How regulation is reshaping crypto infrastructure in 2026

TL;DR

- Major crypto regulations (MiCA, GENIUS Act, California DFAL) become fully enforceable in 2026, ending the era of regulation by enforcement.

- Compliance is shifting from legal strategy to core infrastructure requirement, forcing changes at the protocol level.

- Platforms must now architect real-time transaction monitoring, MPC custody, and proof-of-reserves systems directly into their infrastructure.

- The firms clearing regulatory approvals fastest built compliance into their systems from day one rather than retrofitting it later.

Introduction: The institutional shift in crypto regulation

The difference between a compliant crypto exchange and a non-compliant one in 2026 isn’t about legal strategy anymore. It’s about whether you can keep operating.

For years, crypto companies dealt with regulation mostly through enforcement. The SEC would bring an action, firms would fight it in court, and the industry learned the rules by watching who got sued. That approach is ending. 2026 is when major jurisdictions switch from debating what the rules should be to enforcing the rules they’ve written, and those rules were built specifically for crypto rather than borrowed from securities law or banking regulation.

This transition is driven by institutional capital. Pension funds to banks entering crypto markets demand regulatory certainty, not risk appetite. Compliance is becoming core infrastructure. The regulatory frameworks shaping this infrastructure are global in scope but enforced locally, with different timelines and technical requirements across jurisdictions. Europe is moving first.

MiCA: Europe sets the global standard

July 1, 2026 is a hard deadline. That’s when the Markets in Crypto-Assets Regulation (MiCA) becomes fully enforceable across all EU member states, and crypto asset service providers without proper authorization will be ordered to cease operations. There’s no grace period left to negotiate.

The requirements are specific:

- Anti-money laundering controls that can be audited

- Customer identification systems that meet EU standards

- Complete asset segregation

- Travel Rule compliance for any transfer above €1,000

The transitional arrangements that let pre-MiCA firms keep operating while their applications were processed are ending. The European Securities and Markets Authority (ESMA) provides a technical list of specific deadlines for each Member State. If you’re still waiting for authorization without provisional approval, you either find a licensed partner or stop serving EU customers.

Then there’s DAC8. The Eighth Directive on Administrative Cooperation went live at the start of the year, requiring crypto platforms to report customer transaction data directly to tax authorities. The first information exchange happens in September 2027, covering all of 2026. This isn’t a voluntary transparency initiative. It’s mandatory tax reporting with penalties for failure, and it requires transaction tracking at a level of detail that many platforms never built for. MiCA gives you the license to operate. DAC8 tells you exactly what data you need to collect while you do.

US regulatory reset: GENIUS Act & beyond

While Europe enforces a unified framework, the US is building its regulatory structure in pieces. The approach is more fragmented, but the direction is clear.

Federal stablecoin framework

The GENIUS Act, signed into law in July 2025, establishes the first federal framework for stablecoin issuers in the United States. The core requirement is straightforward: every dollar of stablecoin must be backed by a dollar of high-quality liquid assets, verified monthly through independent attestations.

What counts as a high-quality liquid asset? What are the capital requirements for issuers? Which entities can hold reserves, and under what custody arrangements? Federal and state regulators are still defining the licensing structure, creating a two-track system where issuers may need both federal approval and state money transmitter licenses depending on their operational footprint. The framework exists, but the compliance infrastructure is still being built.

The framework is already operational. This month, Tether launched USA₮ through Anchorage Digital Bank as the first federally regulated stablecoin under the GENIUS Act. Major issuers are now running separate products for different markets: U.S. compliant tokens for domestic users alongside global offerings for international markets. This dual approach reflects how platforms are adapting to fragmented international regulation.

Market structure clarity

The CLARITY Act, which passed the House in July 2025, is undergoing Senate review with committee markup scheduled for early 2026. If passed, it would end the multi-year jurisdictional fight between the SEC and CFTC by giving the CFTC authority over tokens that function as commodities.

Clear rules mean exchanges can build their custody and reporting systems with confidence, without worrying about contradictory guidance from different regulators. Token projects can launch without structuring their entire business around avoiding lawsuits. The shift from “regulation by enforcement” to defined frameworks changes more than legal costs. It changes what infrastructure you need to build.

State-level action

California’s Digital Financial Assets Law becomes operative on July 1, 2026, requiring licensing for any crypto business serving California residents, which given the state’s market size effectively functions as a national requirement for US-focused platforms. New York continues issuing BitLicenses with evolving standards that go beyond minimum AML requirements to include documented disaster recovery procedures, system redundancy, and predefined escalation protocols for security events.

These regulatory frameworks create more than just legal compliance requirements. They are forcing fundamental infrastructure changes that go all the way down to the protocol level.

| Feature | EU (MiCA) | United States |

| Legal Basis | One single, unified EU law | Multiple laws (GENIUS Act, CLARITY Act) + Agency rules |

| Market Access | License in one country, legal in all 27 | Multi-agency (SEC/CFTC) + 50 State licenses |

| Stablecoins | Regulated as E-Money Tokens (1:1 bank-grade backing) | Regulated as Payment Stablecoins (GENIUS Act 2025) |

| Asset Testing | Fixed categories (ART, EMT, Utility) | Flexible/Judicial (Howey Test / CLARITY Act tests) |

| Supervision | ESMA / EBA (centralized | SEC / CFTC / Treasury (divided) |

Crypto infrastructure under pressure: Rising compliance standards

The regulatory frameworks in Europe and the US set the rules. What’s less visible is how those rules are forcing infrastructure changes at the protocol level. Compliance is no longer something you add on top of your tech stack. It’s something you architect from the ground up.

Custody standards evolving

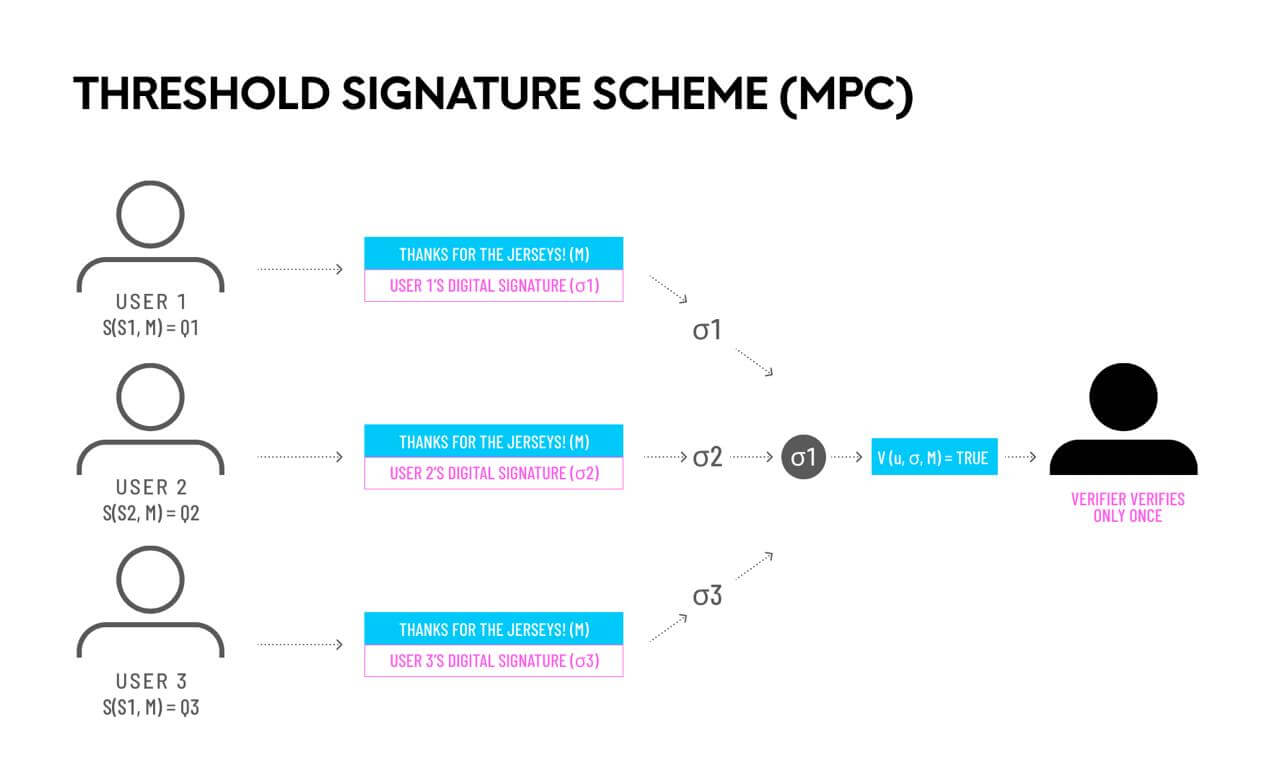

Multi-party computation (MPC) is replacing traditional multi-signature setups as the standard for institutional custody. In multi-sig arrangements, a complete private key exists and is split among parties

In MPC systems, the private key never exists as a complete artifact. Signatures are generated through collaborative computation across distributed nodes, where each party holds only a share that’s mathematically useless on its own. This reduces key exfiltration risk, but more importantly, it matches what regulators want to see in custody models where no single party can unilaterally access assets.

Proof-of-reserves used to be a marketing tool. Now it’s a compliance requirement. Regulators aren’t asking platforms to voluntarily prove solvency. They’re mandating regular attestations from independent auditors, with specific standards for what qualifies as reserves and how verification must happen on an ongoing basis.

Real-time surveillance requirements

Transaction monitoring used to mean flagging large transfers and reviewing them later. That’s no longer sufficient. Platforms now analyze wallets in real-time, assessing risk based on on-chain behavior before transactions even clear. The wallet address itself becomes part of the compliance check, separate from traditional customer identification.

Compliance-by-design architecture

The platforms clearing regulatory approvals fastest aren’t the ones with the best lawyers. They’re the ones that built compliance into their infrastructure from day one.

Client funds and operational funds are separated at the code level, making it technically impossible to mix them. Transaction monitoring happens during settlement, not as an afterthought. Audit trails are written automatically as transactions execute, not compiled later for regulators.

This architecture matters because regulators can verify compliance by examining the system itself, rather than reviewing policies and procedures. When compliance is embedded in how the platform operates, approval processes move faster. This matters for access.

Banks are more willing to provide fiat rails to platforms with SOC 2 Type II certifications. Institutional clients onboard faster when they can review independently audited security controls rather than trust policy documents. Regulatory approvals move quicker when examiners can verify that compliance isn’t enforced by procedure but by the infrastructure itself.

SOC 2 Type II has become the baseline for infrastructure providers serving institutional clients. It demonstrates independently audited security controls that banks and funds now expect to see before working with any crypto platform. This requirement now extends beyond exchanges and custodians.

Beyond compliance certification, institutional clients now demand operational guarantees. Uptime SLAs and infrastructure reliability are non-negotiable, especially for stablecoin payment processing where downtime can freeze millions in transactions. Node infrastructure providers must deliver the same reliability standards as traditional financial rails. Chainstack’s recent SOC 2 Type II achievement combined with enterprise-grade uptime (99.99%) guarantees reflect how even foundational infrastructure layers must meet the same institutional standards to secure partnerships with enterprise clients.

The Travel Rule & cross-border challenges

Even as regulatory frameworks converge on similar principles, implementation is fragmenting the operational reality. The Travel Rule requires virtual asset service providers to share originator and beneficiary information for transactions above certain thresholds, but those thresholds vary:

- EU enforces under MiCA at €1,000

- US Financial Crimes Enforcement Network sets it at $3,000

- Singapore uses different standards under its Payment Services Act

The bigger problem is unhosted wallets. Some jurisdictions treat transfers to self-custody as high-risk transactions requiring enhanced due diligence. Others allow them with minimal friction. This forces platforms to implement jurisdiction-specific controls for the same transaction type, where users face different requirements depending on where they’re located and where their counterparty operates.

Cross-border tax reporting adds another layer. The OECD’s Crypto-Asset Reporting Framework establishes standards for how countries share tax information about crypto transactions, with the first data exchanges expected in 2027. As major markets agree on tax reporting standards, platforms can no longer avoid oversight by choosing low-regulation jurisdictions. However, countries still differ on the specifics such as what transactions must be reported and what data must be collected.

Global landscape: Race for crypto hub status

That inconsistency is creating competition. Jurisdictions that establish clear frameworks quickly are attracting crypto firms that would rather deal with defined rules than regulatory uncertainty, and that’s reshaping where infrastructure gets built.

Hong Kong expects to issue its first Stablecoin Ordinance licenses in early 2026 as part of its push to reclaim status as a major crypto hub. Singapore has fully operationalized its Stablecoin Regulatory Framework, which was finalized in August 2023 and expanded through 2024 amendments to the Payment Services Act that brought custodial services and cross-border money transfers under strict oversight

Canada is building a stablecoin framework that looks a lot like the US GENIUS Act, with similar reserve requirements and attestation standards. South Korea is working on legislation for won-backed stablecoins with strict rules around who can issue them and how reserves must be held. The frameworks vary in specifics but converge on the basics: reserve backing, regular audits, consumer protection.

The Basel Committee on Banking Supervision is requiring banks to start disclosing their crypto exposure from the start of this year, with capital requirements tied to risk levels. This changes how traditional banks evaluate crypto partnerships. Banks now assess whether working with a crypto platform increases their own capital requirements, not just whether the platform is trustworthy. The partnership has to clear both reputational and regulatory hurdles.

Conclusion

By 2026, crypto regulation is no longer theoretical. What matters is execution. Infrastructure is now expected to meet the same standards as traditional financial systems, with compliance enforced through how platforms are built and operated. Firms that clear regulatory approvals faster are not the ones relying on legal strategy, but those that embedded compliance directly into their infrastructure from day one.

This shift raises the bar for infrastructure RPC providers. Reliability, security controls, and auditability are now baseline requirements, not differentiators. Certifications like SOC 2 Type II, independently audited controls, and clear uptime guarantees have become essential for accessing banks and institutional clients. Infrastructure providers like Chainstack are built for this execution-first environment, combining compliance-by-design architecture with enterprise-grade reliability required to operate at scale.

Start for free, connect your app to a reliable blockchain RPC endpoint, and build enterprise and stablecoin applications on infrastructure designed for scale, uptime, and compliance with Chainstack.

Ethereum

Ethereum Solana

Solana Hyperliquid

Hyperliquid Base

Base BNB Smart Chain

BNB Smart Chain Monad

Monad Aptos

Aptos TRON

TRON Ronin

Ronin zkSync Era

zkSync Era Sonic

Sonic Polygon

Polygon Unichain

Unichain Gnosis Chain

Gnosis Chain Sui

Sui Avalanche Subnets

Avalanche Subnets Polygon CDK

Polygon CDK Starknet Appchains

Starknet Appchains zkSync Hyperchains

zkSync Hyperchains