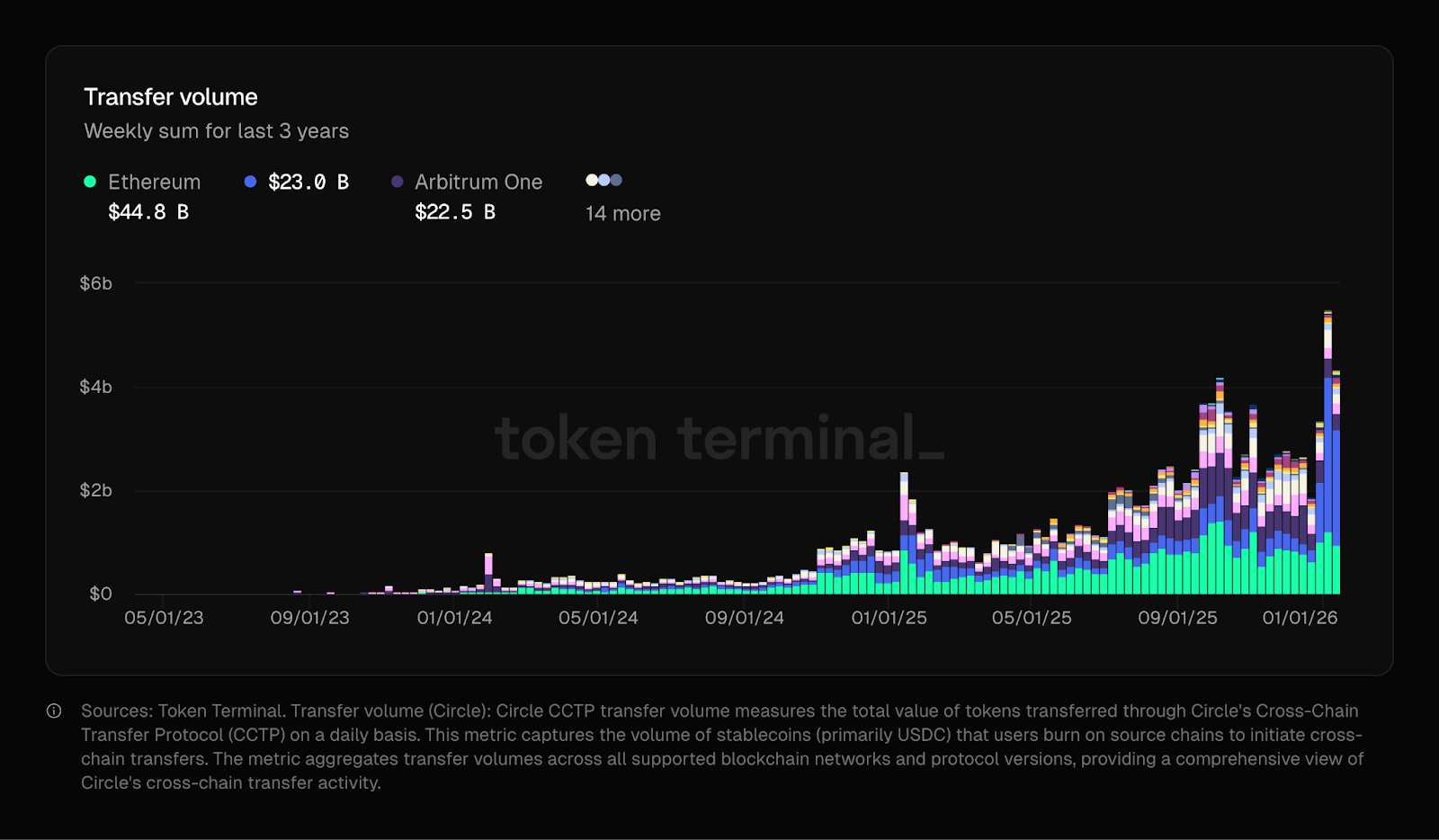

USDC has grown much faster than USDT, giving Solana an advantage over Ethereum, since USDC is the most popular stablecoin on Solana while USDT is the most popular on Ethereum.

USDC dominance, defined as the percentage of the total stablecoin market cap, on Solana is 55.70%. On Ethereum, USDT has a 52.00% market share, making it the most popular stablecoin. Therefore, a growth in USDC favors Solana more than Ethereum, since USDC is more popular on Solana than USDT is on Ethereum.

USDT has grown from a total market cap of $91 billion across all chains in 2024 to $186.617 billion, a twofold increase. USDC has seen a threefold increase, from $24 billion in 2024 to $72.9 billion now.

Though USDC’s market share on Solana is declining amid the entry of smaller stablecoins, the stablecoin market cap on Solana is growing alongside USDC’s popularity.

USDC holders are increasingly choosing Solana for their transactions. Despite having much fewer USDC on Solana ($7.03B) than on Ethereum ($47.064B), USDC transfer volume on Solana surpassed that on Ethereum on December 29, 2025, and has since continued to exceed it.

What to Expect in Solana Stablecoins in 2026

In 2026, Solana is dubbed the “internet capital market,” positioning itself as a high-throughput platform for on-chain trading, stablecoin issuance, and the tokenization of real-world assets.

Armani Ferrante, CEO of crypto exchange Backpack, said Solana is doubling down on the growing use of its financial infrastructure, including the issuance of new stablecoins.

With better financial infrastructure, Solana will be better positioned to manage more users on existing stablecoins and launch even more new stablecoins. Solana co-founder Anatoly Yakovenko expects the Solana stablecoin market cap to reach over $1 trillion, 8x today’s amount.

Solana is already gearing up for new major stablecoins. Jupiter, a leading decentralized trading platform, launched JupUSD in January 2026 with BlackRock, a top asset manager, and Ethena Labs, creators of the USDe stablecoin on Ethereum. In less than a month, it has already generated $11 million in volume. Western Union, one of the world’s largest providers of cross-border payments, is launching USDPT, a US dollar-backed stablecoin to handle faster settlements in the first half of 2026.

How to launch a Stablecoin on Solana

As more institutions and governments issue and use stablecoins, the requirements for stablecoins are becoming stricter, demanding infrastructure that meets institutional standards.

Chainstack can help you issue your stablecoin on a fully audited, SOC 2 Type II-certified, compliant infrastructure with bank-grade security on day one.

Major institutions spanning banking, accounting, and wallets, including Circle (the issuer of USDC), Ernst & Young, Sygnum Bank, and Anchorage Digital, are leveraging Chainstack today for their stablecoin infrastructure needs. Recently, Trust Wallet leveraged Chainstack’s production-grade multi-chain infrastructure to process transaction requests for its 60 million users across 4.5 million assets on 70 chains, streamlining technical operations and resulting in a 44% to 57% cost reduction.

Conclusion

Stablecoins, cryptocurrency tokens pegged 1:1 with a fiat currency, usually the US Dollar, are exploding in popularity, especially on Solana.

With regulatory clarity provided by the GENIUS Act and institutions recognizing the value of instant settlement, institutions and governments are seeking to issue new stablecoins and use existing ones.

Solana has benefited more than other chains from this interest, with the stablecoin market cap increasing threefold since 2024.

The stablecoin market cap growth on Solana is fueled by the variety and volume of trading products it offers. Solana’s strong DeFi presence makes it a strong home for new stablecoins. Solana has also benefited tremendously from the popularity of USDC, the network’s most popular stablecoin.

For teams building payment infrastructure with strict latency and cost predictability requirements, purpose-built alternatives like Tempo offer blockchain architecture optimized specifically for stablecoin settlement and enterprise payment rails.

Learn more about Solana architecture from our articles

- Architecture & Parallel Transactions

- Account Model and Transactions

- Anchor Accounts: Seeds, Bumps, PDAs

- Instructions and Messages

- Transaction, Serialization, Signatures, Fees, and Runtime Execution

- SPL Token Program Architecture

- Where token metadata lives on Solana

Reliable Solana RPC infrastructure

Getting started with Solana on Chainstack is fast and straightforward. Developers can deploy a reliable Solana node within seconds through an intuitive Console — no complex setup or hardware management required.

Chainstack provides low-latency Solana RPC access and real-time gRPC data streaming via Yellowstone Geyser Plugin, ensuring seamless connectivity for building, testing, and scaling DeFi, analytics, and trading applications. With Solana low-latency endpoints powered by global infrastructure, you can achieve lightning-fast response times and consistent performance across regions.

Start for free, connect your app to a reliable Solana RPC endpoint, and experience how easy it is to build and scale on Solana with Chainstack – one of the best RPC providers.

FAQ

Stablecoins on Solana are blockchain tokens pegged 1:1 to fiat currencies (usually USD) that operate on the Solana network. Popular examples include USDC, USDT, and PYUSD.

USDC is the most popular stablecoin on Solana, accounting for 55.7% of the stablecoin market cap on the network.

Stablecoin transactions on Solana cost less than $0.01, significantly cheaper than Ethereum’s fees.

As of January 2026, the total stablecoin market cap on Solana is approximately $14 billion, representing 4.5% of the global stablecoin market.

Yes, Solana’s fast finality (0.4 seconds) and low fees make it ideal for stablecoin payments and real-time settlements.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains